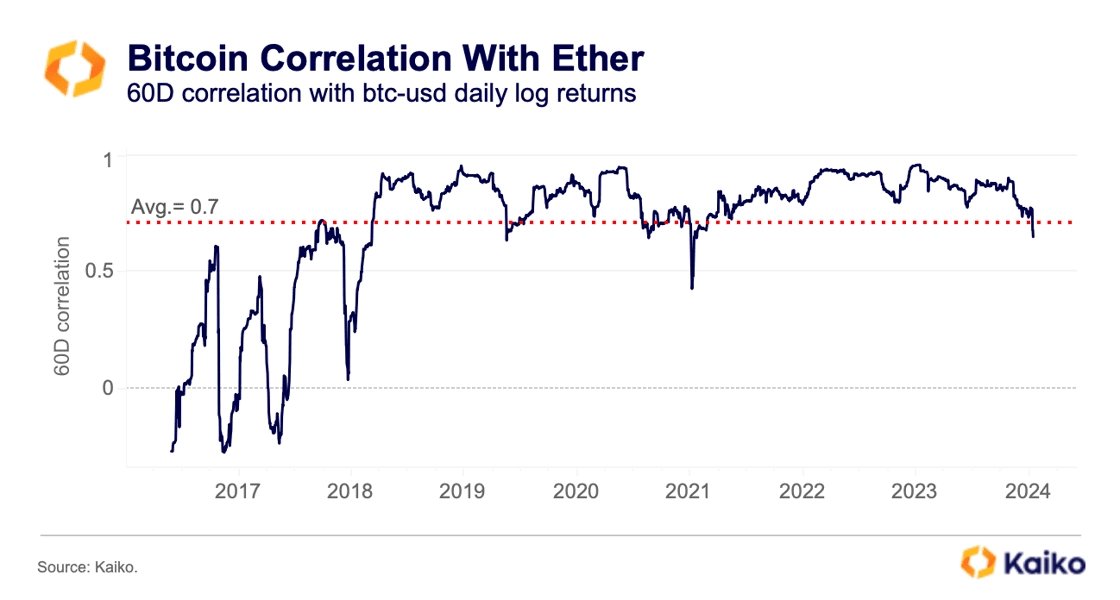

Kaiko has reported a significant change in the BTC-ETH correlation, which has fallen below the long-term average of 0.71 for the first time since 2021. While Ethereum (ETH) has seen an increase in trading volume, this event has sparked curiosity within the cryptocurrency community. However, upon closer examination, a lack of clear indicators in the derivative markets becomes apparent, raising the question of whether ETH can replicate the catalytic effect of ETFs on Bitcoin (BTC).

BTC-ETH Correlation Experiences a Decline

The BTC-ETH correlation, an important measure for understanding the relationship between Bitcoin and Ethereum, has fallen below the long-standing average of 0.71. This deviation from the norm since 2021 raises questions about the evolving dynamics between the two leading cryptocurrencies.

Investors and analysts are closely monitoring this change and considering its potential impact on the broader cryptocurrency market. Concurrently, Ethereum has witnessed a significant increase in trading volume, indicating heightened activity and interest in the ETH market.

This increase leads to speculation about potential market movements and investor sentiment surrounding Ethereum. However, the real point of interest lies in the derivative markets, where the expected signs for a rally are yet to materialize for investors positioning themselves.

ETFs and the Ethereum Narrative: A Comparison with Bitcoin’s History

ETFs play a crucial role in shaping the narrative and market dynamics of Bitcoin. As one of the most catalytic narratives in BTC’s history, ETFs have influenced price movements and investor perceptions. Now the question arises whether Ethereum can replicate a similar narrative and garner the same level of interest and impact from ETFs.

While Ethereum stands at a critical juncture, the crypto community is waiting to see if it can chart a unique path or will mirror Bitcoin’s historical trajectory. The recent increase in trading volume shows growing interest, but the lack of clear signals in the derivative markets creates an element of uncertainty.

The comparison with BTC’s history and the role of ETFs adds a layer of complexity to Ethereum’s narrative. Consequently, Kaiko’s announcement that the BTC-ETH correlation has dropped below its long-standing average highlights Ethereum. Although the increase in trading volume indicates a greater focus on Ethereum, the absence of distinct signals in the derivative markets introduces a degree of uncertainty.

Türkçe

Türkçe Español

Español