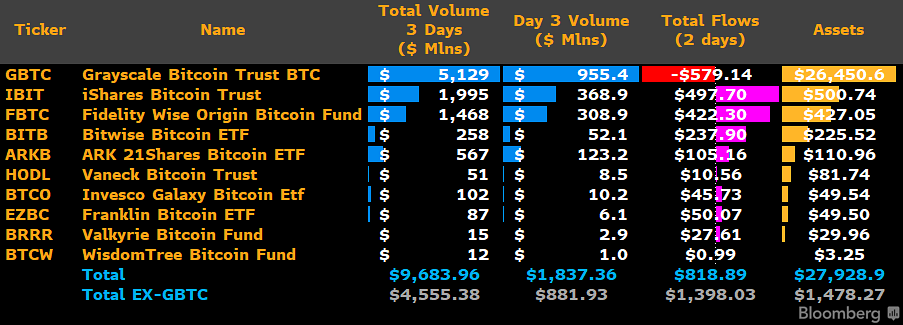

Spot Bitcoin exchange-traded funds (ETFs) in the United States have seen eight-digit trading volumes within three days since their launch. Bloomberg Intelligence analyst James Seyffart shared data via social media platform X, indicating that as of January 16, spot ETF volumes had exceeded $10 billion.

Bitcoin and the ETF Process

The latest Bitcoin-focused ETF products have been the subject of debate since their initial launch on January 11, and the high trade activities have had little effect on the increase in Bitcoin prices. Bloomberg analyst Eric Balchunas argues that despite some experts’ cautious approach, the figures speak for themselves. Seyffart shared the following statement:

“Let me put into context how crazy the $10 billion volume in the first 3 days is. There were 500 ETFs launched in 2023. Today, they collectively did a volume of $450 million. The best one did $45 million. And many of them had months to get going. Just $IBIT is seeing more activity than the entire 23 Freshman Class.”

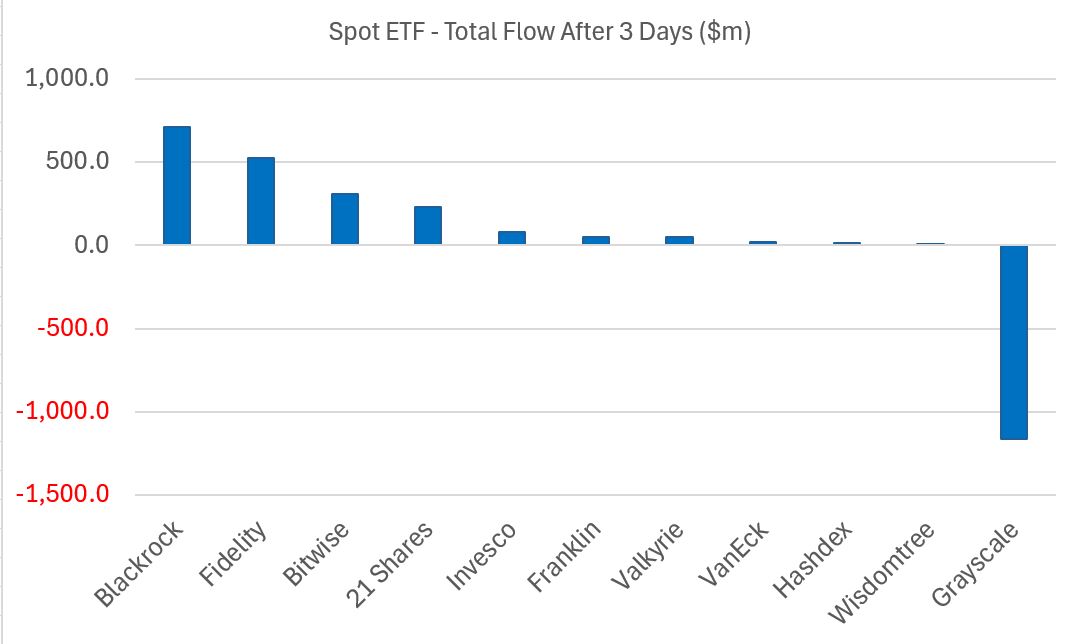

In terms of net inflows and outflows, the picture continues to show sales from the newly converted ETF product Grayscale Bitcoin Trust (GBTC). According to data from BitMEX research, the most significant net gains belong to BlackRock’s iShares Bitcoin Trust (IBIT). IBIT saw an increase of $700 million in three days.

Meanwhile, GBTC experienced more than $1.1 billion in net outflows. This suggests that investors are transitioning to ETF products due to higher transaction fees associated with GBTC.

Famous Figures Comment on ETFs

James Van Straten, a research and data analyst at crypto analysis firm CryptoSlate, expressed in part of his statement that the pace of transactions continuing throughout the first month would be very encouraging:

“Spot Bitcoin ETF inflows of $2 billion versus GBTC’s total outflows are currently at $1.18 billion.”

Meanwhile, Jan3 CEO Samson Mow predicted that the balance in the ETF field would return after the volume increase post-launch, and stated the following:

“Everything needs time to recalibrate. The GBTC selling pressure will not be a long-term process. Many can’t sell because the tax burden is too great, and eventually, Grayscale will have to give in regarding fees. This is likely to happen sooner rather than later.”

Türkçe

Türkçe Español

Español