When examining the past few days, Bitcoin (BTC) showed signs of price momentum, giving hope to investors. However, despite the increase in price, long positions were liquidated and removed from the market.

The Current State of Long Positions in Bitcoin

According to CryptoQuant analyst SignalQuant, there was a clear struggle with longs as Bitcoin prices rose. This event is associated with investors with long positions deciding to sell their cryptocurrencies to minimize their losses during a bear market. Essentially, it is considered a defensive move made by traders who trade with expected price increases but are forced to sell as the market moves downwards.

Especially during the past month, there has been an increase in the number of long positions despite the lack of interaction with short positions. A “short squeeze” is referred to as a situation where investors with short positions are forced to buy to minimize their losses during a bullish market.

The recent increase in long positions may indicate that sudden short positions could be more frequent in the still uncertain crypto market. This situation presents potential implications for future price movements of Bitcoin.

Notable Metric in Bitcoin

Another critical aspect to consider is the “Put to Call” ratio. This ratio compares the number of put options (allowing selling) to call options (allowing buying) to measure market sentiment. An increase in the “Put to Call” ratio may indicate a change in market sentiment or a hedging strategy implemented by traders.

Additionally, the open interest of Bitcoin, which measures the total value of outstanding futures contracts, has also increased. This indicates an increased interest in Bitcoin derivatives trading despite market fluctuations.

Furthermore, volatility, which is one of the most closely watched factors in Bitcoin, has also increased. Volatility represents investor expectations about future price fluctuations in the market. Its rise can shed light on increasing uncertainty among traders, potentially stemming from various factors, including macroeconomic events or regulatory developments.

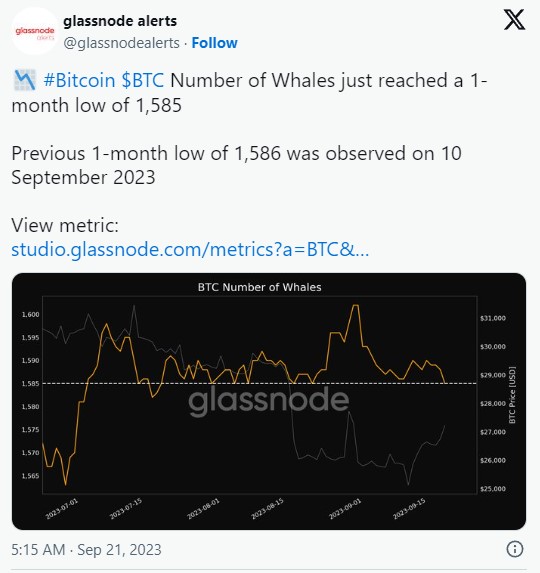

In addition, it appears that whales have started to lose interest in BTC. Data from Glassnode revealed that the number of Bitcoin whales dropped to the lowest level in a month, at 1,585. This suggests that whales may be reducing their Bitcoin positions or diversifying their portfolios. As of the latest data, Bitcoin was trading at $26,600, and trading volume continued to decline.

Türkçe

Türkçe Español

Español