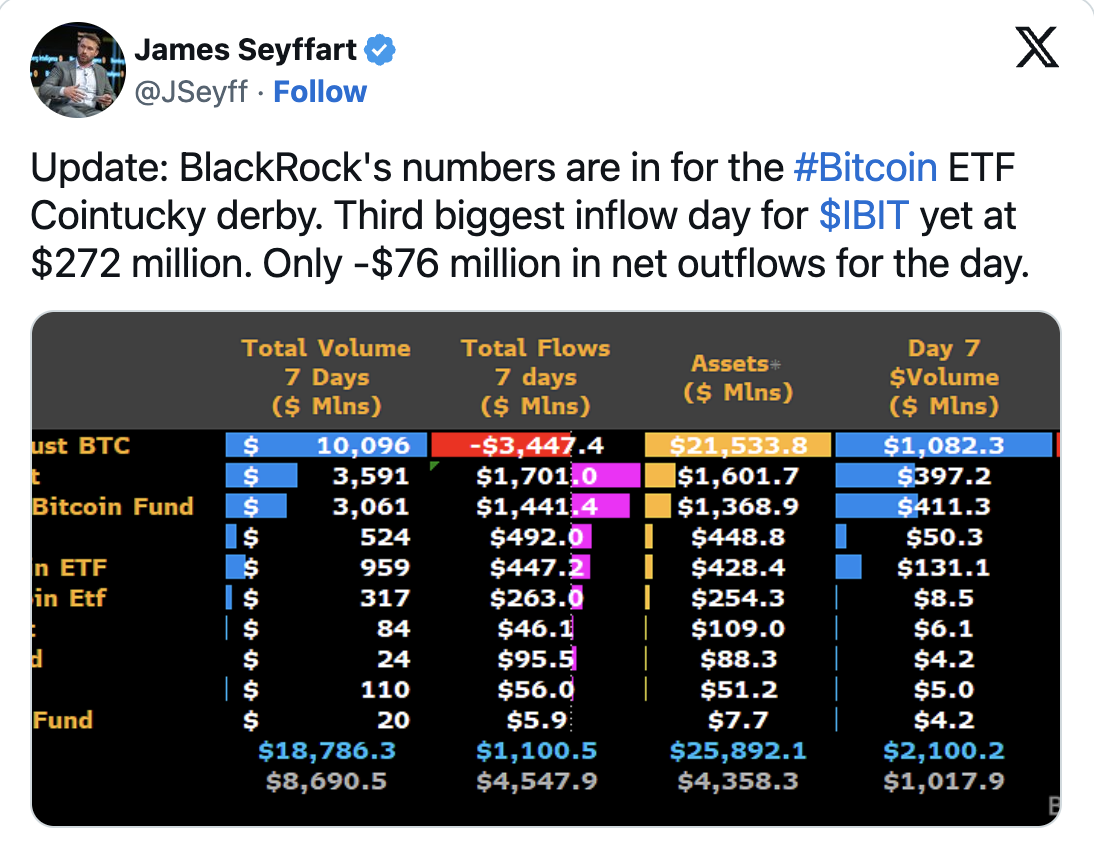

According to new data shared by Bloomberg ETF analyst James Seyffart, spot Bitcoin exchange-traded funds (ETFs) experienced a net outflow of $76 million on their seventh day. In an article, Seyffart mentioned that it was generally a bad day for Bitcoin ETF products and pointed out that Grayscale’s ETF products still contained the largest net outflows.

GBTC Sales Continue

Continuing his remarks, Seyffart stated that capital flows to spot Bitcoin ETF products remained positive overall, with BlackRock experiencing its third-largest day of positive inflows, totaling a net entry of $272 million for the day.

“Today there was a capital outflow of $640 million. The outflows are not slowing down; they are increasing. This is the largest outflow for GBTC to date. So far, the total outflow is $3.45 billion. Even after accounting for the net outflows from GBTC, spot Bitcoin ETF products have seen over $1.1 billion in capital inflows.”

