While we observed sudden sell-offs in altcoins at the time of writing, most cryptocurrencies are still trading above their critical resistance levels. Notably, we witnessed significant price increases in meme coins yesterday. Bitcoin may have dropped below $61,500, but it remains close to its historical peak, and an increase in volatility is expected after the weekly close.

Meme Coins on the Rise

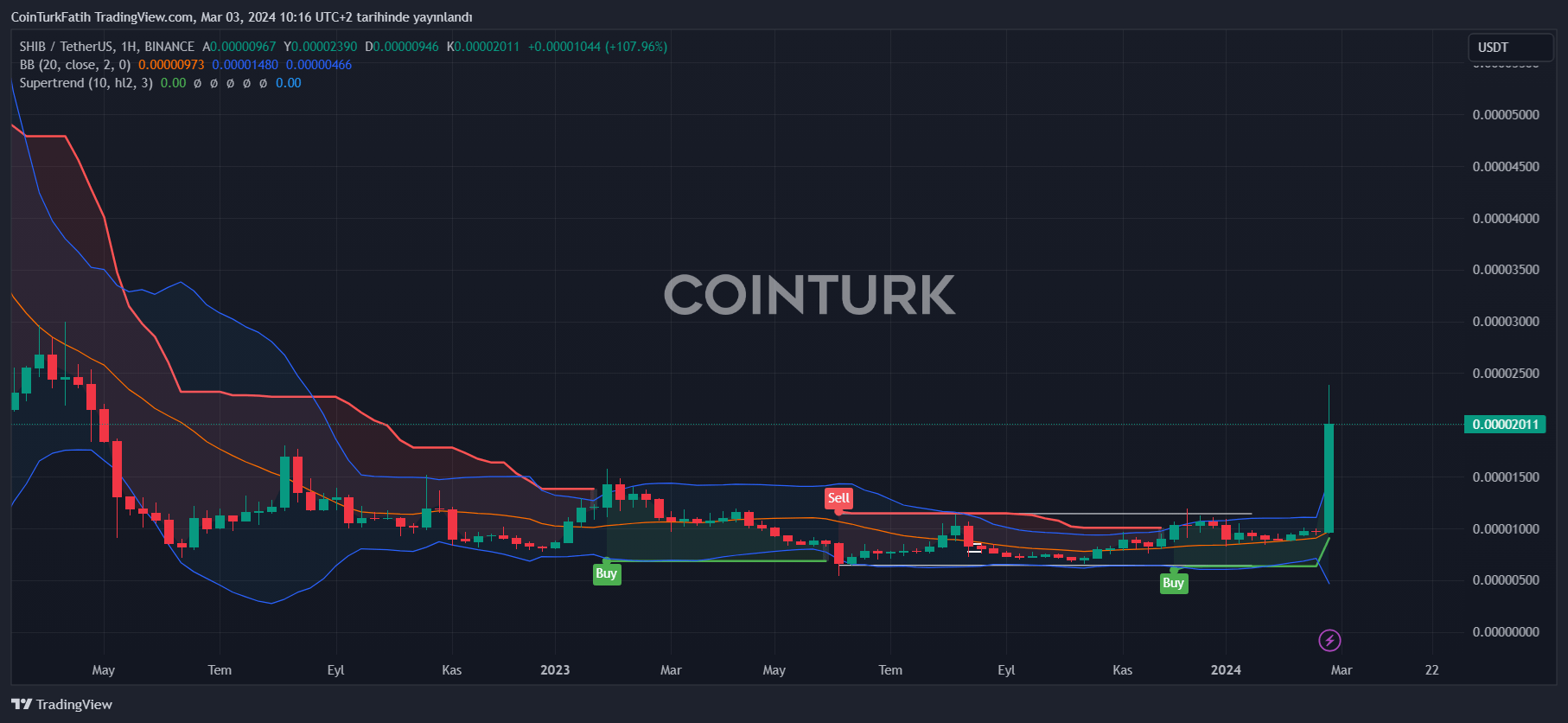

Over the weekend, Shiba Coin’s price impressed with a 69% rally, and several other meme coins followed its lead. Blockchain analytics firm Santiment views the rise in meme coins like SHIB, DOGE, BONK, WIF positively following the recent BTC surge. Typically, during periods of increased risk appetite and altcoin rallies, we see investors triggering double-digit gains in riskier cryptocurrencies.

