For cryptocurrency investors, the $29,000 level was a psychological support zone and had been at risk of being lost for the past few days. And it happened. With buyers weakening amidst market uncertainty, the price has retreated to the $28,800 support level, just above where it was at the time of writing this article. If this zone is also lost, we may see significant losses in altcoins.

Will Bitcoin (BTC) Rise?

It was expected that the price would make such a move after spending a long time in a narrow range. As anticipated, the price of Bitcoin fell to $28,800. While the price remaining stable last week was frustrating, now investors are facing millions of dollars in liquidations due to the decline.

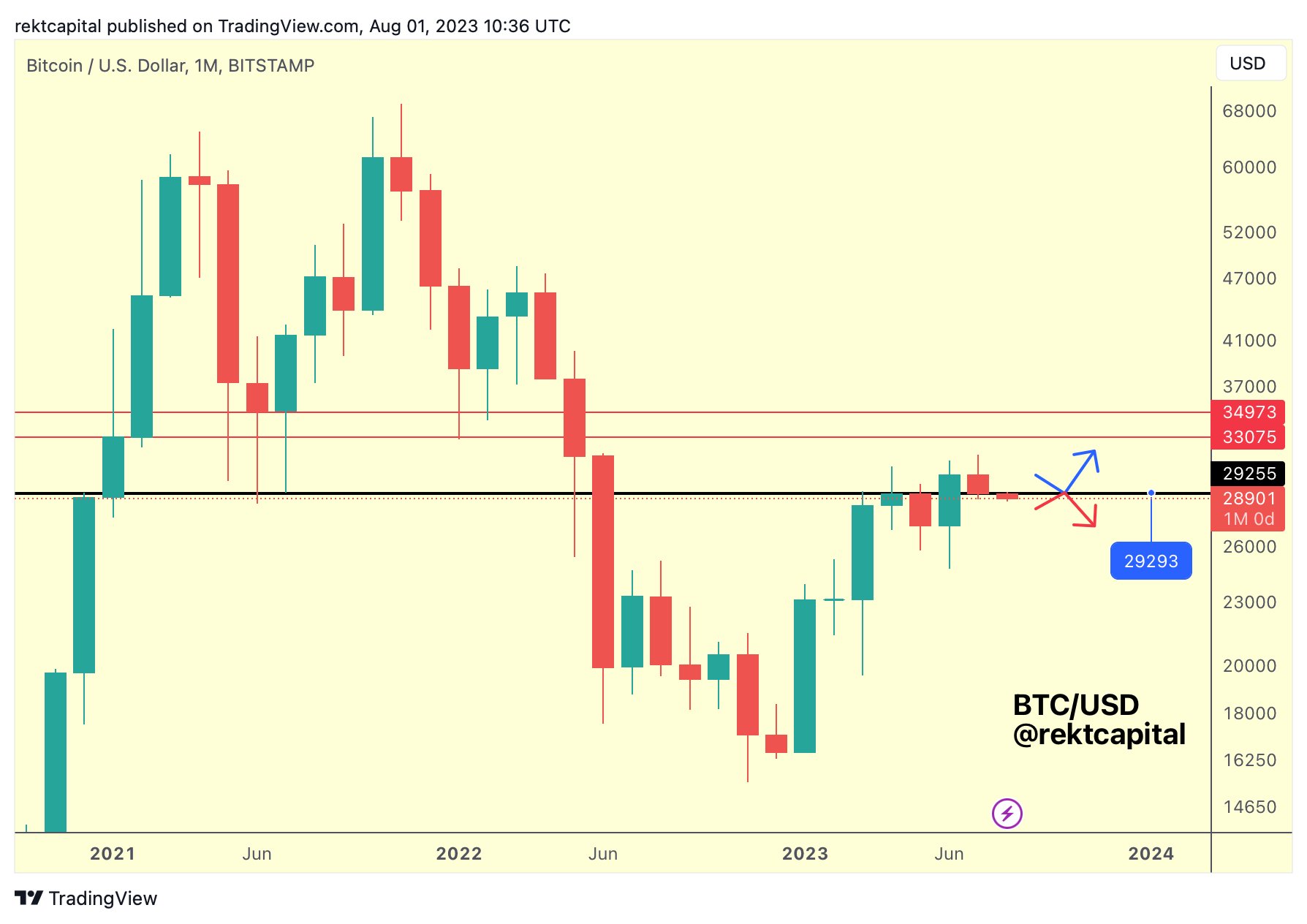

For popular crypto analyst Rekt Capital, the closing price was important, but he now demands that buyers step in to maintain the trend.

“BTC failed to close above the $29,250 level. A close below that is negative for the rise. If there is going to be a recovery, the $29,250 level needs to be regained.”