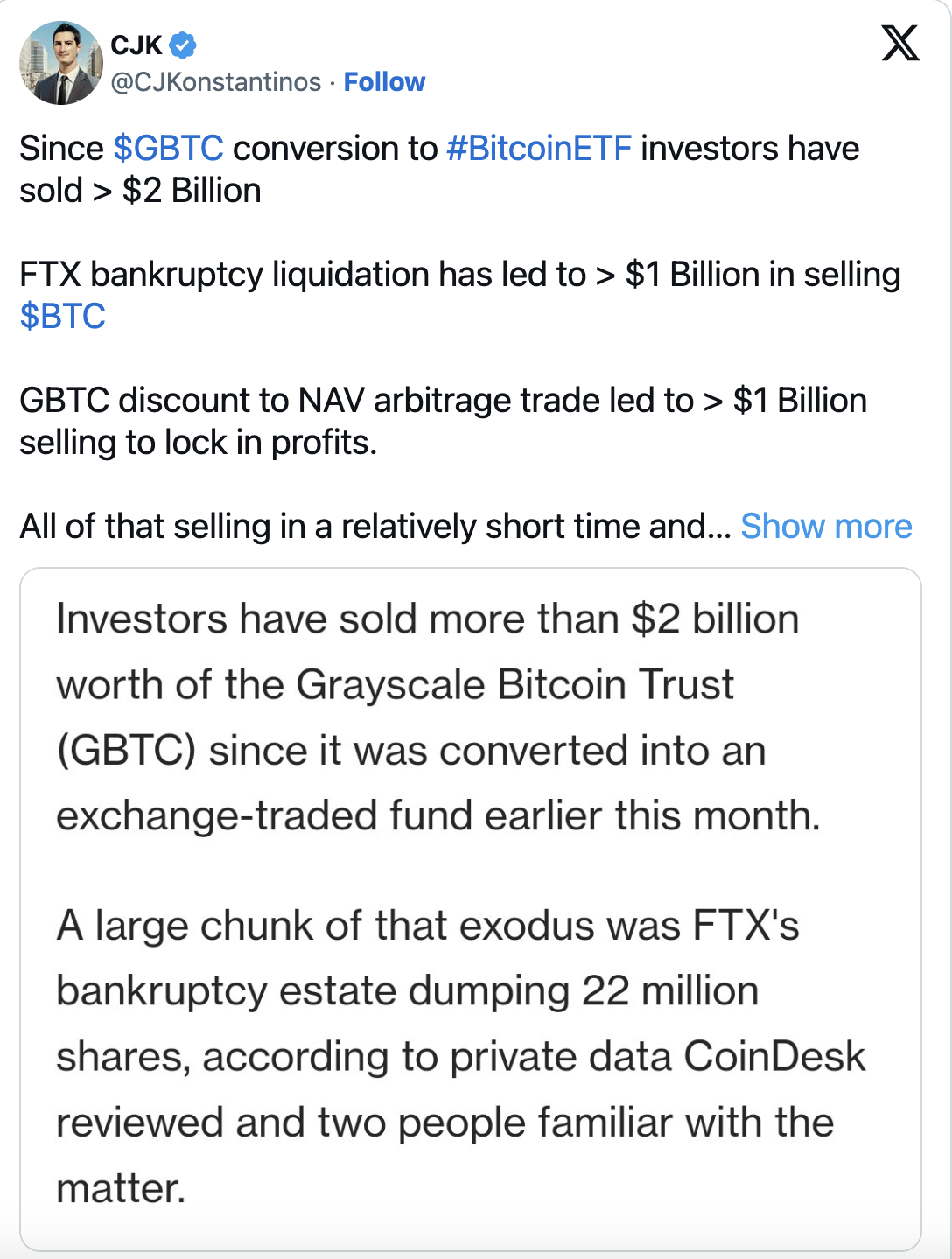

While Seyffart acknowledges that the outflows from GBTC are currently relentless, he expects the selling pressure led by GBTC to slow down over the next two weeks. Most of the outflows from Grayscale’s recently converted GBTC fund are linked to large sales conducted by FTX.

According to a report dated January 22, based on sources familiar with the matter, FTX had liquidated approximately two-thirds of its 22.8 million GBTC shares as of January 22. It is estimated that these share sales account for about $600 million of the total net outflows of $3.4 billion related to GBTC.

What’s Happening with Bitcoin?

Since the approval of ten spot ETF products on January 10, the price of Bitcoin has significantly dropped from $49,100 to $39,500 as of January 23. According to TradingView data, Bitcoin is trading at $39,741 at the time of writing.

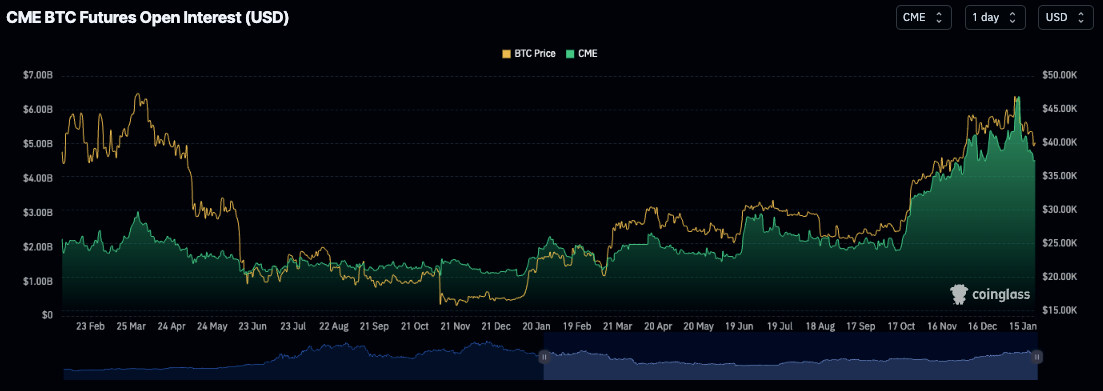

The downward price movement of Bitcoin coincides with a sudden and sharp decline in open interest for Bitcoin futures at the Chicago Mercantile Exchange (CME), indicating a loss of interest in Bitcoin futures positions among institutional investors.

According to data from blockchain data analytics platform CoinGlass, open interest at CME dropped from a record level of $6.4 billion on January 12 to $4.4 billion at the time of publication.