Solana’s value dropped by 25% in the last month and continues to stay below key moving averages. This decline indicates that SOL is struggling to break above resistance levels, further weakening market sentiment and suggesting the potential for prolonged price drops.

What is Happening with Solana?

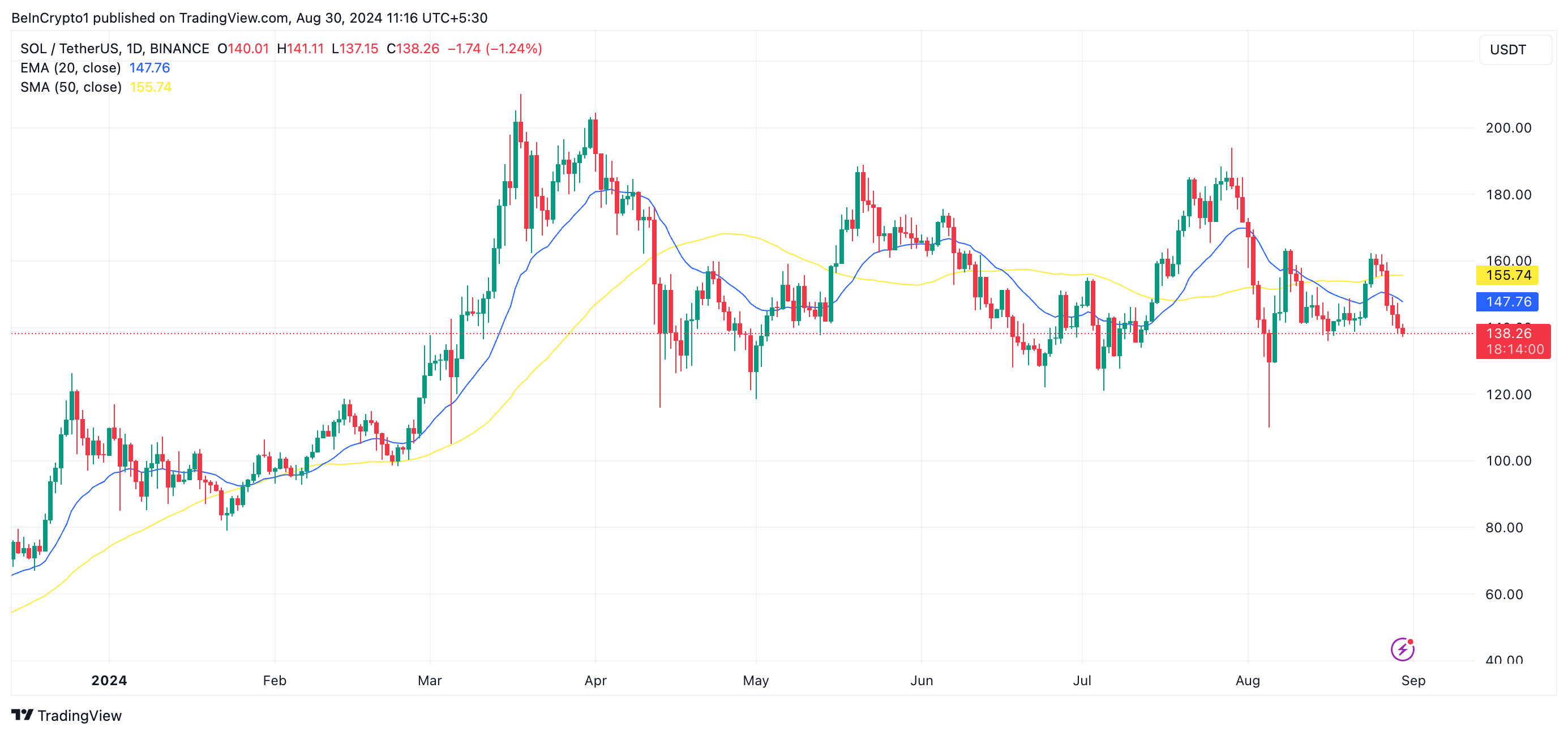

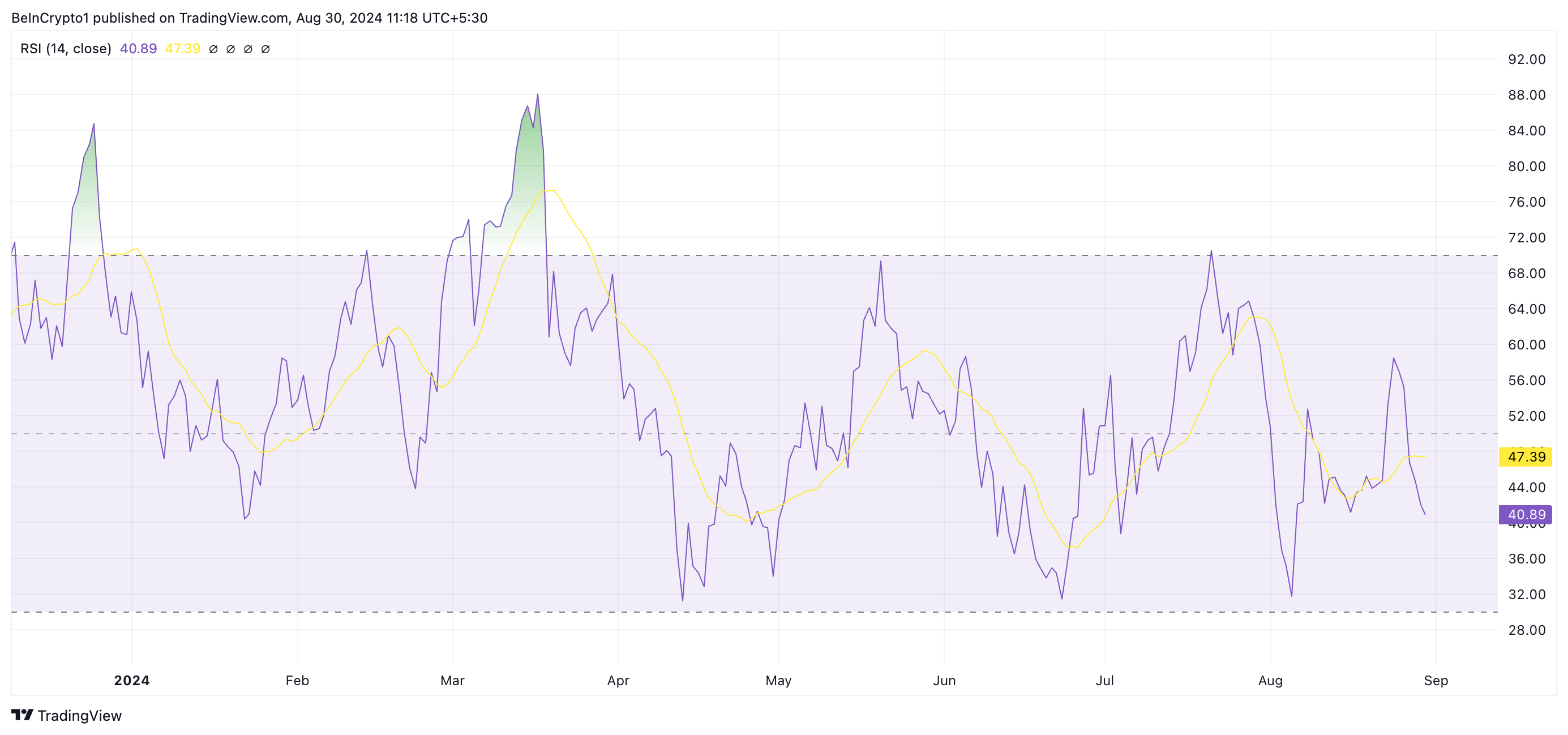

Solana’s recent daily chart readings show its price fell below both the 20-day exponential moving average (EMA) and the 50-day simple moving average (SMA) on August 27, and attempts to stabilize above these levels have failed. Currently, SOL’s 20-day EMA is at $147.72, and the 50-day SMA is at $155.74, with SOL trading at $137.86 at the time of writing.

The 20-day EMA reflects SOL’s average closing price over the last 20 days, and the 50-day SMA tracks the average closing price over the last 50 days. In a downtrend, these moving averages act as resistance levels, making it difficult for the price to rise above them due to significant selling pressure.