Some whales have seen this latest rise as an opportunity to sell, and the price of SHIB dropped just below $0.00002 at the time of writing. According to on-chain analysis firm Lookonchain, between November 17 and December 27, 2023, whales on the Binance exchange directed profit-taking in SHIB.

Commentary on SHIB, WIF, BONK

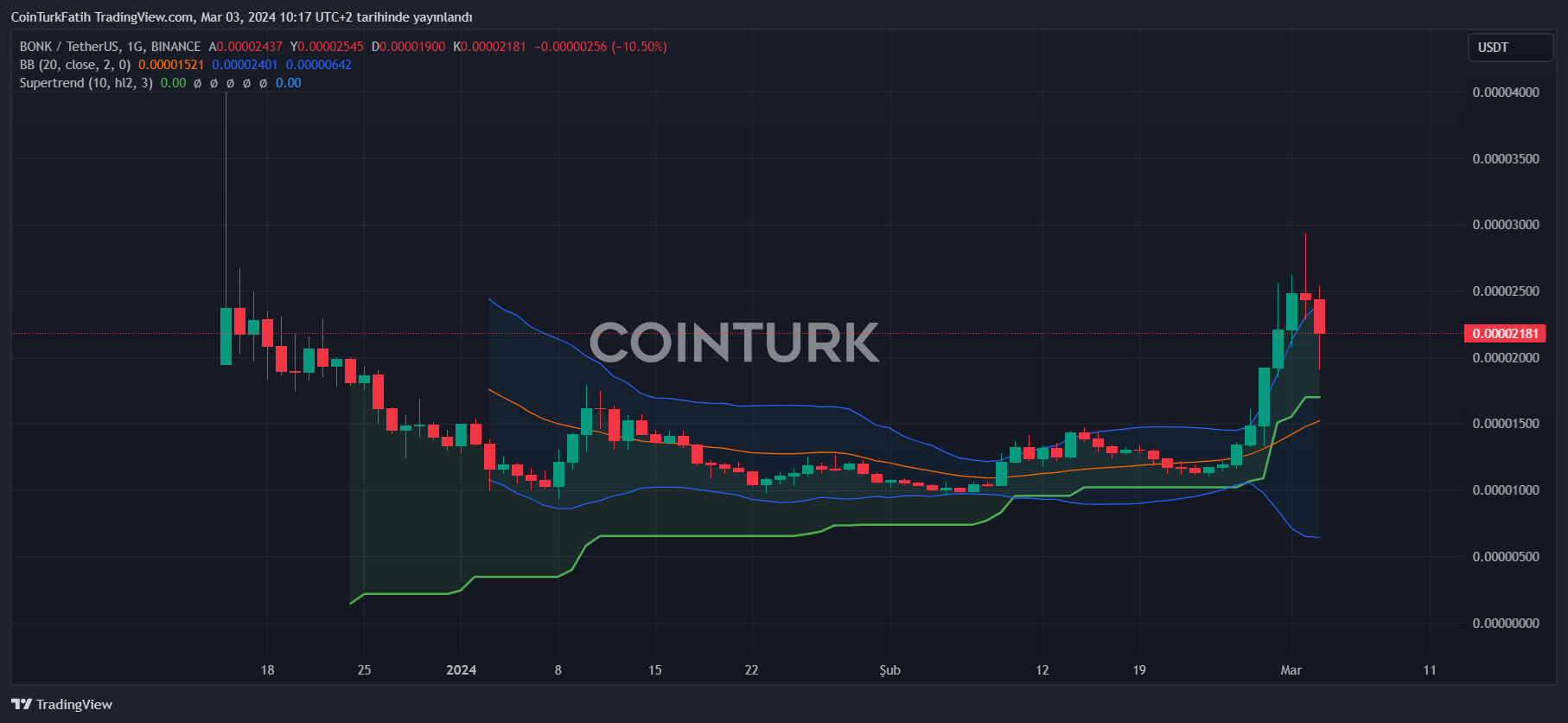

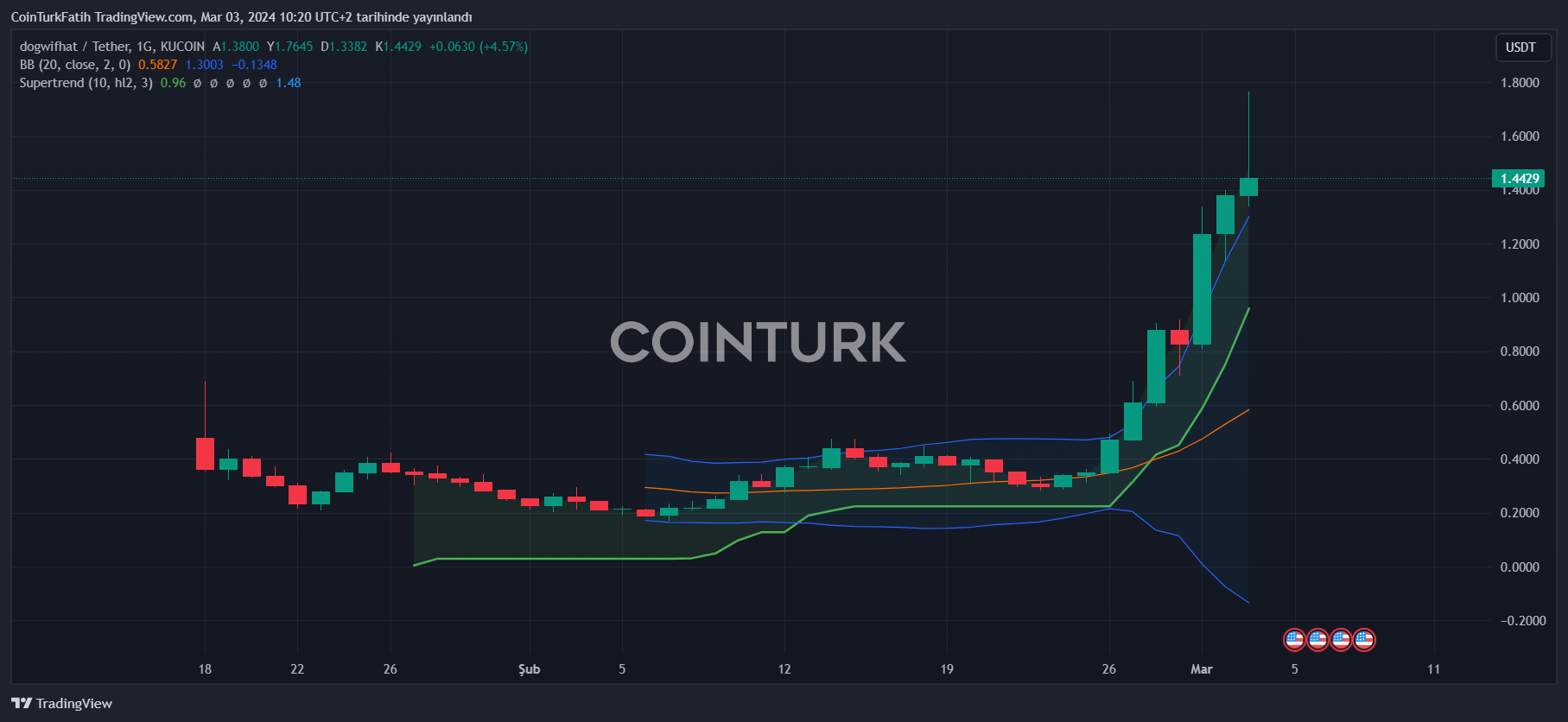

Throughout the past week, various cryptocurrencies such as PEPE, WIF, BONK, DOGE, and FLOKI have seen significant gains, and their social dominance has increased substantially. According to a Lookonchain report, a single crypto whale made a profit of $1.35 million after purchasing 673,394 WIF for 7,059 SOL. Another whale jumped on the bandwagon early with a million-dollar purchase at $0.71.

For Shiba Coin, closing above the key price region of $0.00001830 could lead to new peaks between $0.00002587 and $0.00003588. However, a close below support could see a return to the $0.000012 parallel channel resistance without surprise.

BONK Coin, aiming to revisit its peak on the Binance exchange, is just above the $0.00002068 support region. If it loses this area, we could see a drop to $0.00001742 and $0.00001473.

Finally, WIF Coin, which reached its all-time high, is also falling victim to profit-taking at the time of writing. If it loses the $1.4 level, a pullback to $1.15 and $0.92 could be seen.

Türkçe

Türkçe Español

Español