Bitcoin price is struggling to break the $26,000 level but has not been able to initiate a clear breakthrough yet. There is not much good news coming from China. The price of BTC has been staying below $28,000 for about 10 days, partly due to the concerns about Evergrande. So, what is Evergrande? Why is it affecting cryptocurrencies negatively?

Evergrande Collapse

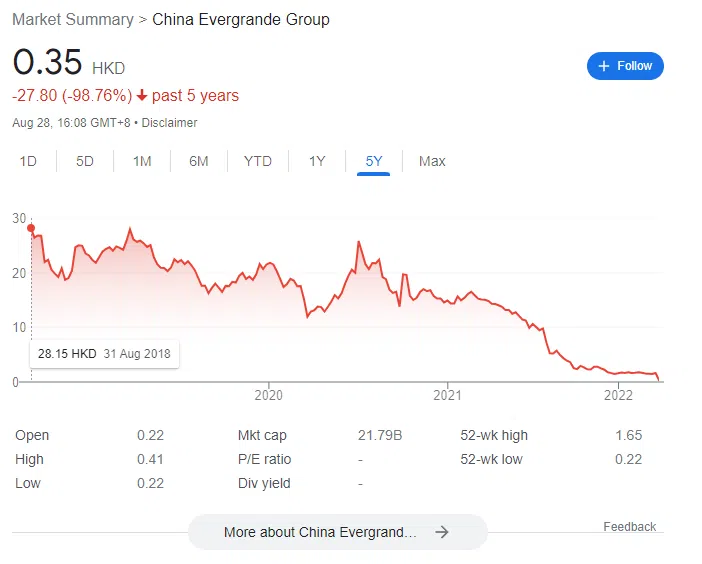

China Evergrande Group’s shares have experienced a significant drop in value. The stock price dropped by 87% in Hong Kong after a 17-month trading suspension. The besieged real estate giant, which had a value of over $50 billion in 2017, saw its market value plummet to $586 million, rendering its shares worthless. In the latest announcement made to the Hong Kong Stock Exchange, the company struggling with a prolonged debt restructuring reported a surprising loss of 33 billion yuan for the half-year ended on June 30.

In addition to its previous two-year loss of 582 billion yuan, this marks the largest loss since its initial public offering in 2009. The situation of the Chinese giant is causing concerns in the stock markets, and cryptocurrencies are also being negatively affected by it.

China’s Decline in Cryptocurrencies

The situation of Evergrande represents an example of a broader housing crisis engulfing China, the world’s second-largest economy. Regulatory pressures to reduce risks and make housing more affordable have resulted in unintended consequences. The financial statements also paint a grim picture: Evergrande recorded a net loss of 39.3 billion yuan for the first half. This loss is mainly due to increasing operating costs, losses related to lawsuits, and devaluation of real estate projects. Its staggering liabilities of 2.39 trillion yuan overshadowed its assets of 1.74 trillion yuan by the end of June.

Bloomberg Intelligence analysts Kristy Hung and Lisa Zhou warned that the cash crunch also threatens China’s broader housing recovery. This situation can have a negative impact on the global economy and potentially trigger a greater flight from cryptocurrencies indirectly.

In the midst of this financial turmoil, the company’s new auditor, Prism, refrained from issuing a conclusion on the interim earnings report, citing multifaceted uncertainties.

Türkçe

Türkçe Español

Español