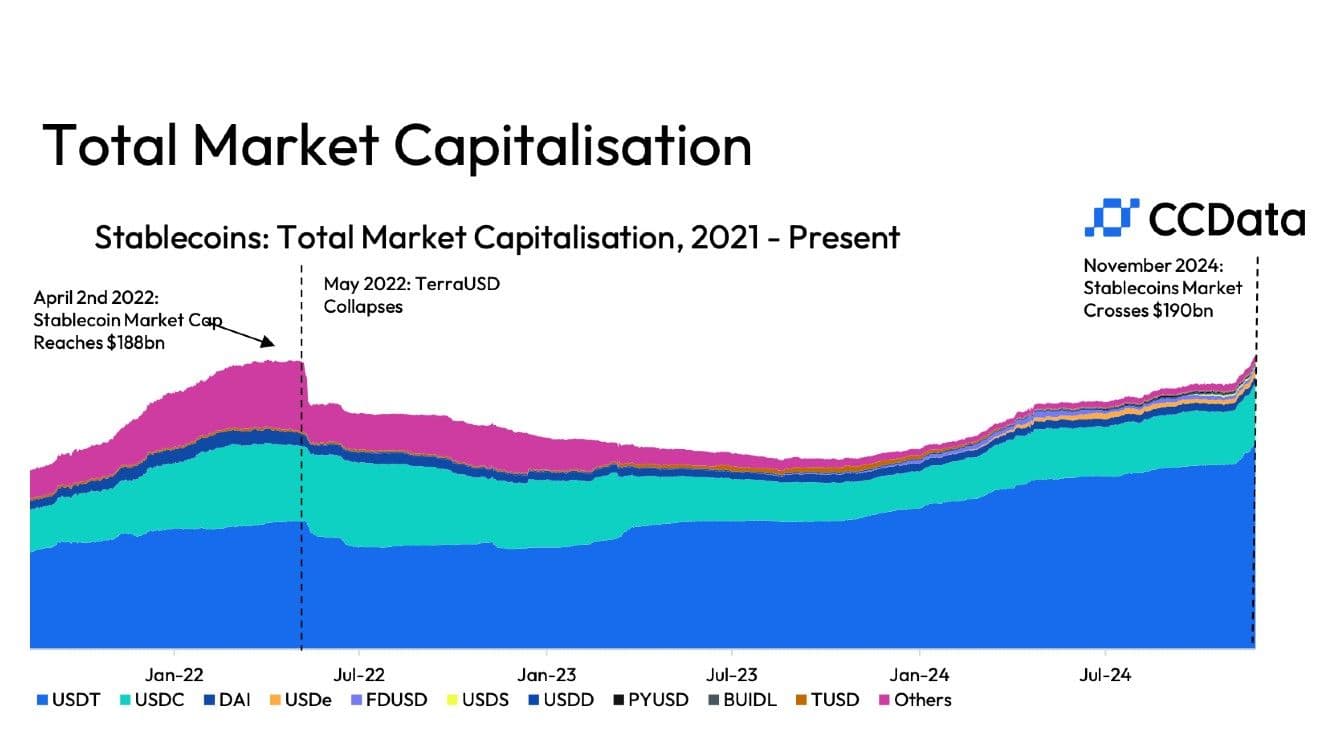

The stablecoin market, a significant branch of the cryptocurrency sector, reached a total market size of 190 billion dollars in November, marking its highest level ever. According to the report by crypto analysis firm CCData, this record surpasses the previous peak before the Terra-Luna collapse in April 2022. The overall rise in the cryptocurrency market has boosted demand for stablecoins, leading to significant growth in trading volumes.

USDT and USDC Lead the Sector

Tether’s USDT, the leader in the stablecoin sector, increased its market value by 10% to 132 billion dollars. Meanwhile, Circle’s USDC also saw a 12% rise in market value, reaching 39 billion dollars. The report indicates that USDT holds the top position with a market share of 69.9%, while USDC ranks second with a 20.5% share.

Additionally, of the nearly 200 stablecoins in the market, 38 set supply records in the last month. For instance, Ethena’s USDe coin increased its supply by 42%, reaching 3.8 billion dollars. USDe stands out by offering investors an annual return of 25%.

Volume of Stablecoin Transactions Increases

In November, stablecoin trading boosted transaction volumes on centralized cryptocurrency exchanges by 77%, rising to 1.8 trillion dollars. Of these transactions, 83% were conducted using USDT, with FDUSD holding a 9% share and USDC capturing 8%.

CCData emphasized the importance of stablecoins as a source of liquidity, noting that the introduction of new tokenized products in the market has contributed to this growth. The surge of the stablecoin market is supported by both new investment tools and expanding trading volumes.

Türkçe

Türkçe Español

Español