Fed interest decisions have become even more important in the ongoing bear market for cryptocurrency investors. For about 2 years, the Fed has been rapidly increasing interest rates. Now we are seeing the results of these rate hikes. Powell has now stepped back from further increases and the data continues to support his decision.

December Interest Expectations

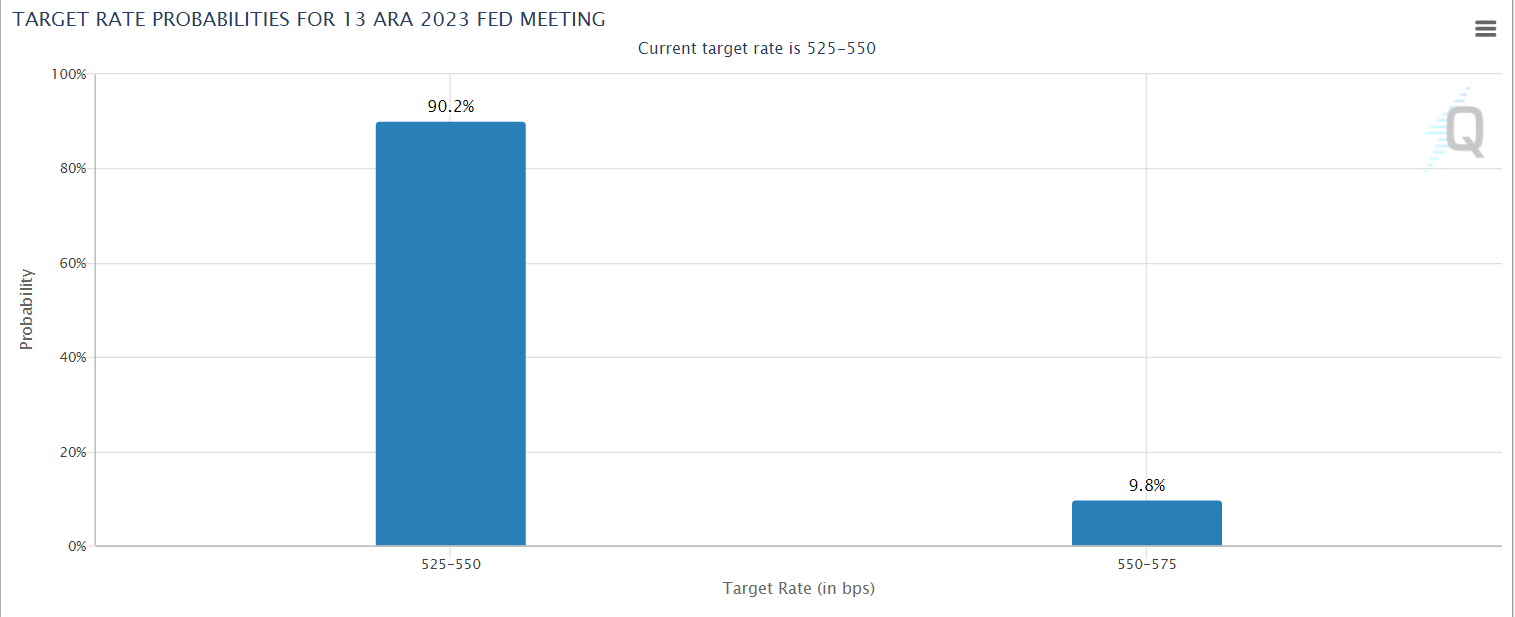

Before today’s macro data was released, it was expected that interest rates would remain unchanged in December. This view has been further reinforced after the release of the data. Economists were surprised by the 150,000 NFP figure, which was lower than the expected 180,000. Additionally, the unemployment rate rose to 3.9%.

December interest expectations are expected to remain unchanged.

On October 19, the yield on the 10-year Treasury bond, which exceeded 5%, fell to 4.64% before the employment news. The yield on the 2-year Treasury bond also experienced a similar decline. The decline in bond yields could lead to more liquidity flowing into the risk markets. The current situation is good for risk markets, especially US stocks and cryptocurrencies.

Current Outlook for Cryptocurrencies

If there is no interest rate hike in December (which the data suggests), we will understand that the Fed has reached the interest rate ceiling. The messages of a possible last interest rate hike do not convince the market, and the incoming data also suggests that more interest rate hikes may not be necessary. Therefore, the Fed may start expected interest rate cuts in the second quarter of next year.

The rapid front-loaded interest rate hikes that shocked the cryptocurrency market will have the opposite effect as they are reversed. To understand the current situation, we need to go back to the beginning of 2022. There was a negative sentiment in the markets and the Fed’s minutes had strong messages about interest rate hikes. In previous meetings, the Fed saw inflation as temporary, but in the minutes from the beginning of 2022, they clearly stated that they would take action.

Today, it seems like the exact opposite. The Fed says inflation is resilient, interest rates (which were at their lowest that day) are now at their peak, and everyone can predict what will happen next. Interest rates will start to be lowered in 2024, SEC ETF approvals will be given, and unless a major global war breaks out, there will be a strong flow into cryptocurrencies.

Those who saw these days at the beginning of 2022 are expecting the opposite to happen in 2023 and 2024. Therefore, we can continue to count down for the new bull season.

Türkçe

Türkçe Español

Español