The consumption of ETH gas for NFTs in the Ethereum ecosystem has significantly decreased since its peak in 2021. The NFT markets and projects that were at the top of gas consumption during that period have experienced a sharp decline in the past two years.

NFT: The Product of Excessive Liquidity

Data shared by the blockchain data analysis platform Glassnode shows that NFT marketplaces’ gas usage is currently trending downwards. This indicates a possible shift in NFT usage. Users may prefer to hold onto their assets instead of trading them on marketplaces during this period.

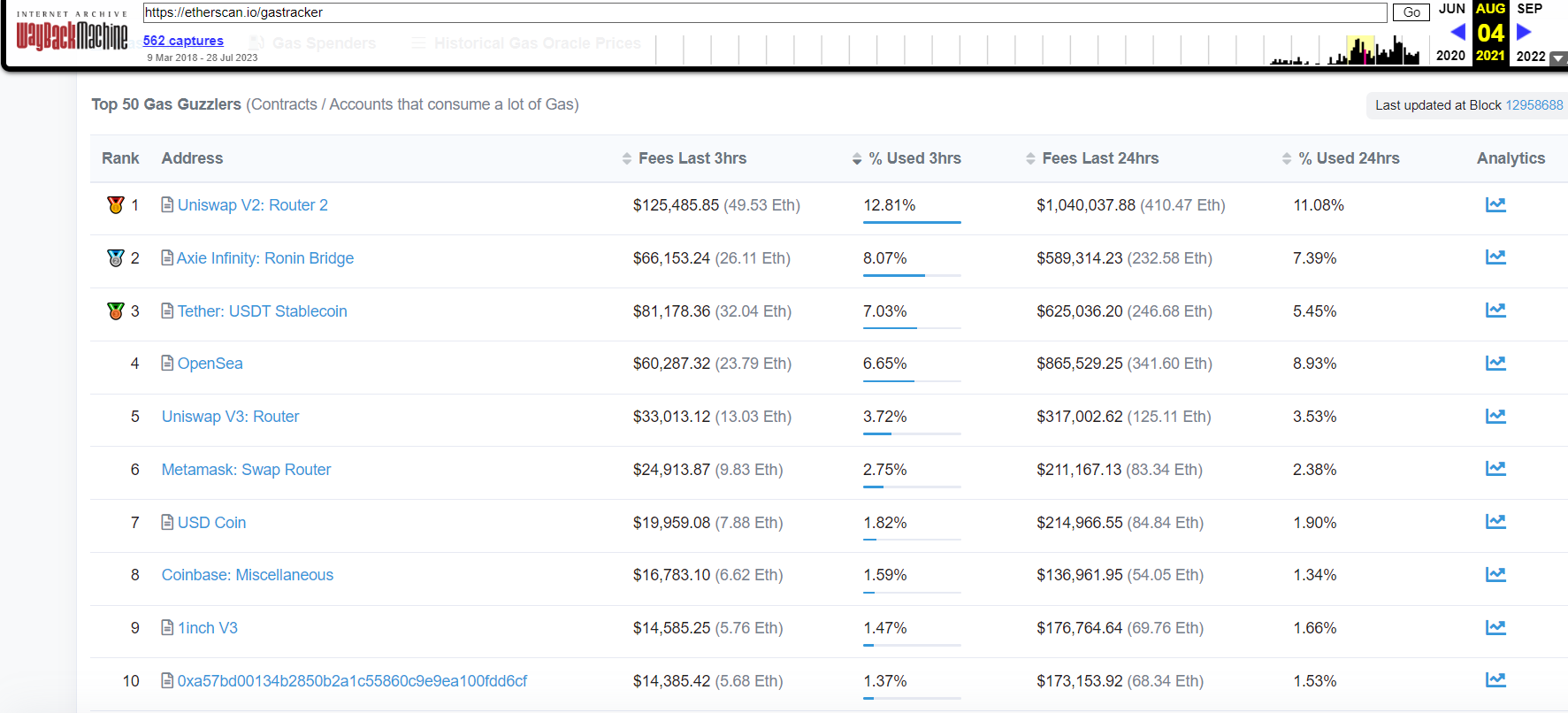

According to data from Etherscan, NFTs were leading in terms of Ethereum gas usage in 2021. On August 4, 2021, the NFT gaming project Axie Infinity ranked second in gas usage due to the Ronin bridge that transferred assets from Ethereum to the Ronin network. On the same day, the NFT marketplace OpenSea ranked fourth on the list.

