Once considered a serious rival to Ethereum, Solana is showing resilience despite its loss of corporate backing. It had built a robust community thanks to its high speed and low fees. However, investor departure from the network has considerably diminished Solana’s value. Most recently, the Security Exchange Commission (SEC) filed a case placing it in the securities class.

Is Solana a Security?

The Solana Foundation objects to the SEC’s classification of its SOL token as an unregistered security. The SEC had earlier this week filed a lawsuit against cryptocurrency exchanges Binance US and Coinbase, accusing them of trading Crypto Asset Securities, including SOL. Addressing the issue on Thursday, the Solana Foundation stated:

SOL is the native token of Solana blockchain, a robust, open-source, community-based software project that relies on decentralized user and developer participation for growth and development.

At a hacker house event organized by Solana in New York on Thursday, it was observed that the Solana community wasn’t too concerned with the network’s regulatory troubles. A developer speaking at Solana’s New York City Hacker House on Thursday stated, “I don’t think any of the developers care. Whether SOL is a security or not doesn’t really affect anyone who’s building something on Solana.”

SOL Coin Commentary

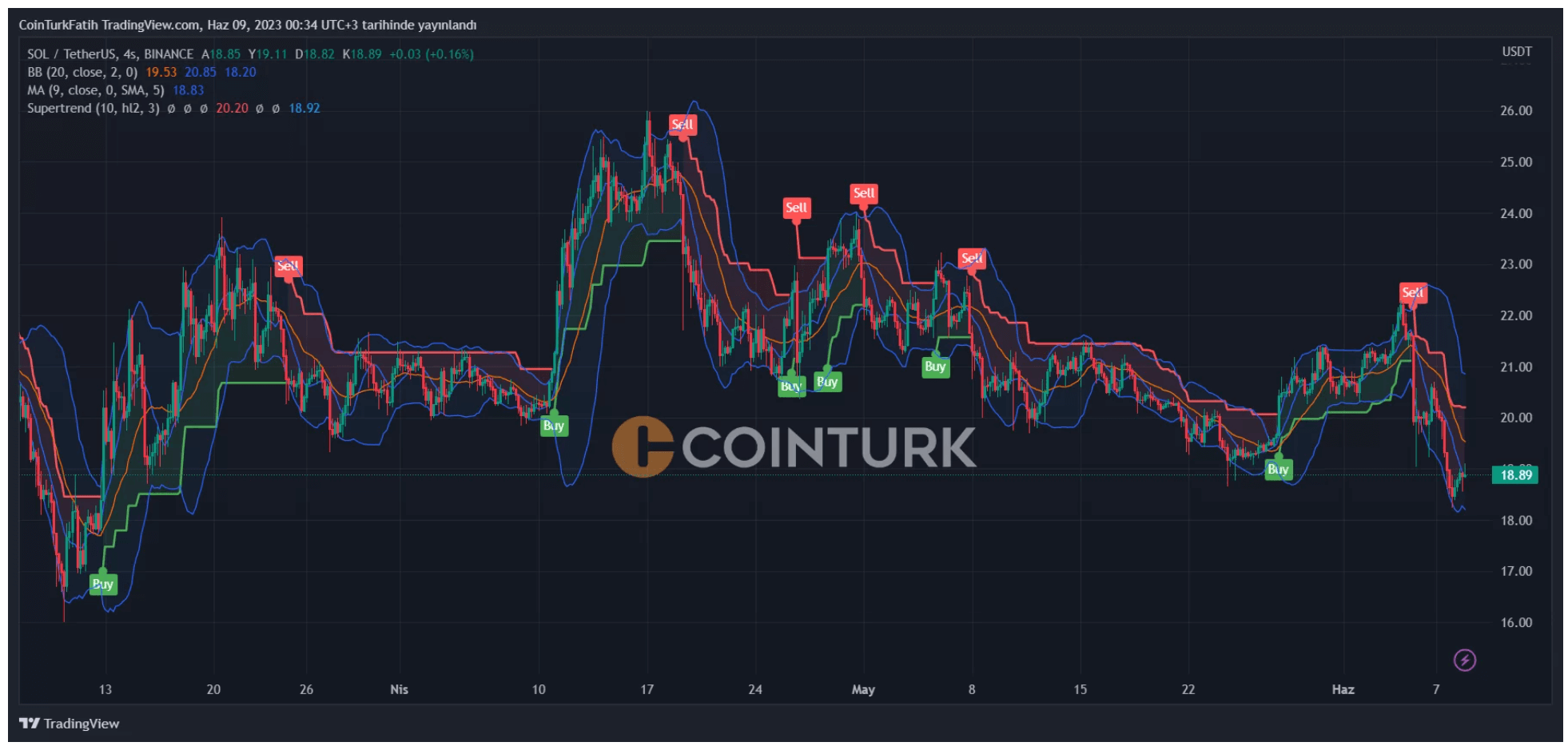

The popular altcoin was significantly affected by the recent wave of fear in the market. Even though the BTC price remained stable today, most altcoins witnessed heavy sales in the past 24 hours. The SOL Coin price also plummeted to an $18.5 support level. While it seems to be showing signs of recovery from here, it’s too early for investors to celebrate, especially with the potential drop of BTC as volumes decrease over the weekend.

If the sales continue, we could see the SOL Coin price drop to $16.7. In the opposite scenario, the price needs to surpass $20 before the $19 level turns into resistance. The safe zone appears to be at $20.2 for now. In case of a recovery, the $27 resistance could be tested again after $22.44 and $24.35 levels. The strongest support is located in the $15 area.

As of the writing of this report, Bitcoin’s price was trading at $26,552.