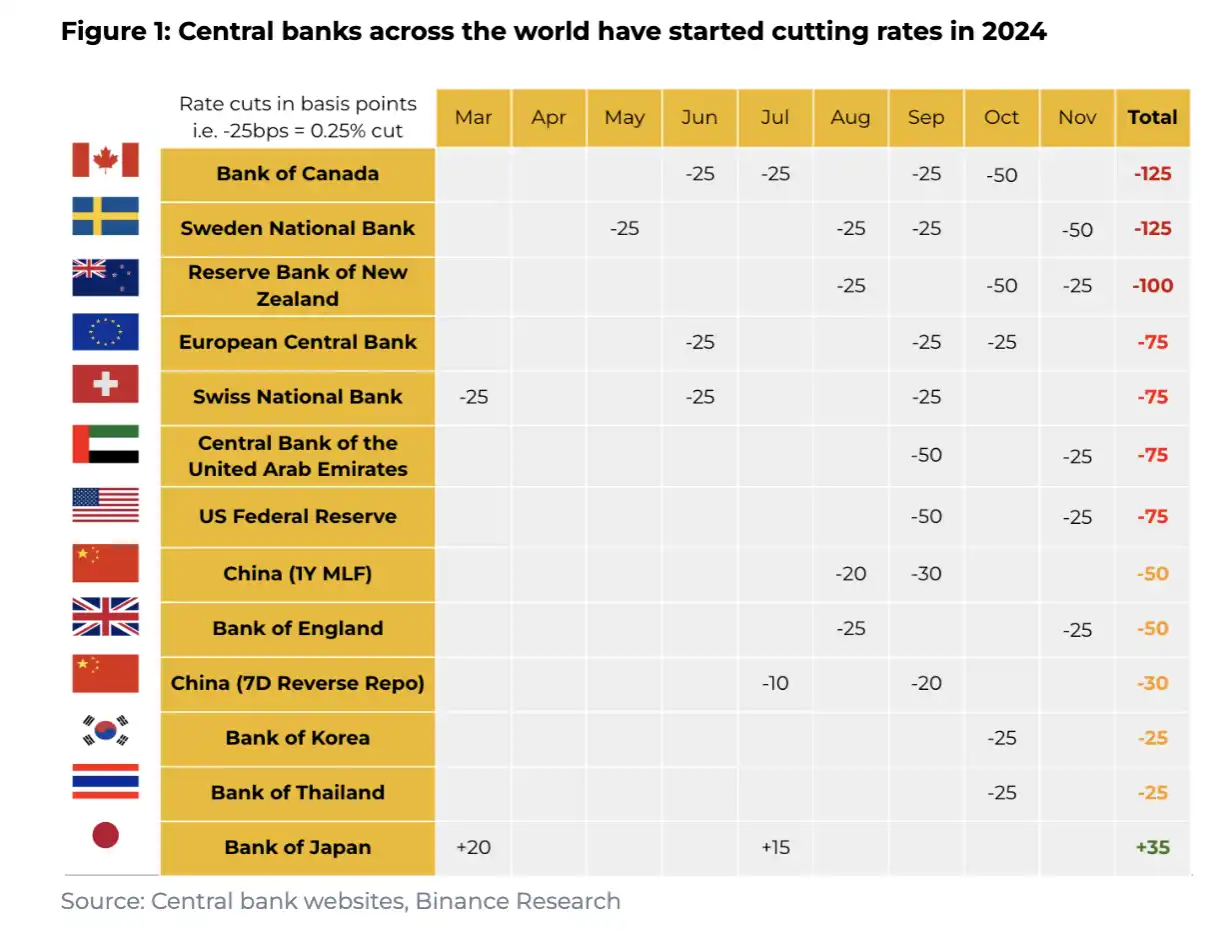

On September 18, 2024, the Federal Reserve (Fed) reduced its benchmark interest rate by 0.5 percentage points. This marked the first significant rate cut since the response to the Covid-19 pandemic in 2020. Subsequently, another cut of 0.25 percentage points occurred in November, indicating the Fed’s move towards a cycle of interest rate reductions, which has led to an increased appetite for riskier assets.

Impacts of Interest Rate Cuts on the Economy

The Fed aims to maintain maximum employment while controlling inflation. In mid-2022, inflation exceeded 9%, prompting aggressive interest rate hikes, which brought rates to their highest levels in two decades. However, with inflation decreasing, the Fed seized the opportunity to begin lowering rates.

Experts expect a total interest rate reduction of 1-2% throughout 2025, with a 62% likelihood of a 0.25 percentage point cut in December 2024.

The Role of Interest Rate Cuts in Cryptocurrency and Other Markets

Interest rates also influence commodities and fixed-income assets. Commodities, sensitive to inflation, tend to exhibit volatility following rate cuts. Additionally, such cuts generally lead to higher bond prices.

Historically, cryptocurrencies tend to benefit from interest rate cuts. For instance, after the rate cut in March 2020, the cryptocurrency market grew by 537% within a year. This trend has sparked interest in monitoring cryptocurrency performance following 2024’s cuts, with expectations of continued market growth.

Changes in interest rates affect fundamental dynamics within the U.S. economy. However, it’s important to evaluate these effects alongside other factors such as inflation, unemployment, and regulatory policies.