<a href="https://en.coin-turk.com/bitcoin-enters-bull-market-as-analyst-predicts-market-crash/”>Bitcoin (BTC) and major altcoins’ funding rates in the futures markets had led to unusually high fees due to investors’ tendency to keep their long positions open following the increase in market excitement. Indeed, after the recent drop in the overall cryptocurrency market, funding rates have started to return to normal levels.

The increase in open interest (OI) to over $35 billion over the weekend, along with the significant volatility in the spot markets, indicated that investors who expected higher prices were inclined to open high-leverage positions. Data shows that there has been an approximately 40% increase in OI since the end of October this year when it was recorded at $24 billion.

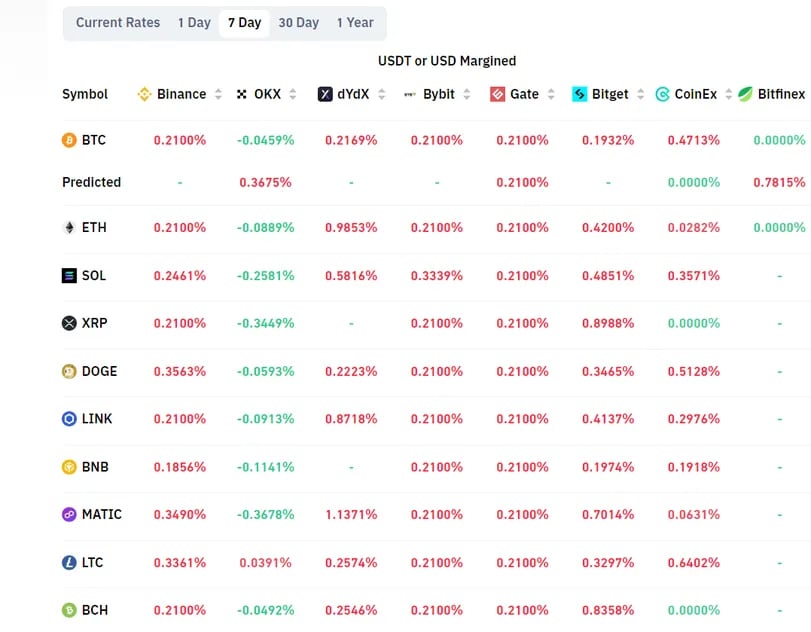

The accumulation of leveraged positions led to a significant increase in funding rates. Funding rates reflect the periodic payment made by investors based on the difference between prices in the futures and spot markets. Current data shows that investors are paying fees ranging from 0.2% to 0.5% every eight hours on funds they borrow to keep their long positions open. This means that speculators are paying fees up to $0.5 to cryptocurrency exchanges for a $100 position. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Some market observers warned of a potential drop due to investors shifting to short positions or refraining from opening positions against price increases, pointing to the increase in funding rates. A positive funding rate in the futures markets means that long positions pay short positions. Conversely, when the funding rate is negative, the opposite occurs. Indeed, the excessive rise in funding rates and investors taking profits after a week-long rally resulted in a decline.

Cryptocurrencies’ Funding Rates Are Returning to Normal

Approximately 90% of long positions opened with the expectation of an increase were liquidated, totaling over $300 million. Bitcoin investors saw liquidations worth $120 million with a drop of over 4%. Ethereum (ETH) investors followed with $63 million in liquidations, while XRP and Solana (SOL) investors saw a total of $30 million in liquidations.

Liquidation refers to the forced closure of an investor’s leveraged position by a cryptocurrency exchange due to the partial or complete loss of the investor’s initial margin. In short, liquidation occurs when an investor cannot meet the margin requirements necessary to keep their leveraged position open (i.e., when they do not have enough funds to keep the trade open).

Significant liquidations can indicate that a peak or bottom has been reached in a sharp price movement. Therefore, funding rates of Bitcoin and most altcoins have returned to normal levels, averaging around 0.01% on most cryptocurrency exchanges since this morning.

Türkçe

Türkçe Español

Español