At the time of writing this article, the price of BTC was above the $28,300 resistance level, and the closing price for the day was $28,500. Now, bulls need to close the week above the $28,300 resistance level. Meanwhile, the latest report measuring institutional interest in crypto has been released today. It contains some interesting details and data that fuel investors’ hopes.

Institutional Investors and Crypto

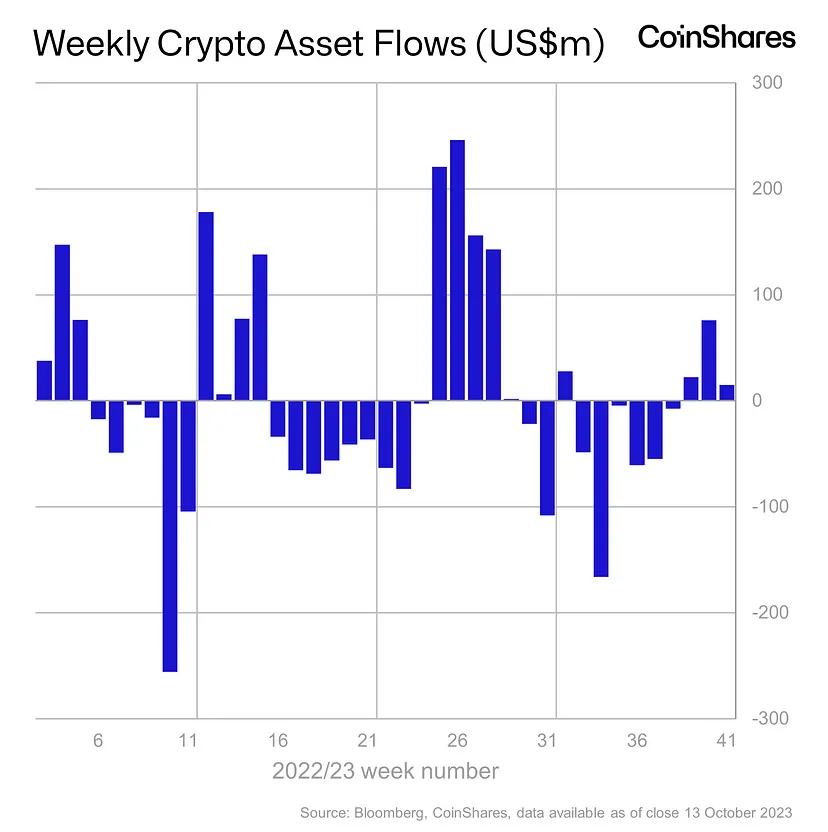

For the past 3 weeks, this report has been positive. Institutional investors have finally put a halt to their continuous outflows. If this trend continues, we will see how strong the sentiment of professional investors towards the rise is. The report published by CoinShares indicates the interest of institutional and qualified investors in crypto. Although there is no approval for a spot ETF, there are futures ETFs and ETPs traded in many regions.

Despite the trading volume of crypto funds being 27% below the 2023 average, net inflows were observed in the third week as well. Last week, a net $15 million entered the funds. The interest in the US region is still weak. Investors from Europe represent $7 million of the total inflows. Only Sweden had outflows from Europe.

Cryptocurrency Report

Inflows into Bitcoin (BTC) funds were $16 million. Since the beginning of 2023, net inflows have reached $260 million, while short-BTC saw $1.7 million inflows last week. The comment section of the report published by CoinShares states the following:

“It should be noted that our data, as of Friday’s closing, did not capture the positive news coming from the US regarding the SEC not taking Grayscale’s legal objection to appeal and potentially clearing the way for a spot-based ETF in the US.”

Last week was not very good for altcoins. Tezos, Litecoin, and Chainlink saw outflows of an average of $300,000. XRP is experiencing its 25th consecutive week of demand, which is surprising. Regardless of XRP Coin’s price, there is a stable demand for XRP Coin through institutional funds. We mentioned this for SOL Coin as well.

Despite the recent launch of an ETF based on futures contracts, Ethereum received very little interest from investors. Last week, the futures ETF saw outflows of $7.5 million, and most of the inflows were neutralized. Reasons for this include concerns about protocol design, a decrease in network activity, and a decline in network revenue, which could lead to short-term inflation of Ether.