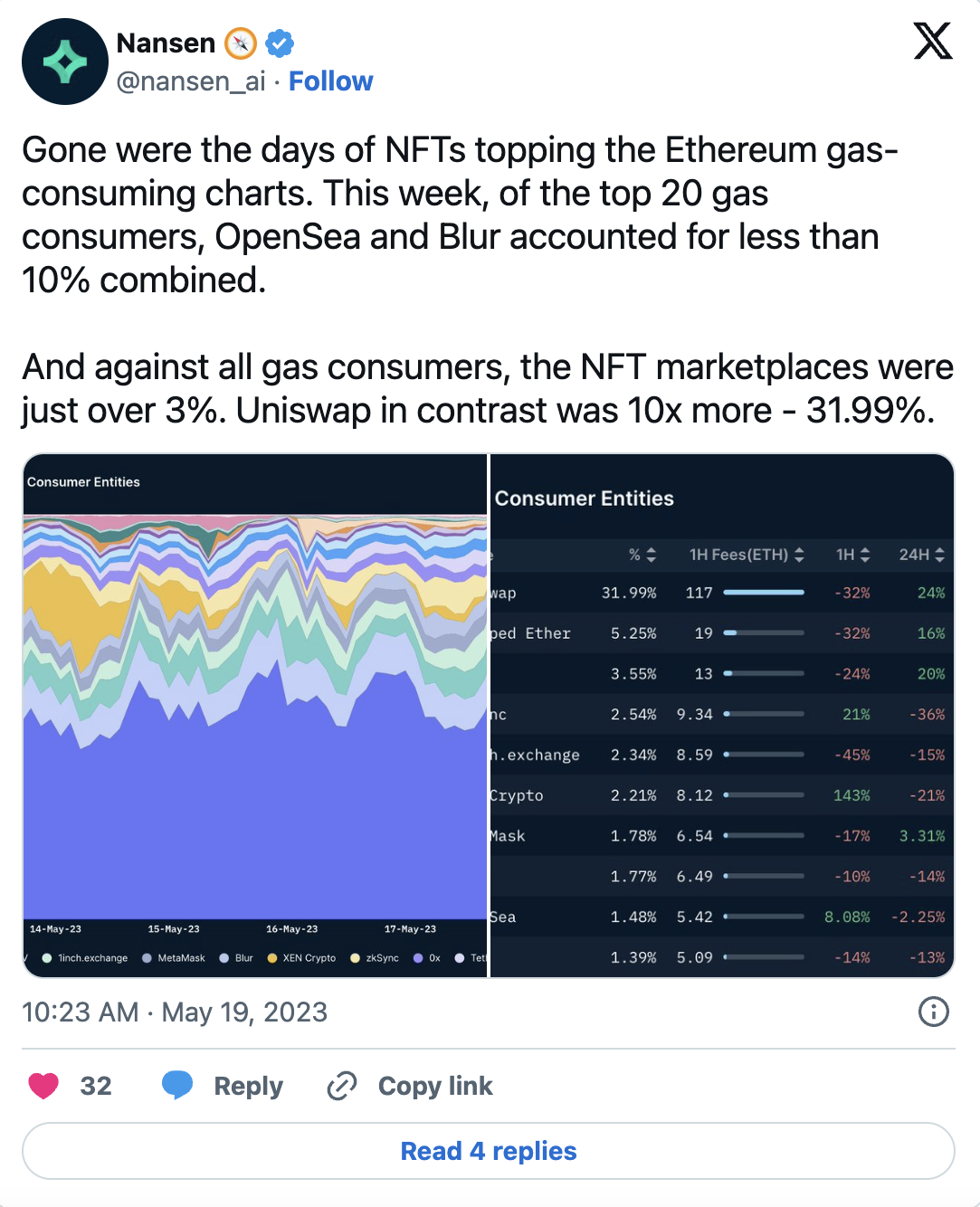

However, the crypto analysis platform Nansen revealed that during a one-week period in May 2023, only 3% of the total gas consumption on the Ethereum network was used for NFT markets. This occurred during a volatile period for Ethereum’s price and led to theories that NFTs are simply a product of “excessive liquidity” due to the excessive money printing during the pandemic.

Lowest Level of Gas Consumption

The gas consumption of NFTs continues to decrease. Currently, the gas consumption of Blur, OpenSea, SuperRare, LooksRare, and Rarible constitutes only about 1.85% of the total gas consumption on the Ethereum network.

Furthermore, the once prominent gas consumers OpenSea and Axie Infinity are nowhere to be seen on Etherscan’s top gas users list. However, while marketplaces are not seen anywhere in terms of gas consumption, the NFT marketplace Blur continues to be among the top 30 gas consumers on Etherscan at the time of writing this article.

Türkçe

Türkçe Español

Español