The claim that Elon Musk’s SpaceX company sold Bitcoin, the bankruptcy of a Chinese real estate giant, and fears of rising interest rates were among the theories put forward regarding the strange drop in the price of Bitcoin. On August 18th, at around 00:35, the price of Bitcoin suddenly dropped by over 8% in just 10 minutes, affecting the entire cryptocurrency market and confusing many in the crypto community.

SpaceX Allegedly Selling Bitcoin

Josh Gilbert, a market analyst at eToro, based the drop on a news article from August 17th, suggesting that the drop could be due to SpaceX selling a portion or all of its $373 million Bitcoin holdings.

“Whenever a big name in the industry sells Bitcoin, especially someone as influential as Elon Musk, it will put pressure on the price.”

Gilbert also mentioned another theory, stating that the rapid change in market sentiment could be due to expectations of interest rate hikes by the Federal Reserve.

“In the past few weeks, we have seen some weaknesses in global markets, especially in risk assets, and considering the expectation that interest rates will likely remain high for a longer period, this was a recipe for a pullback. Bitcoin struggled to reach higher levels last month and received very little ‘good news’ to push its value higher in the narrow range of $29,000 to $30,000, which only increased these sales.”

US Treasury Yields

Tina Teng, a market analyst at CMC Markets, shared a different view, attributing the sell-off to the recent increase in US Treasury yields. Teng explained that rising bond yields typically lead to a decrease in liquidity for the broader market, which she linked to the drop in the cryptocurrency sector.

Teng also mentioned that the Evergrande crisis could have an indirect impact on the price of Bitcoin, but she did not believe it was among the primary reasons for the drop. She stated, “It has more to do with sensitivity to the Chinese economy and investors.”

Chinese Yuan Still a Risk for Bitcoin

While Teng did not consider the Evergrande crisis as a significant reason for the price fluctuations in Bitcoin, Markus Thielen, Research Director at Matrixport, claimed that the risk of devaluation of the Chinese Yuan could have played a significant role in the sell-off.

“The biggest macro risk is the potential devaluation of the Chinese Yuan, which has been trading at its weakest level since 2007. The last time China devalued the Yuan in August 2015, Bitcoin prices dropped by 23% over the following two weeks. Bitcoin completed the year with a 59% gain from the devaluation level before a more significant rally began.”

Whale Making a Big Sell-Off

A Twitter account named TheFlowHorse suggested that the drop may have been caused by a single major player making a large sell-off, which put additional pressure on derivatives.

“This was not just a natural step. Someone big sold for a purpose and triggered it. The spot volume was very low compared to the actors.”

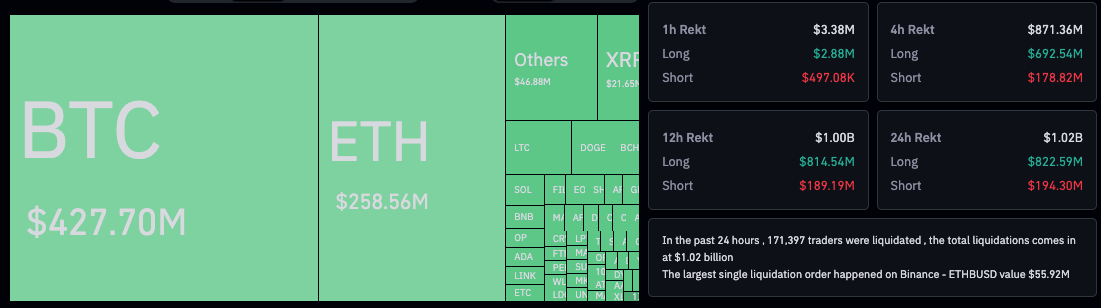

According to data from the crypto analysis platform Coinglass, over $427 million worth of Bitcoin long positions were liquidated in the four hours leading up to the publication time. In the past 24 hours, there have been over $822 million in liquidations for investors with open long positions.

Horse, who qualified most of the explanations for the drop as “pure speculation,” suggested that a large fund may have dumped its Bitcoin position to “trigger buying ETH,” as news implying the SEC’s approval of an Ethereum Futures ETF came shortly after the drop.

According to TradingView data, Bitcoin has recovered slightly since the drop and was trading at $27,089 at the time of writing. News about the SEC potentially approving an Ethereum Futures ETF product in October seems to have boosted Bitcoin’s price.