Hong Kong market is set for the highly anticipated launch of spot Bitcoin ETFs and spot Ethereum ETFs, scheduled for April 30, 2024. Notable participants include China’s leading asset managers HashKey Capital and Bosera, who are currently finalizing preparations for the launch. However, amidst these expectations, a significant question emerges: Can Hong Kong’s spot Bitcoin ETFs achieve the success seen by U.S. spot Bitcoin ETFs?

Asia’s Market Outsizes Both the U.S. and Europe

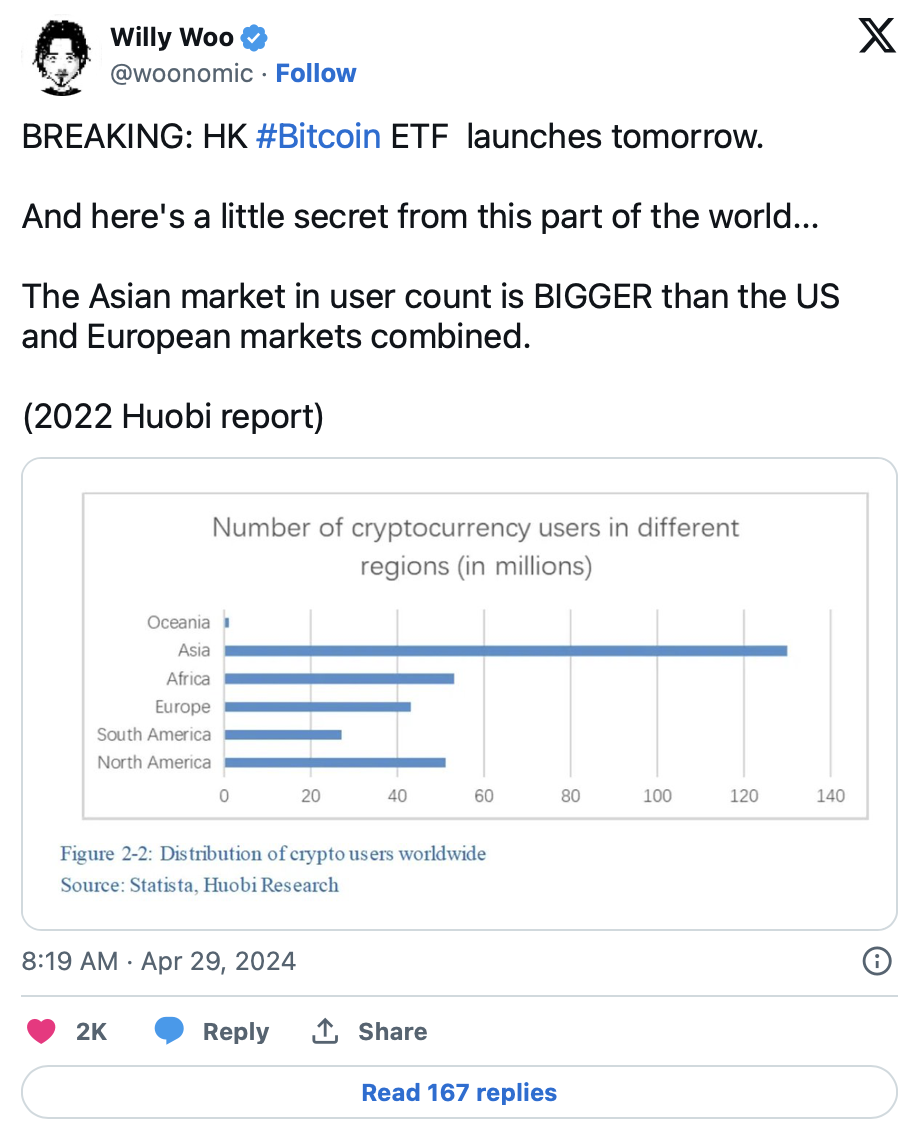

Bitcoin analyst Willy Woo highlights the significant market presence in Asia, pointing to the upcoming launch of spot Bitcoin ETFs in Hong Kong. Woo notes that the number of users in Asia surpasses the combined user base in the U.S. and Europe, a notable situation despite their relatively smaller physical assets. This observation underscores the significant impact Asian investors have on the cryptocurrency market.

Currently, the cryptocurrency community in Asia stands out as one of the most active globally. However, a major hurdle for spot Bitcoin ETFs in Hong Kong is the strict ban on cryptocurrencies in mainland China. This situation prevents Chinese capital from flowing into spot Bitcoin and Ethereum ETFs. Consequently, this restriction could deter many wealthy Chinese investors from investing in this asset class.

Expert Expects $1 Billion Inflow

Market analysts had previously raised expectations by forecasting a potential $25 billion inflow for Hong Kong’s spot Bitcoin ETFs, but Bloomberg analyst Eric Balchunas considers these predictions exaggerated and expects a potential inflow of $1 billion. Balchunas adds that even this revised estimate is high for both spot Bitcoin and Ethereum ETFs in Hong Kong. He also emphasizes that reaching this adjusted target quickly depends significantly on infrastructure developments.

On the other hand, other leading Asian markets like South Korea and Japan are also considering launching their own spot Bitcoin ETFs. Despite the significant presence of players in Asia’s cryptocurrency community, capital flow from these regions to Hong Kong seems unlikely.

Amid local competition and restrictions on Chinese investments, the level of initial capital attracted by Hong Kong’s spot Bitcoin ETFs will be closely monitored. Moreover, other jurisdictions like Australia are also preparing to offer similar products by the end of the year, signaling a broader trend towards the adoption of cryptocurrency investment tools.