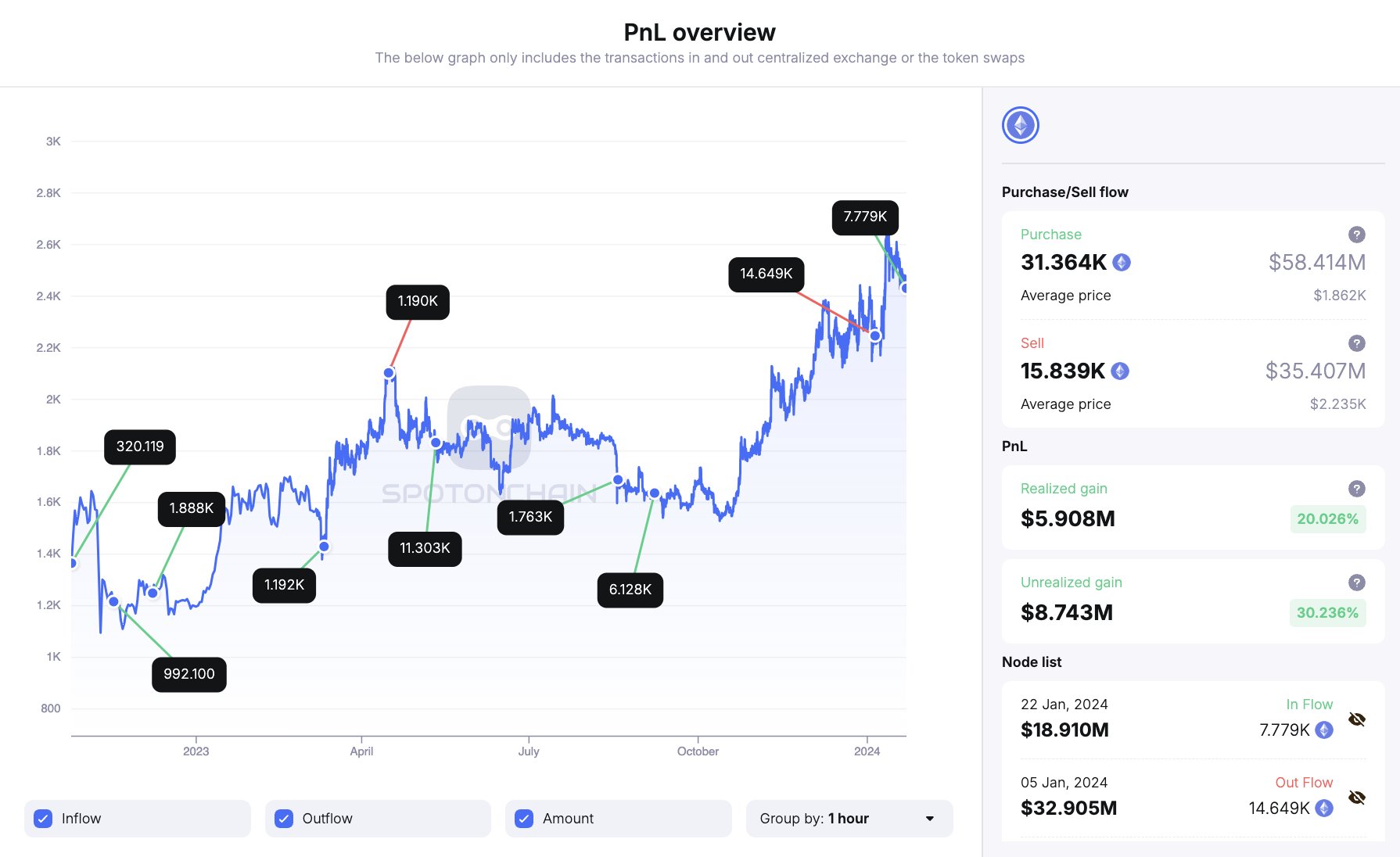

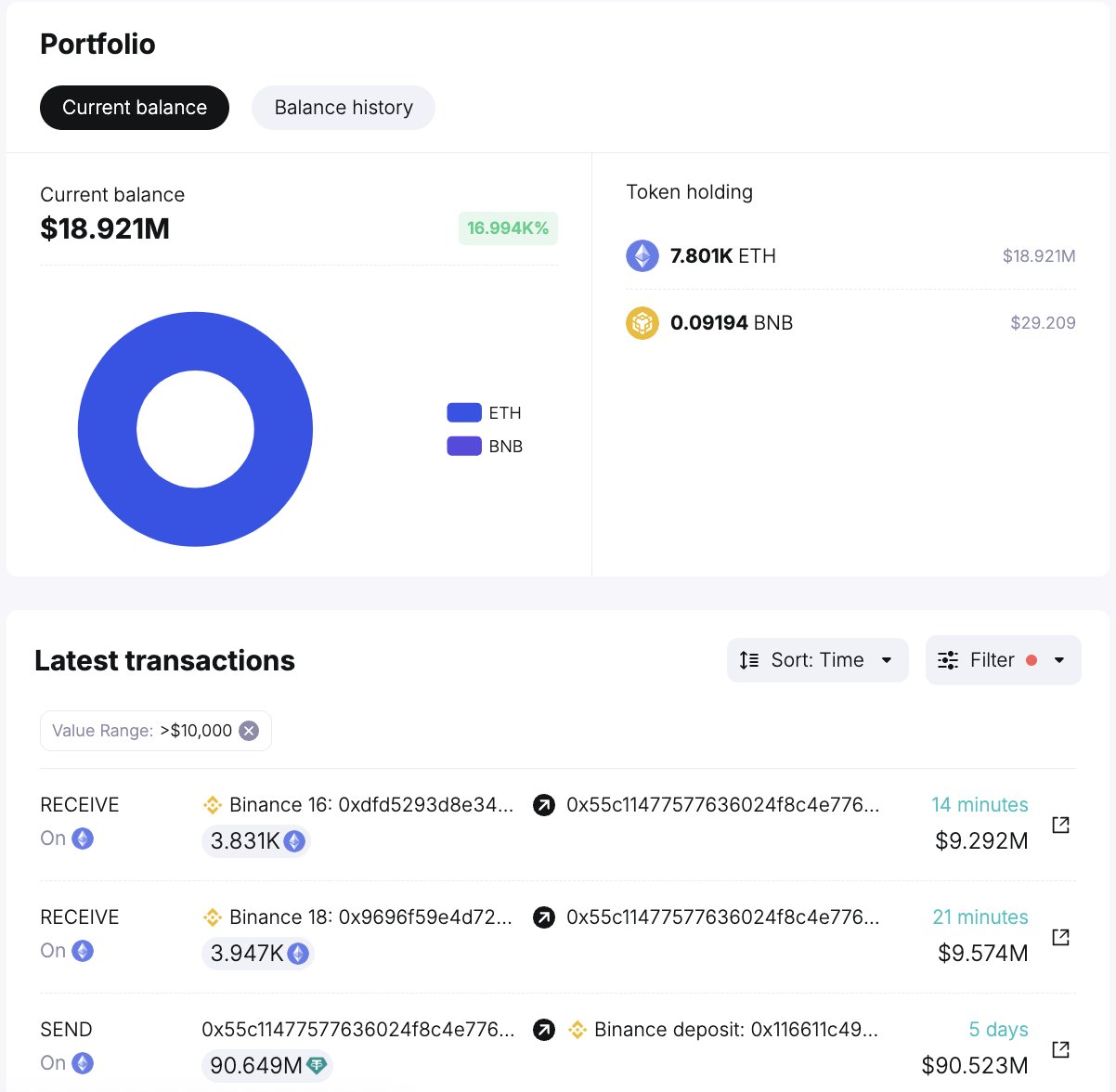

In a recent market maneuver, a significant player who profited a total of 14.6 million dollars from Ethereum (ETH) took advantage of the latest market downturn to acquire more tokens. The whale, identified as 0x55c, withdrew approximately 7,779 ETH worth 18.9 million dollars from Binance about an hour ago.

Analyzing the Whale’s Tactical Withdrawal

The withdrawal by 0x55c indicates a calculated move to benefit from the market downturn, suggesting a strategic accumulation of more ETH. The timing of the withdrawal, aligned with the local bottom, shows the whale’s skillful use of market dynamics to optimize assets.

The whale’s significant total profit of 14.6 million dollars from ETH positions them as a noteworthy participant in the cryptocurrency space. However, what adds intrigue to their recent actions is their deposit of 90 million dollars to Binance just five days earlier. This raises the question: Is this extensive financial activity solely focused on ETH?

Unraveling the Motivation: Is It All About ETH?

The connection between the whale’s profit accumulation in ETH, the recent withdrawal from Binance, and a significant USDT deposit leads to speculation about their inclusive strategies. The possibility of an all-in approach to Ethereum becomes an intriguing point as the whale appears to strategically maneuver funds to maximize focus on this particular cryptocurrency.

Understanding the movements of significant players like 0x55c provides insights into potential market trends and sentiments. A strategic retreat during a market downturn suggests the whale sees value in accumulating more tokens in ETH, indicating a bullish outlook despite short-term market fluctuations.

Deciphering Strategic Moves in a Fluctuating Market

As the cryptocurrency market continues to evolve, the actions of leading participants like 0x55c offer a glimpse into the strategic decision-making process prevalent in this dynamic environment. The alignment of withdrawals, profit accumulation, and significant deposits raises questions about the whale’s specific goals and the perceived potential of ETH in their portfolio.

In conclusion, the recent activities of the Ethereum whale who earned a profit of 14.6 million dollars, especially the strategic retreat and previous USDT investment, narrate a tale of tactical decision-making.