Bitcoin‘s price has been navigating dangerous waters, and yesterday we discussed the anticipation of significant developments on the macro front. Following the approval of a spot Bitcoin ETF, BTC rose to $49,000 but then dropped $9,000 due to sales by whales who were satisfied with the peak. So, what are the latest developments? What significant events have occurred?

Significant Events in Cryptocurrencies

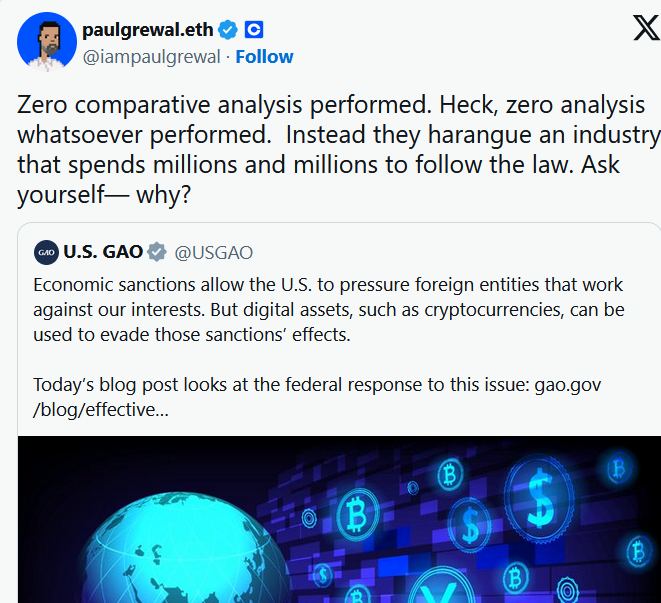

Significant developments have taken place in the past few hours. This week, a decision was expected for Grayscale’s ETH ETF, but excitement waned due to a postponement decision for Fidelity. On the other hand, Coinbase’s Chief Legal Officer Paul Grewal accused a government agency of refusing to conduct research and analysis while publishing a report on crypto.

There is a non-surprising development on the Terra front, which we have been warning about for almost 1.5 years.

Coinbase and the US Accountability Office

Coinbase’s Chief Legal Officer Paul Grewal has heavily criticized the United States Government Accountability Office (GAO). The GAO’s recent report mentioned that those seeking to evade sanctions are widely using cryptocurrency. The report, which blames cryptocurrencies for helping bad actors evade sanctions, emphasizes the need for strict supervision.

Reports from a few years ago stated that Iran and other states under US sanctions were not evading sanctions with crypto as much as feared.

Paul Grewal stated that the government agency signed off on this report without any analysis or detailed research. US institutions are consistently criticized for such hasty and biased actions.

Terra Files for Bankruptcy

Its founder is in prison, and its ecosystem has collapsed; the new CEO was not very successful either. Although Terra’s fate was apparent 1.5 years ago, investors chasing speculative trades continued to engage in short-term buying and selling. The losers were long-term dreamers, deceived by unrealistic promises.

The company filed for Chapter 11 bankruptcy in the United States Bankruptcy Court for the District of Delaware, according to an application dated January 21. The estimated liabilities range between $100-500 million.

Terraform Labs CEO Chris Amani said;

“The Terra community and ecosystem have shown unprecedented resilience in the face of challenges, and this action is necessary to continue working towards our collective goals while resolving pending legal challenges. We have overcome significant obstacles before, and despite long-term challenges, the ecosystem has remained standing and even grew in new ways after the separation. We look forward to the completion of the legal process.”

Grayscale and the Ongoing Sales

We had mentioned that the negative premium of GBTC being zeroed could mean that the selling pressure in the market could continue. According to YChart and Grayscale data, the assets managed by Grayscale Bitcoin Trust (GBTC) fell to $23.7 billion between January 10 and January 18. This indicates that GBTC investors reduced their net assets by $5 billion.

However, the impact of these outflows is weakening as other ETF reserves grow, and a more positive trend is expected over time.

Türkçe

Türkçe Español

Español