In the world of Bitcoin and altcoins, early detection of certain cryptocurrency projects is very important. Entering these cryptocurrencies before they appreciate in value can yield significant gains. On the other hand, once prices rise, people start wishing they had invested in these cryptocurrencies earlier. Now, I will talk about two cryptocurrency projects so that you won’t have to say in the future that you wish you had bought them.

Altcoin Timeswap

Timeswap stands out as a pioneer in oracle-less lending and borrowing protocols, facilitating the creation of money markets for ERC-20 tokens. Inherent in its design, Timeswap ensures that all loans are fixed-term without being liquidated and operate completely without oracles.

This unique approach eliminates the common risks associated with oracle manipulation in DeFi. Currently active on platforms such as Arbitrum, Mantle, Polygon PoS, Polygon zkEVM, and Base, Timeswap possesses several key features.

What are the Features?

- Timeswap’s reliance on user-driven pricing and risk management processes eliminates the need for oracles, protecting the protocol from oracle manipulation attacks. It also allows for the creation of lending and borrowing markets for various ERC-20 tokens.

- Timeswap grants everyone the authority to create a market for any ERC-20 token. Participants can freely engage in lending, borrowing, and providing liquidity in existing pools.

- Borrowers benefit from the security of non-liquidatable loans, borrowing against their token assets without the constant threat of liquidation. If repayment is not made before maturity, the protocol forfeits the borrower’s collateral.

- All lending and borrowing activities in Timeswap are tied to a predefined loan duration and fixed interest rate, providing users with certainty and transparency.

- Despite being fixed-term, users including lenders, borrowers, and liquidity providers can exit their positions early. However, it is important to remember that early withdrawals may cause price discrepancies.

- Each lending and borrowing pool in Timeswap operates in isolation, containing risks within a specific pool and preventing participants from being affected by the outcomes of other pools.

- Timeswap’s design prevents borrowers from taking low-collateral loans at any time and price by embracing arbitrage, enhancing security and stability for lenders.

- As a base layer protocol, a Timeswap contract or pool remains unchanged after deployment. However, certain protocol-level parameters, such as fee keys and token distribution, can be altered through governance when the TIME token is in operation.

TIME Token Review

Timeswap is currently in the development phase of launching its native TIME token, which will enhance the protocol’s governance with active participation from community members. The token has not yet been released. This token will enable active participation within the decentralized network, and users will have the option to acquire it through a special liquidity mining event to get involved in providing liquidity.

As the DeFi ecosystem continues to grow and mature, protocols like Timeswap become increasingly important in addressing structural and capital inefficiencies and introducing new financial principles to enhance the ecosystem.

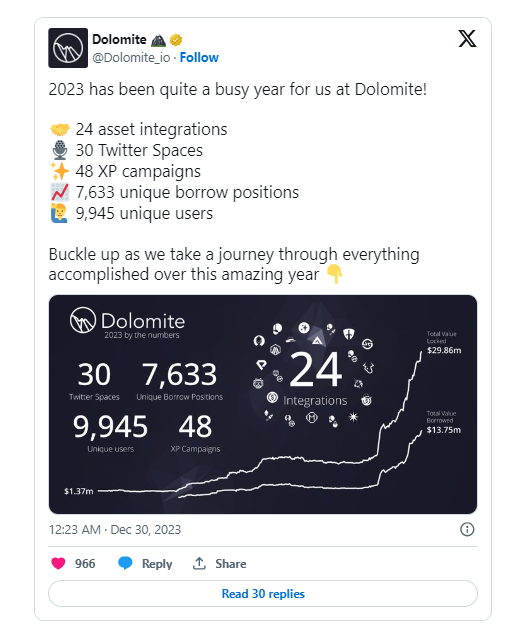

Altcoin Dolomite

Dolomite is a dapp that facilitates secure trade agreements and provides over-collateralized loans. It distinguishes itself by avoiding custody of users’ funds and offers features such as margin trading using spot settlement and on-chain liquidity through AMM pools. Specifically, Dolomite excels in offering a range of financial instruments including over-collateralized loans, margin trading, and spot trading.

With a broader vision, Dolomite aims to become a hub for DeFi activities. It will enable various assets such as other protocols, yield aggregators, decentralized autonomous organizations (DAOs), market makers, hedge funds, and more to efficiently manage their portfolios and execute strategies on-chain.

In May 2023, Dolomite raised $2.5 million in a funding round led by Draper Goren Holm (DGH) and NGC Ventures. Additionally, strategic partnerships with industry leaders like ChainLink, Harvest Finance, and Arbitrum further enhance Dolomite’s capabilities.

What Makes It Different?

Dolomite also differentiates itself from other lending protocols with the assets it supports and the features it offers to optimize user engagement. Users on Dolomite can stake directly from the platform’s interface and earn rewards even while using its borrowing services or other offerings.

More importantly, Dolomite promotes a user-centric approach by ensuring users receive full rewards. The platform’s extensive asset support facilitates complex strategies such as loops and hedging that were previously inaccessible.

Dolomite’s Native Token Review

Although Dolomite currently does not have its own token, there is a possibility of a token launch in the future. Accordingly, early users interacting with the DEX may receive an airdrop if the platform launches such a token.

Meanwhile, Dolomite recently introduced a designated token called vARB for “vote-focused ARB,” which allows owners to participate in governance voting on the Arbitrum network. Dolomite plans to keep vARB in “isolation mode” within the protocol, allowing users to use it specifically for voting on Arbitrum.

This feature is not present in ARB tokens locked in liquidity pools for lending and borrowing. Traditional ARB tokens locked in various DeFi protocols like Aave or Compound lack the necessary capacity for governance voting.

The ability for users to convert their ARBs to vARB, thus using the same tokens for voting and lending/borrowing, is a significant advantage of vARB. More importantly, since the value of vARB remains consistent with ARB, owners do not face liquidation risks due to price movements. Dolomite stands out in DeFi by offering a seamless platform for users to acquire assets and native DeFi rights and interact with unique features.

Türkçe

Türkçe Español

Español