SOL spent most of the month trading below the 20-day EMA and the 50-day SMA. Although a brief wave of buying pressure on August 24 pushed the price above these averages, the rise was short-lived as profit-taking quickly drove the price back down. Falling below the 20-day EMA and the 50-day SMA reinforces the bearish trend, indicating strong selling pressure and a lack of buying interest to lift the price.

SOL Chart Analysis

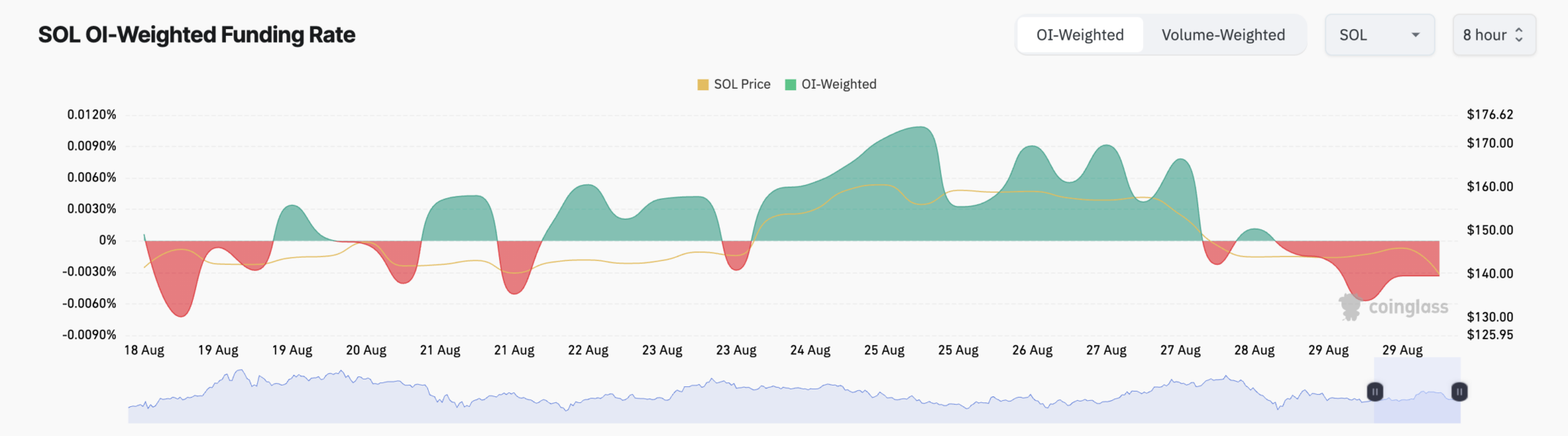

SOL’s sentiment in the futures market mirrors the bearish outlook in the spot market, with investors increasingly taking short positions over the past two days. Since August 28, SOL’s funding rate has remained negative, indicating that more investors are predicting further price declines.

If the current downtrend continues, SOL’s price could drop to $133.64. If negative sentiment persists, the next target could be $110. On the other hand, if demand revives, SOL’s price could recover and rise to $148.27.

Türkçe

Türkçe Español

Español