Renowned on-chain data platform Santiment has reported that Solana (SOL), a formidable competitor to Ethereum (ETH) and having grown by over 150% since the beginning of the year, seems to be losing its momentum.

Funding for Solana Rapidly Decreasing

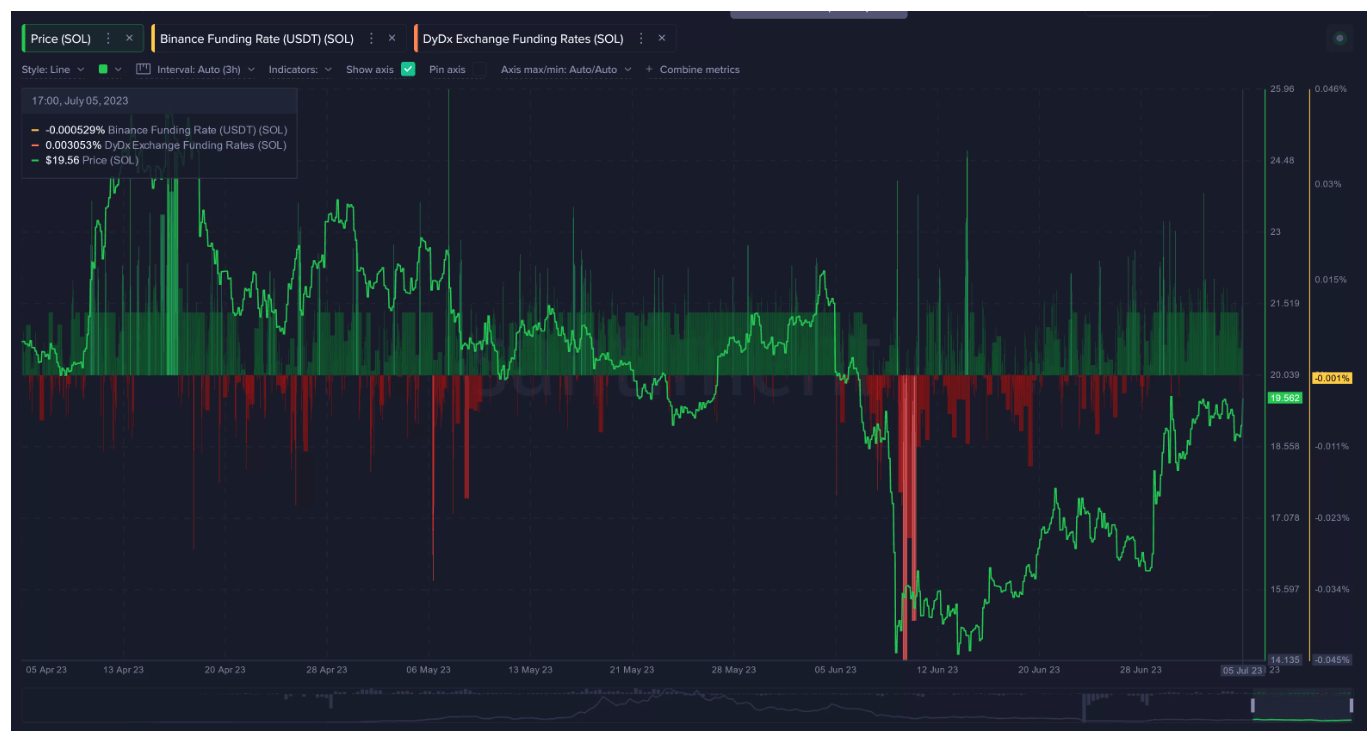

Santiment states that the recent Solana rally was fueled by short position liquidation, and that support now appears to be dwindling. According to the data platform, the ideal time to buy Solana was in the second week of June when the funding rate entered a decline, which has since given way to an uptrend:

As can be seen from Solana’s funding rate on Binance and DyDx, the optimal time to buy would have been the second week of June when a sharp increase in the funding rate was seen. While prices may continue to climb before short positions are liquidated, the probability of an uptrend has definitively decreased.

A funding rate above zero indicates a predominant bullish trend, while a negative rate suggests a bearish trend. An increasing funding rate indicates an upward trend, while a decreasing funding rate suggests a downward trend.

