Significant moves occurred today in spot Bitcoin ETFs. As a notable development for the cryptocurrency market, iShares, a subsidiary of Blackrock, made a bold move by adding approximately 249 million dollars worth of 5,264 Bitcoins. This move signals that Bitcoin is increasingly being accepted as a legitimate asset class by traditional financial institutions.

Changing Investment Trends

The addition of more than 5,000 Bitcoins by iShares is indicative of a broader trend where institutional investors are increasingly recognizing the value and potential of cryptocurrencies. As the financial world evolves, more established players are diversifying their portfolios to include digital assets like Bitcoin, seeing them as a hedge against traditional market fluctuations.

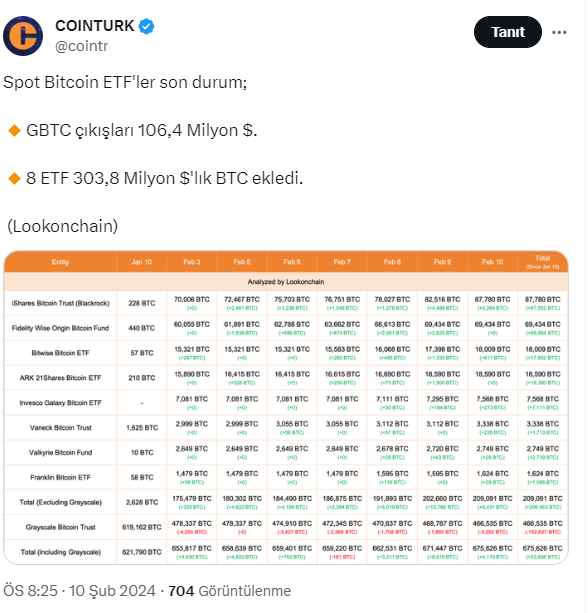

While significant inflows are seen in iShares’ spot Bitcoin ETF, Grayscale, one of the largest crypto investment firms, has adopted a different approach. Notable outflows were observed in GBTC. Accordingly, an outflow of 2,252 Bitcoins, valued at approximately 106.4 million dollars, is noteworthy.

What Do the Numbers Indicate?

Looking at other spot Bitcoin ETF issuers, we see the following figures:

- Bitwise Bitcoin ETF: Saw an inflow of 611 BTC.

- Invesco Galaxy Bitcoin ETF: Saw an inflow of 273 BTC.

- Vaneck Bitcoin Trust: Saw an inflow of 226 BTC.

- Valkyrie Bitcoin Fund: Saw an inflow of 28 BTC.

- Franklin Bitcoin ETF: Saw an inflow of 29 BTC.

- No inflows were seen today for Fidelity and Ark.

Looking at the total of 8 ETFs, we see that the inflows more than compensate for the outflows from GBTC. There is a total of 303.8 million dollars in inflows and 106.4 million dollars in outflows. This situation also reflects the growing optimism towards the cryptocurrency market.

What Do the Inflows Mean?

That inflows into spot Bitcoin ETFs exceed outflows indicates that investor interest in these ETFs is increasing and that demand for Bitcoin is strengthening. This situation signifies that Bitcoin is gaining acceptance among both institutional and individual investors and becoming more popular.

Investors’ strong interest in Spot Bitcoin ETFs could lead to increased liquidity in the cryptocurrency market and more robust price discovery. Additionally, this could indicate that traditional financial institutions and investors are growing more confident in Bitcoin and are more inclined to shift towards digital assets.

Türkçe

Türkçe Español

Español