The increase in stablecoin transaction volumes is generally seen as a positive indicator for the cryptocurrency market. However, the recent decline in the market value of major stablecoins like Tether (USDT) raises concerns. Experts caution against interpreting this trend as an early signal of a downturn, suggesting that the current decline may stem from seasonal effects typical during the year-end holiday period.

Understanding the Decline in Tether’s Market Value

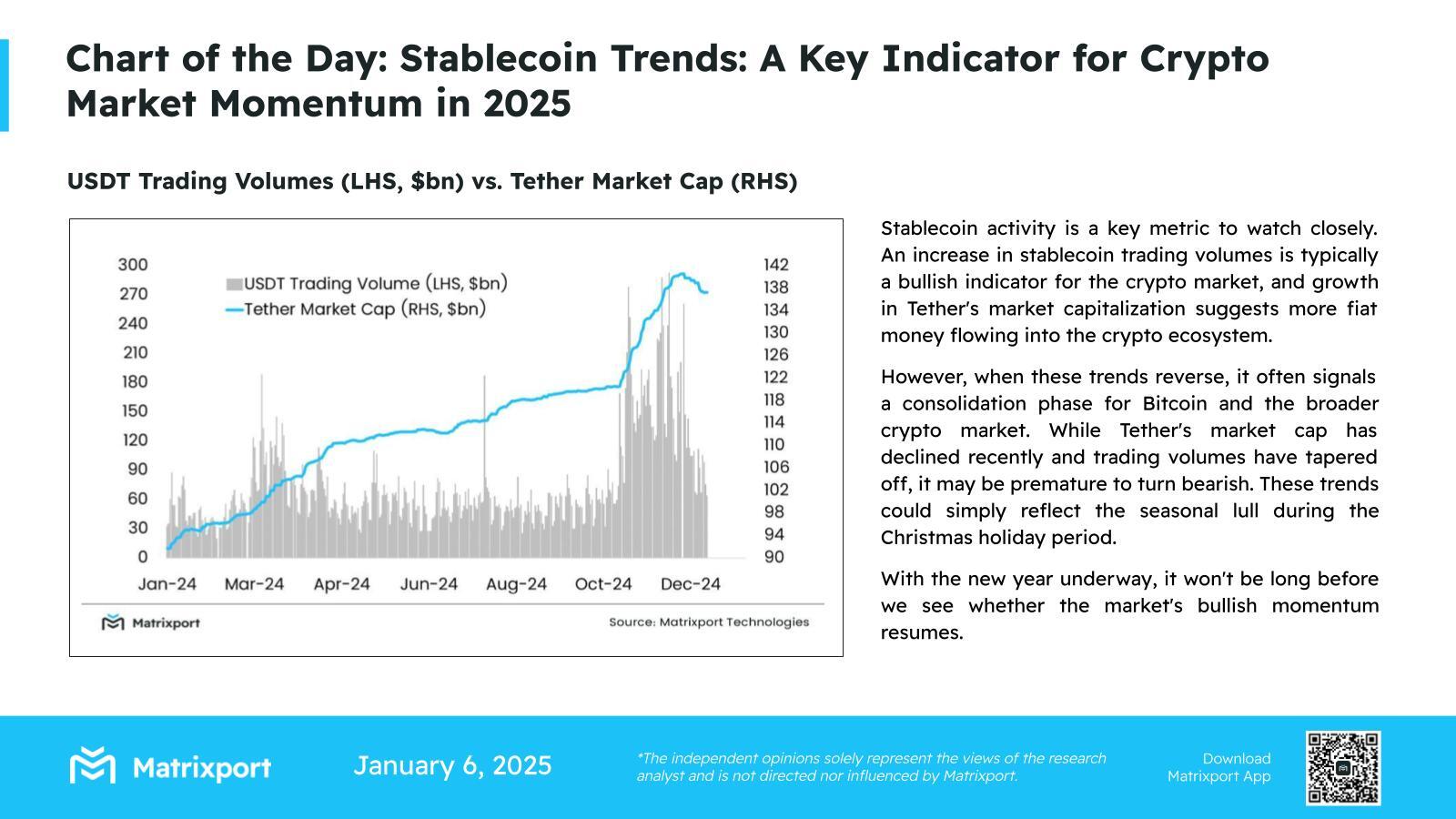

Transaction volumes and market values of stablecoins are crucial indicators for understanding fiat currency inflows and outflows in the cryptocurrency market. The recent drop in Tether’s market value and transaction volume may indicate a short-term stagnation in market dynamics. However, according to Matrixport’s report dated January 6, this situation should not be viewed as a definitive sign of the market’s long-term direction. The fluctuations caused by seasonal changes could revert to an upward trend once the holiday season concludes.

Experts emphasize that monitoring changes in transaction volumes and market values is essential for accurately interpreting stablecoins’ effects on the market. As the new year begins, the activity of stablecoins could play a decisive role in determining the overall direction of the cryptocurrency market.

What Directions Will the Cryptocurrency Market Take in the New Year?

It should be noted that stablecoins are strong indicators reflecting market trends. In this context, changes in the market value of large stablecoins like Tether provide significant insights for market participants. Experts highlight that the current stagnation could be a typical process seen before significant price movements in the market.

With the anticipated activity the new year brings, an increase in stablecoin mobility is expected. The impacts of this mobility on the market will continue to be closely monitored.