At the time of writing, Solana’s funding rate on Binance, the world’s largest crypto exchange, is positive at 0.010%. At the beginning of June, the funding rate on Binance had dropped to -0.045%.

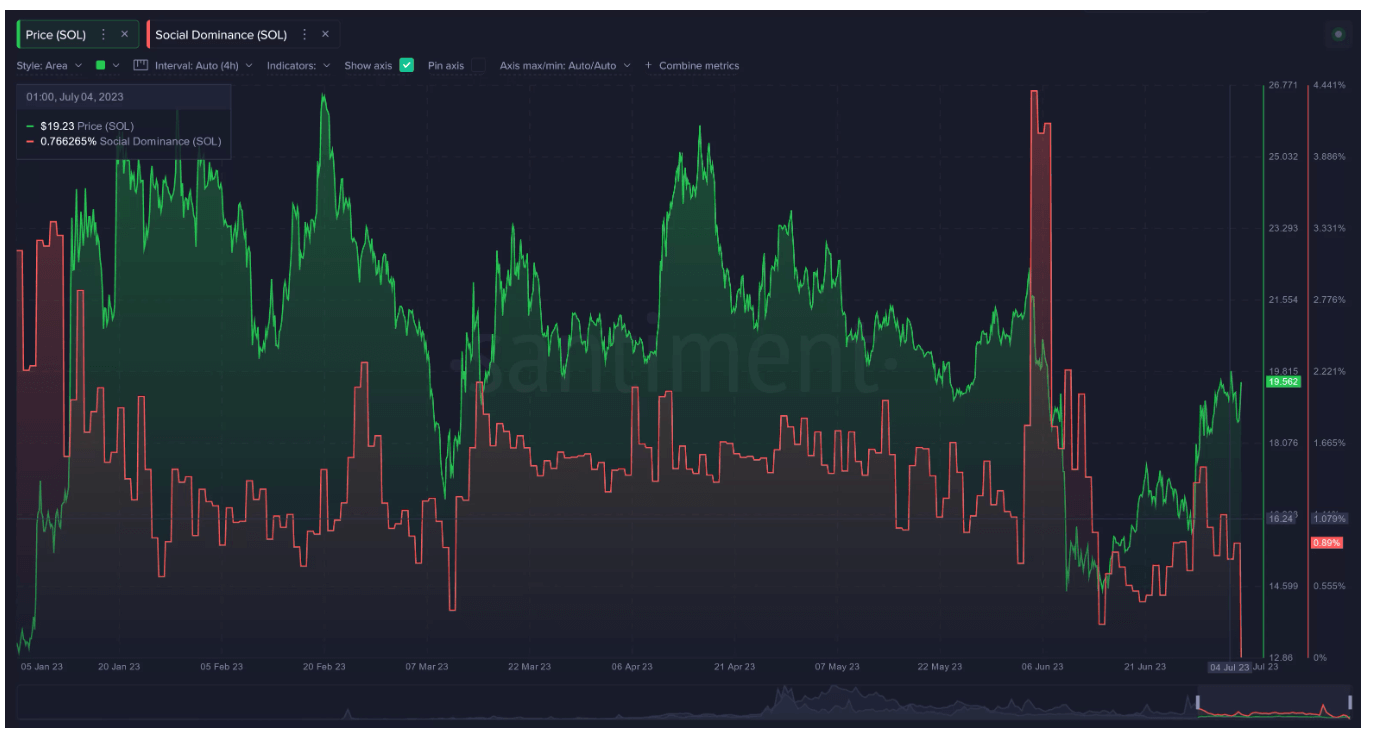

Altcoin’s Social Dominance Rapidly Decreasing

Santiment also highlighted a decrease in Solana’s social dominance since the start of the year, indicating that buyers might be struggling to support the current price level:

The decline in Solana’s social dominance since the start of the year is also evident from the metric of social dominance.

SOL, which had dropped to $8 in December 2022, has increased in value by 152% since the beginning of the year and is currently trading at $19.47, a 0.76% decrease in the last 24 hours as of the time of writing this article.