The price of Bitcoin is making another attempt to surpass $36,000, but it is retracing from near $35,700. Recently, Bloomberg ETF Specialist James Seyffart made some predictions regarding the approval of a spot Bitcoin ETF. Following the finalization of the GBTC court decision, the SEC has accelerated its discussions with potential issuers.

Spot Bitcoin ETF Approval

In his latest market commentary, James Seyffart reiterated his prediction that the approval of a spot Bitcoin ETF has a 90% chance of happening by January 10th, 2024. The expert believes that there is a strong possibility of all 12 applications being approved simultaneously, further highlighting the significance of November. James stated:

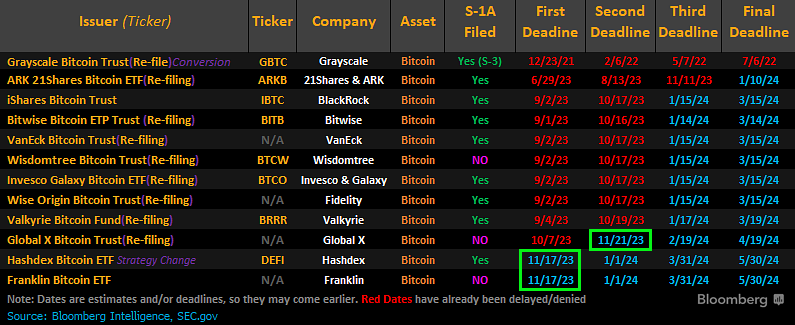

“We believe there is still a 90% chance of spot Bitcoin ETF approvals by January 10th. However, if it comes earlier, we expect approval for all existing applicants. The SEC has issued simultaneous delay decisions for BlackRock, Bitwise, VanEck, WisdomTree, Invesco, Fidelity & Valkyrie. If the agency wants to allow all 12 applicants to launch as we believe, this is the first opportunity since Grayscale’s court victory was confirmed.”

The deadline for all 12 is also ending on November 17th. However, theoretically, the SEC can make a decision regarding the first 9 applications on this list at any point until January 10th, 2024.”

He also added:

“If the SEC wants to be ‘fair’ and approve all spot applications simultaneously, they should do it when there is no pending comment period, between November 9th and 17th.”

According to this, the period between November 9th and 17th will be a range in which we can expect volatility in BTC price.

Bitcoin (BTC) Price Predictions

The sharp upward movement in BTC price seems to have taken a pause for now. The price is within an ascending parallel channel, and investors are now more cautious. The upward sloping 20-day exponential moving average (33,612 dollars) and the RSI lingering in overbought territory suggest that the upward movement may continue. If buyers can push above the resistance line of the channel, it would indicate the start of a rally targeting $40,000.

In the opposite scenario, if the price closes below $33,612, it could drop to $32,400 and $31,000.

Türkçe

Türkçe Español

Español