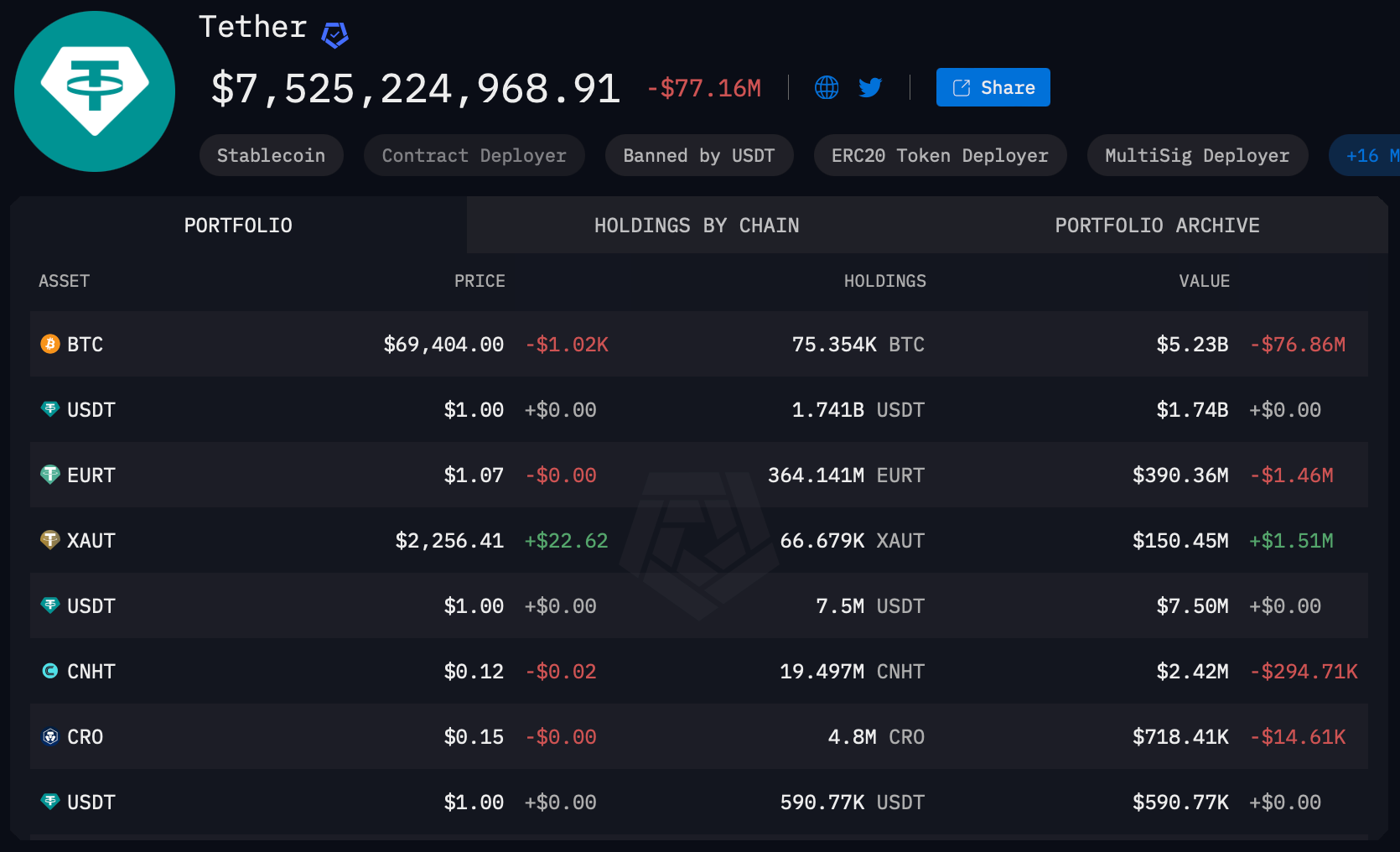

The issuer of the largest stablecoin Tether, recently purchased 8,889 BTC, significantly increasing its Bitcoin reserves. This strategic move has raised Tether‘s total Bitcoin holdings to over 75,000 BTC, with a valuation surpassing $5.3 billion.

Purchase Made Through Bitfinex Platform

According to Arkham Intelligence data, the purchase was confirmed on March 31, 2024, with approximately $627 million worth of Bitcoin transferred from the crypto exchange Bitfinex‘s hot wallet to Tether via an on-chain transaction. This significant increase in reserves has bolstered Tether’s Bitcoin wallet address to the seventh-largest globally.

Throughout the past year, Tether has made a noteworthy increase in its Bitcoin assets and first disclosed its BTC reserves in the first quarter of 2023. The company also indicated that it would invest 15% of its corporate profits from excess stablecoin reserves into BTC, signaling a strengthening of its position in the cryptocurrency market.

Tether’s CEO Paulo Ardoino emphasized the rationale behind the decision to invest in Bitcoin, pointing to its status as the world’s first and largest cryptocurrency and its potential as an investment asset. The latest attestation report for the fourth quarter of 2023 showed that Bitcoin contributed $2.8 billion to the company’s consolidated reserves, providing valuable insights into the financial impact of these investments. This strategic approach is part of Tether’s commitment to leveraging cryptocurrency market dynamics to strengthen its position.

Artificial Intelligence Initiative

In addition to focusing on cryptocurrencies, Tether is expanding its ventures into various technological areas, including Bitcoin mining and artificial intelligence technology. This diversification indicates the company’s desire to be a versatile investor and infrastructure developer in the cryptocurrency industry. Ardoino highlighted Tether’s broader goals, stating the company’s intention to be involved in various sectors from peer-to-peer (P2P) telecommunications to renewable energy production.

Tether’s move into artificial intelligence technology involves developing open-source, multimodal artificial intelligence models to set new industry standards and promote innovation and accessibility in AI technology. This strategic expansion, combined with high Bitcoin reserves, demonstrates Tether’s commitment to diversification and innovation in its pursuit of broader market impact and infrastructure development.