The price of Bitcoin turned around from $30,000 near the opening of the US markets, and altcoins focused on the weekly close. Many cryptocurrencies are waiting for a continuation of the recovery in BTC price for resistance tests, although they are above support levels. The confidence of investors has been completely shattered due to the sales that have followed every rise for months.

Solana (SOL) Analysis

With ETF news and SEC defeats, the nightmare days of cryptocurrencies in 2022 are starting to be forgotten. The crypto king surpassed $30,000 this time without fake news. Although it cannot currently make closings in the critical zone, the weekly closing above $28,800 can open the door to new highs.

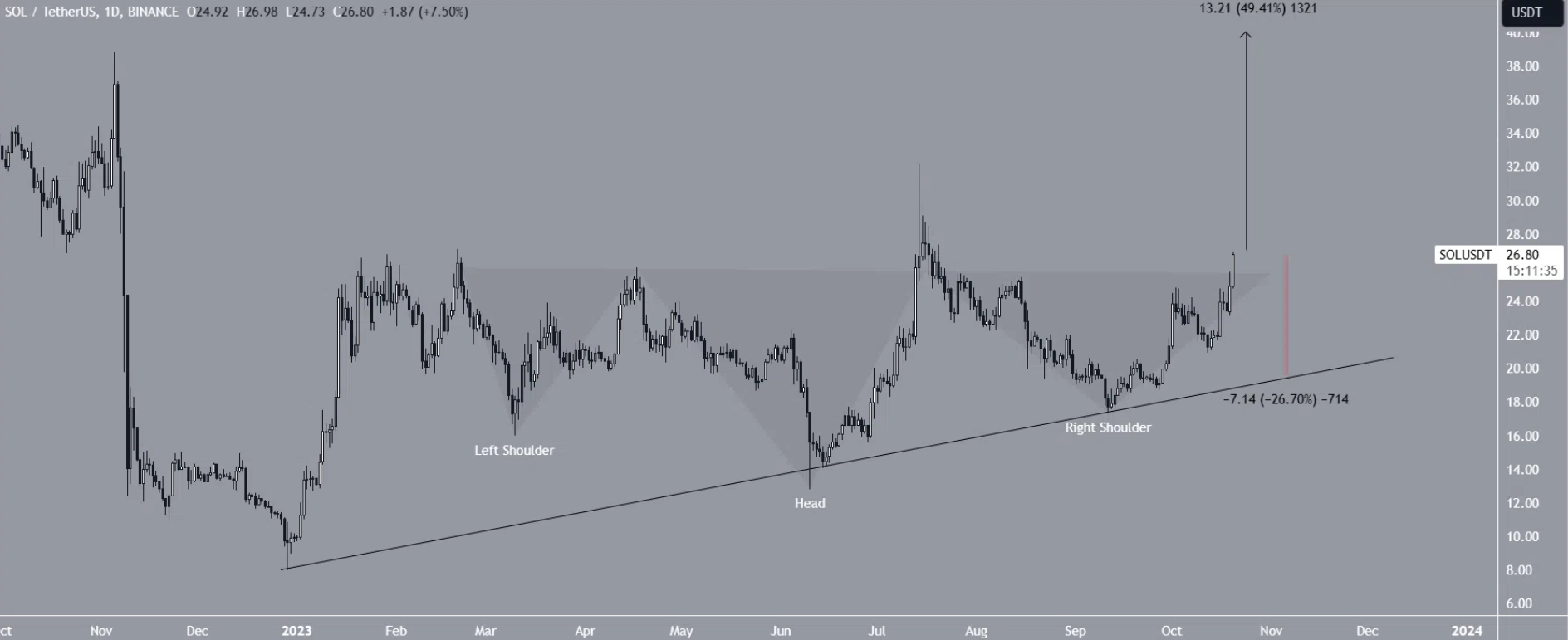

Unlike the general market, SOL Coin is showing a more positive trend. Since March, the SOL price has been trading within a reverse head and shoulders formation. This is a bullish formation, and visible demand from institutional investors is fueling hopes for a clear comeback.

We said reverse head and shoulders is a bullish formation, if SOL Coin breaks out of the formation upwards, it could mean the beginning of a significant rally. If the expected price movement occurs, we can see an encouraging peak at $40. However, closings below the $27 resistance area can cause a 21% drop in price.

The key factor here will be the performance of BTC price, so it is important for investors to focus on the weekly closing.

Injective (INJ) Chart Analysis

INJ Coin is gaining popularity, and investor sentiment is positive due to recent good news. While all this is happening, with the addition of the BTC rally, the price is targeting new highs. Since April, INJ Coin has been trading within a long-term symmetrical triangle. The Elliot wave count indicates that the price is in the fourth wave of a five-wave upward movement.

If Elliot is correct, INJ will break out of the triangle and target the all-time high of $25.6. Although technical analysis suggests an overly optimistic target, a 200% increase is not impossible. Just like the possibility of the trend reversing and the price dropping to $4 if the triangle breaks downward.

Volatility is increasing, and if the US Department of Justice does not announce a surprise lawsuit, market sentiment currently supports optimistic scenarios.

Türkçe

Türkçe Español

Español