Terra Classic (LUNC) recently exhibited a notable performance with a double-digit price increase. This occurred at a time when the token’s burn rate increased, and the circulating supply decreased. However, is the high burn rate the sole reason behind this surge, or are there other factors to consider?

LUNC’s Burn Effect

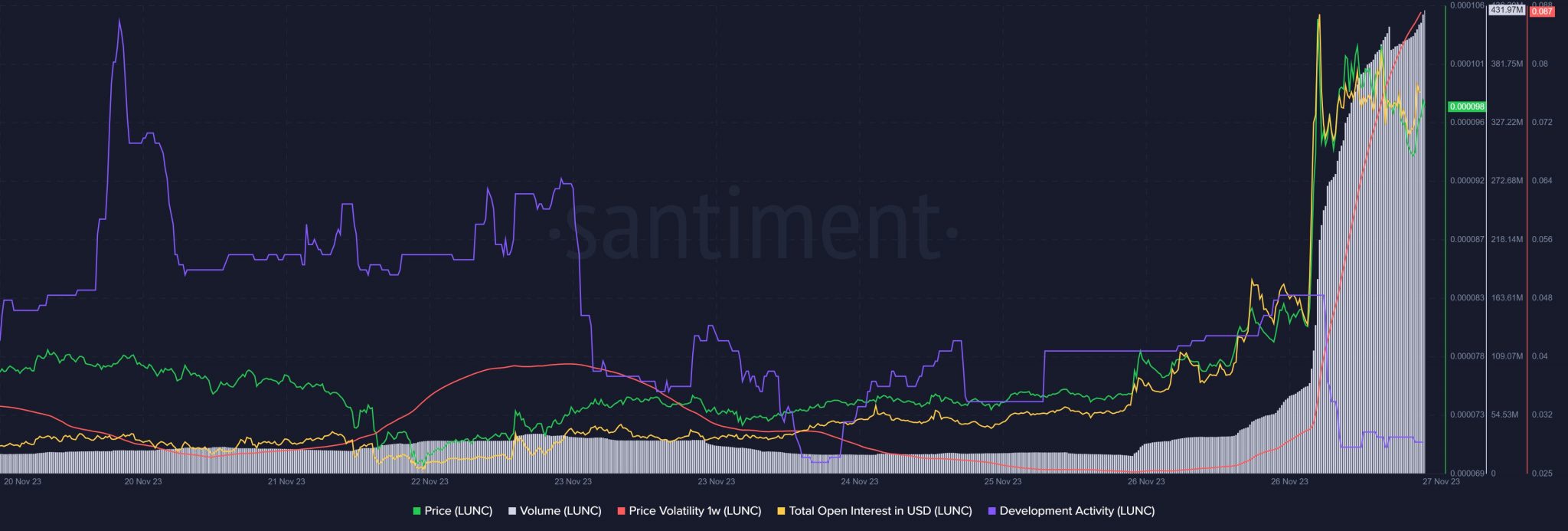

According to data, the LUNC price surged by more than 25% in just the last 24 hours. At the time of writing, Terra Classic was trading at $0.00009977 with a market value exceeding $578 million, making it the 79th largest cryptocurrency. One possible reason for this increase could be LUNC’s high burn rate. When tokens are burned, the circulating supply decreases, making the asset more valuable. Luncmetrics analysis showed that over 700 million LUNC tokens were burned in the last seven days alone.

To date, more than 78.24 billion LUNC tokens have been burned, reducing the circulating supply to 5.8 trillion. In addition to the high burn rate, several indicators supported LUNC’s recent price increase trend. Notably, the trading volume increased by more than 1000% in the last 24 hours. Consequently, LUNC’s price volatility rose as it did in the open position in one week, enhancing the likelihood of a continued uptrend.

Data Indicates an Uptrend for LUNC

However, as the price increased, development activity around the Blockchain decreased. Analysis of LunarCrush data also revealed that LUNC’s social dominance and market dominance increased by 196% and 28%, respectively, in the last 24 hours. Another bullish metric was the improvement in LUNC’s AltRank during the same period.

Subsequently, to better understand if the bull run would continue, the daily chart of Terra Classic was checked. According to analyses, LUNC’s MACD indicated an uptrend. The Chaikin Money Flow (CMF) also followed a northward trajectory, increasing the chances of the uptrend continuing. However, the Relative Strength Index (RSI) was close to the overbought zone, signaling potential selling pressure that could lead to a price correction.

- LUNC’s burn rate correlates with price surge.

- Trading volume and market dominance rise sharply.

- Technical indicators show mixed potential outcomes.

Türkçe

Türkçe Español

Español