On the sixth trading day of Spot Bitcoin ETF products, the cumulative trading volume surpassed $15 billion. While notable developments occurred in the ETF space, Bitcoin’s price fell below the $41,000 level during the day. At the time of writing, Bitcoin was trading at $42,002. Let’s examine the potential effects of developments in the ETF area on the Bitcoin price.

Recent Decline Triggers Liquidations

The volatility experienced by Bitcoin in the last 24 hours resulted in approximately $87 million in liquidations in the futures market. More than $74 million of these liquidations were long positions. According to data from the analytics platform CoinGlass, the overall crypto market saw over $230 million in liquidated long positions in the last 24 hours, contributing to a total of $271 million in liquidations across various centralized exchanges.

Liquidations in the futures market occur when an investor’s position is forcibly closed due to insufficient funds to cover the losses. This situation arises when market movements are unfavorable for the investor’s position, leading to the loss of the initial margin or the amount set by the investor.

Developments in the ETF Space

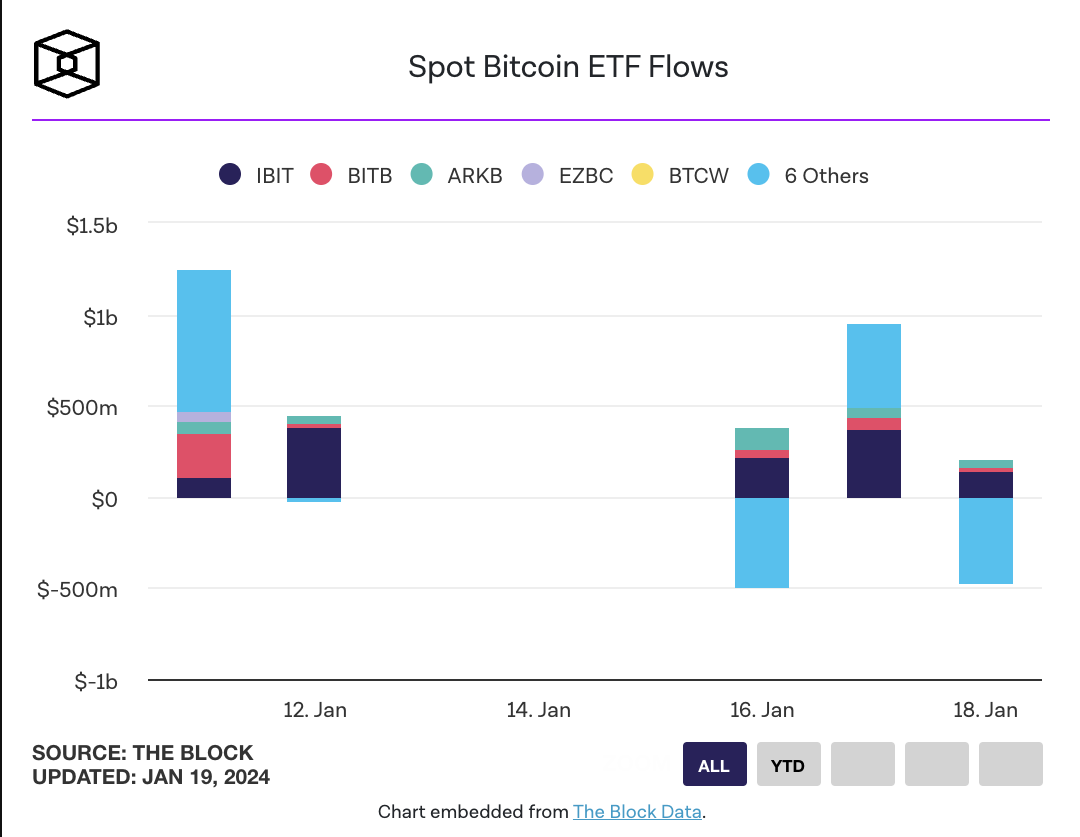

The declines in Bitcoin occurred amidst a net outflow of $137.4 million from spot Bitcoin ETF products on January 18th, largely due to a withdrawal of $582.3 million from Grayscale’s fund.

Analysts led by Nikolaos Panigirtzoglou at JPMorgan stated yesterday that if investors in the spot ETF product converted from Grayscale’s flagship GBTC fund continue to take profits, Bitcoin’s price could face additional downward pressure in the coming weeks. Nate Geraci, president of the investment advisory firm The ETF Store, mentioned in an article shared on X:

“Since the ETF conversion, GBTC has lost approximately $5.5 billion in assets amidst Bitcoin’s price fluctuations.”

According to blockchain data analytics platform The Block Data, net inflows into other new ETF products continue, with Fidelity’s fund seeing an inflow of $177.9 million on January 18th. BlackRock’s iShares Bitcoin ETF also experienced an inflow of $145.5 million on the same day. The new Bitcoin ETF products, which began trading last week, reached a total volume of $1.4 billion on January 19th, with Grayscale’s fund accounting for 58.5% of the total flow.

Türkçe

Türkçe Español

Español