The SOL Coin price has climbed to $64 and then returned to the $50 range after liquidating massive short positions. The parabolic rise was exciting, and we witnessed a movement related to Grayscale’s SOL Trust. Now, even though the price is starting to pull back, three different altcoins are standing out.

Solana (SOL) and Others

The popular altcoin on Binance is currently trading at $53.3, experiencing a loss of more than $10. While the recent rally was exciting, every rise has an end. However, the price has risen almost uninterrupted from the $27 resistance to the $64 range. In the second part, we will discuss the comprehensive price evaluation of SOL Coin.

Although the SOL Coin price is decreasing, the native token of the decentralized storage service Filecoin, FIL, has increased by approximately 10% in the past 24 hours, surpassing $5.33. We have also seen a 23% increase in its price over the past 7 days. Polygon (MATIC) has surpassed the $0.88 range with a nearly 10% increase. Finally, Cosmos (ATOM) approached the $10 range and then retracted slightly.

A relaxation in the Solana (SOL) front could lead to the further prominence of alternative major altcoins. Of course, for this to happen, BTC must maintain the $37,000 range. As of writing this article, BTC is trading at $36,700.

Why is Solana (SOL) Falling?

The SOL Coin price had embarked on a journey towards $100 with excessive demand, but the bulls’ patience ran out at $64. Short-term investors’ profit-taking declared the temporary peak of the rally. However, comments explaining the relationship between social media GBTC and the BTC rally were shared. Many experts defended the connection, highlighting the extent to which Grayscale’s involvement in the crypto crash was not understood.

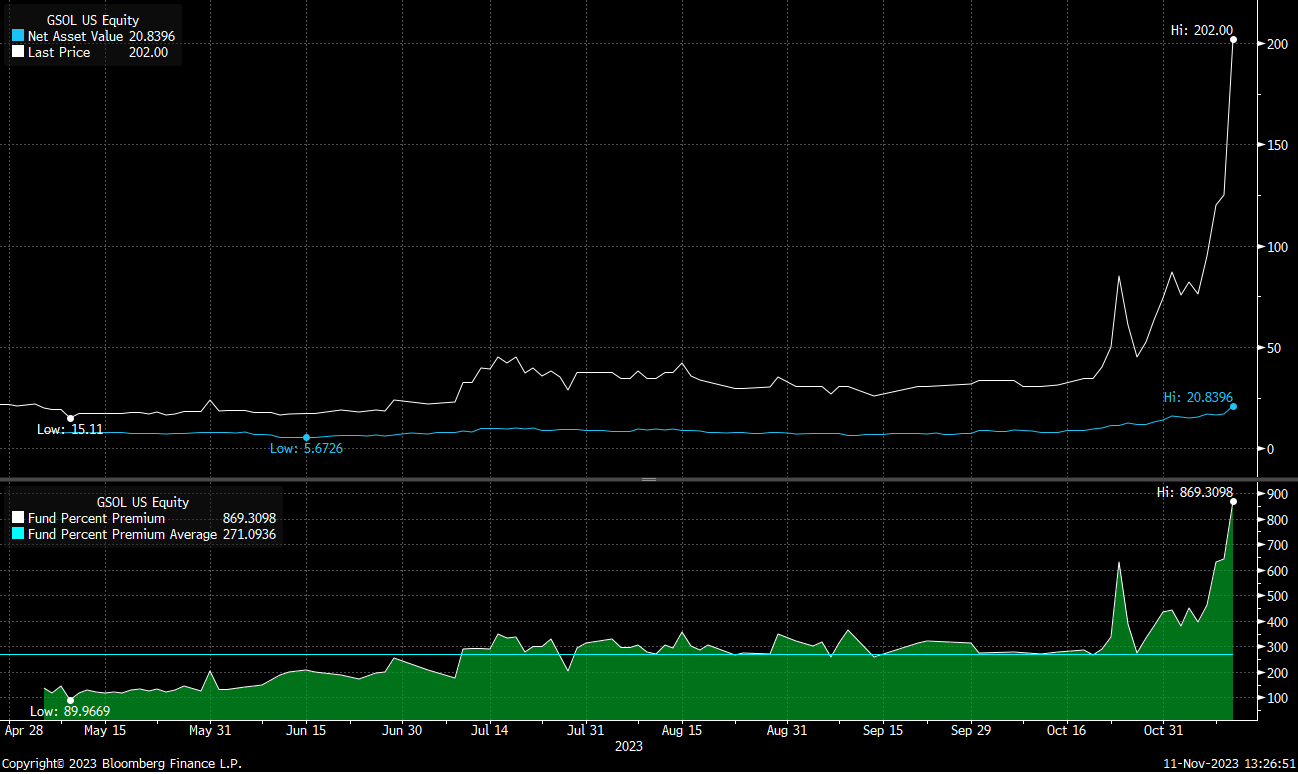

The problem is that as the connection between GBTC and the increase in BTC price and the relationship between SOL Coin and Grayscale Solana Trust (GSOL) became apparent, the price retracted. In the graph below, you can see the chart explaining the GSOL price (showing the positive premium) that exceeds the total USD value of SOL Coin assets held by Grayscale.

If the decline of SOL Coin continues, it may find support in the range of $38-40. However, a retracement towards the old resistance zone of $27 is possible. At this stage, we know that institutional demand for SOL Coin remains alive, according to the CoinShares report (data until last Friday). Therefore, speculative rallies would not be surprising.

Türkçe

Türkçe Español

Español