Bitcoin Chart Analysis

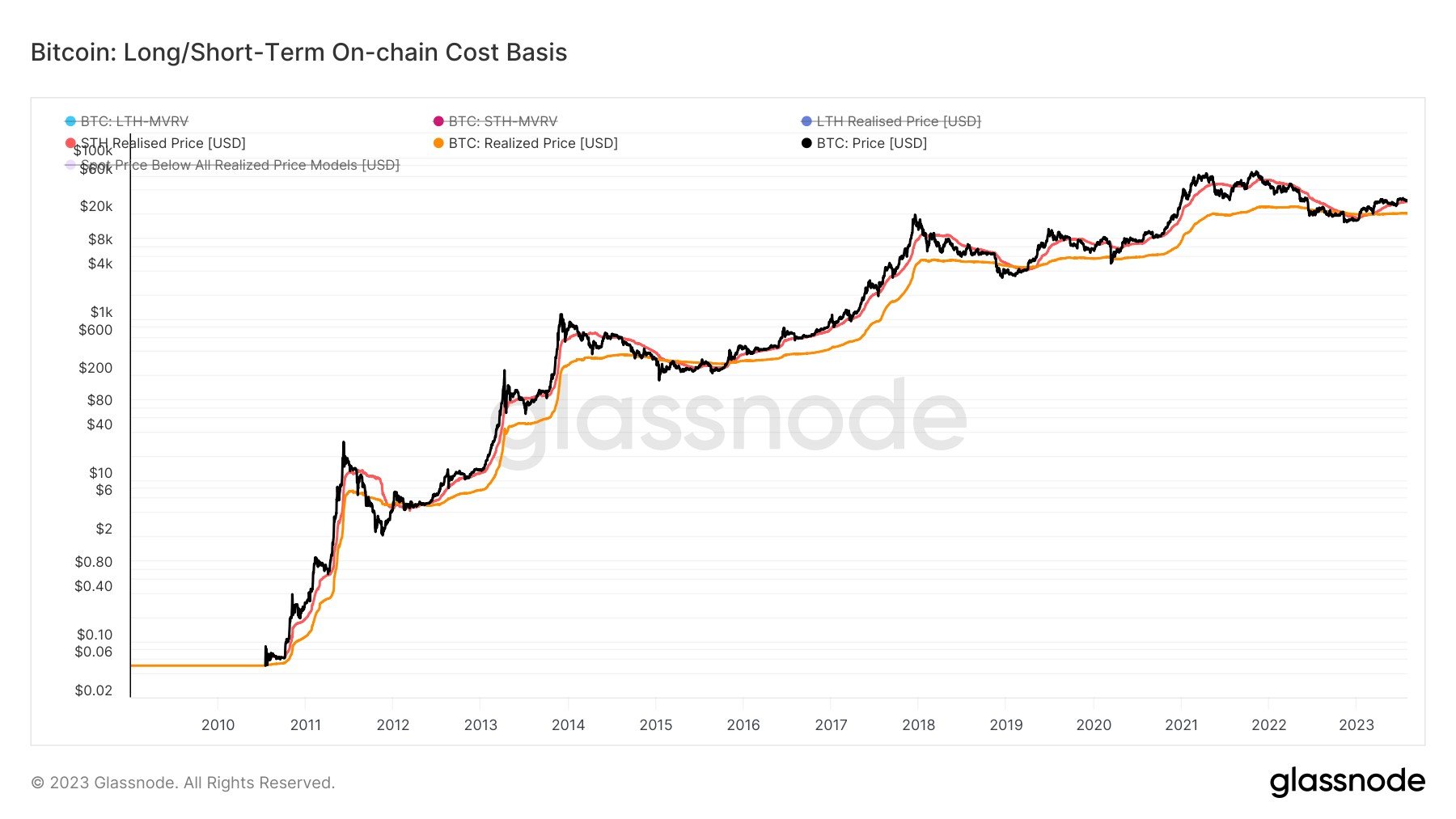

Meanwhile, looking at short-term targets, many market participants say that the $28,000 area needs to be tested. As we mentioned in our previous article, three analysts pointed to this area. In particular, the $28,300 support area stands out. This figure forms the cost basis of speculative investors known as Short-Term Holders (STH) in Bitcoin.

“We expect Bitcoin to test the $28,300 short-term investor cost base.”

James Straten, a research and data analyst at crypto analytics firm CryptoSlate, predicted during the day with Glassnode data that this support level will be tested for the third time this year. The expert known as Titan of Crypto also draws attention to the same area.

Daan Crypto Trades, which gained a lot of attention in July, marked the 200-week moving average (MA), a classic bear market support level, as an important level if it goes further down. At the time of writing, this corresponds to $27,235 and interest should increase here.