Within the past week, the fourteenth largest American bank has been acquired by JPMorgan, and two additional banks find themselves teetering on the edge of insolvency. Just yesterday, Pacific Western Bank prepared for sale, followed by another mid-sized bank today. Banking stocks plummet at an unprecedented rate, yet Yellen insists there is no cause for concern; Powell echoed this sentiment yesterday.

US Bank Failures

American officials who reassured markets in March that the bankruptcies were transitory have since lost credibility. Merely hours after the Federal Reserve Chairman declared the banks secure, it was revealed that two banks were nearing collapse. Pacific Western Bank was disclosed at the eleventh hour early today, and now Western Alliance Bank is next in line.

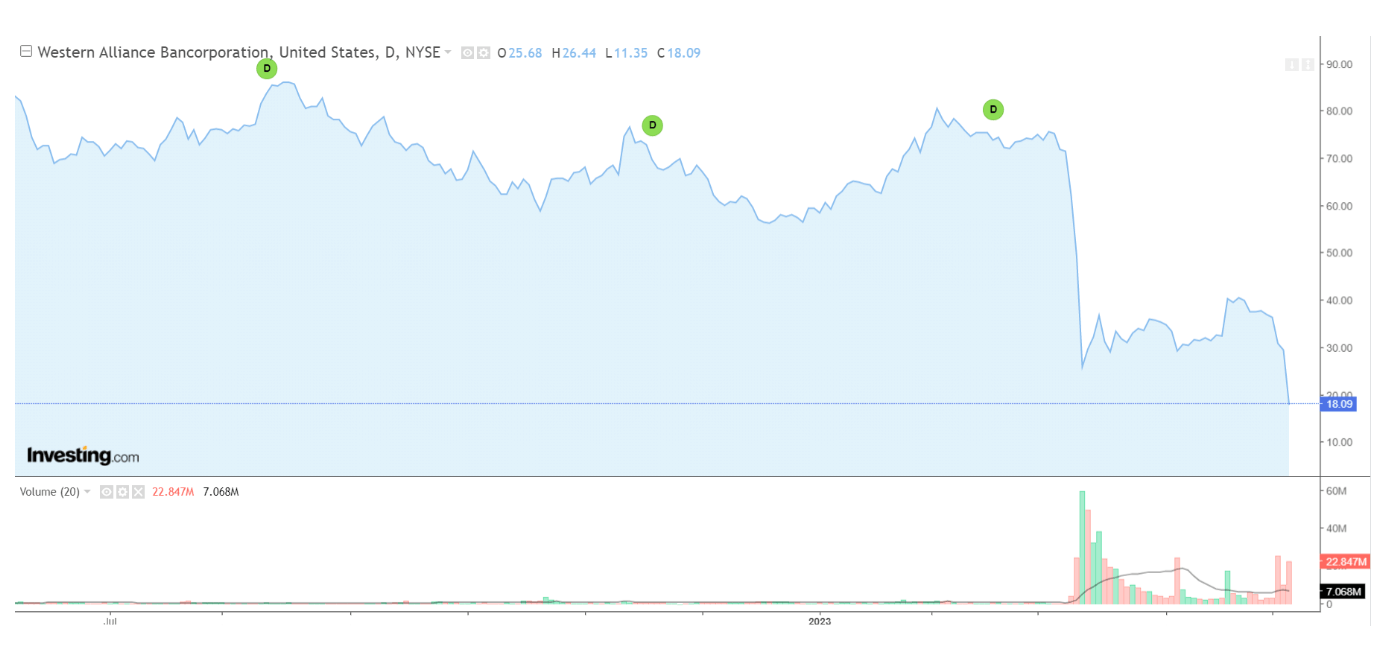

As reported by the Financial Times, the bank is in distress and considering all potential avenues, including a sale. Nonetheless, the bank’s latest statement denies these claims. Despite this denial, the bank’s shares have declined by 38% today, indicating investor apprehension.

Other banks that sustained significant losses today include:

- Pacific Western Bank

- First Horizon

- HomeStreet Bank

- Metropolitan Bank

- Citizens Financial Group

- Zions Bank

These banks have experienced losses ranging from 10% to 52% of their value, even though the stock market has only been open for two hours. As rumors surrounding Pacific Western Bank’s bankruptcy circulated yesterday, Bitcoin‘s price spiked and may very well surge again.

Western Alliance Bankruptcy

Western Alliance is the most recent US regional bank seeking a lifeline, according to insiders. The Arizona-based bank, which held $71 billion in assets as of March’s end, has engaged consultants to evaluate its options. These individuals added that the bank’s negotiations are in their infancy and may not reach a resolution.

US regional bank shares have faced significant selling pressure this week after the regulator-mediated acquisition of First Republic by JPMorgan Chase failed to bolster confidence in the sector.

Regulators probing the bankruptcies of Signature Bank and Silicon Valley Bank lamented inadequate oversight. They also attributed their inability to sufficiently manage the banks to shortcomings in personnel and regulations. The Democrats, who previously tied the March bank failures to relationships with cryptocurrency firms, have remained silent for now. Numerous high-ranking officials, including the SEC Chairman, have sought solace in this unconvincing justification.