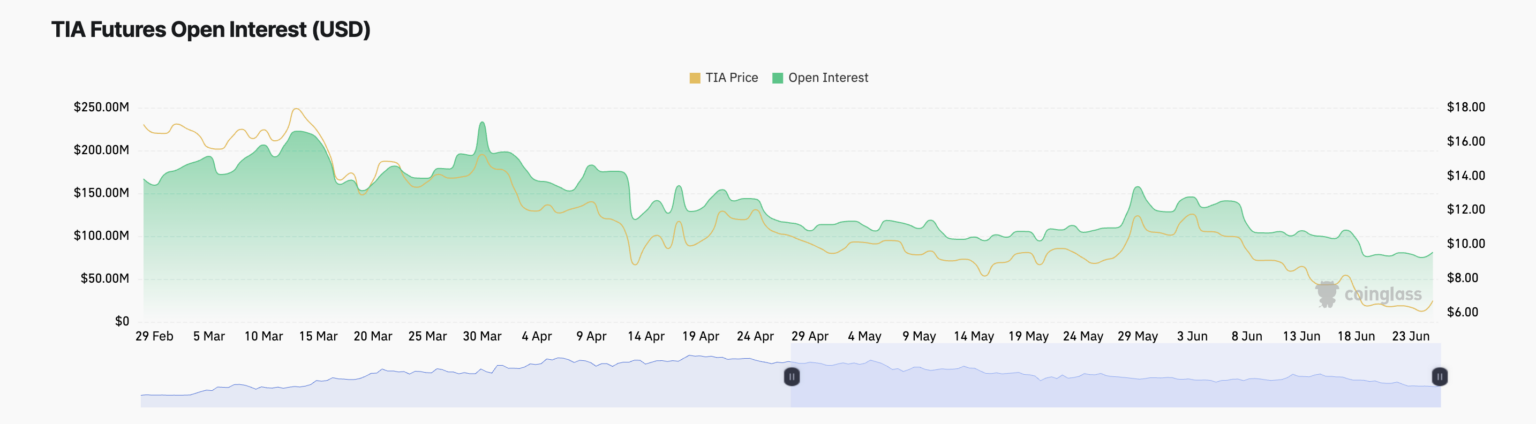

The value of Celestia’s native token TIA, a modular blockchain network, has dropped to the price level last observed in November 2023. As of the time of writing, the altcoin was trading at $6.82, having lost nearly 30% of its value in the last 30 days. The decline on the Celestia front also led to a corresponding drop in activities in the futures market.

TIA Continues to Fall

As of the time of writing, the value of open positions in the futures market was $81.20 million, down 37% since the beginning of the month. Year-to-date, open futures positions in the altcoin market have fallen by 44%. At its current level, TIA’s open futures positions are at their lowest since November 11, 2023.

The open position of an asset in the futures market highlights the total number of futures contracts that have not yet been closed or settled. When it falls, investors close their positions without opening new ones, which is usually followed as a bearish signal indicating reduced market activity and the possibility of further price declines.

The altcoin’s double-digit devaluation since the beginning of June has led to a series of long liquidations in the futures market. This is because most investors continued to demand long positions despite TIA’s price decline.

Notable Details on the TIA Front

TIA’s negative Elder-Ray Index currently confirms the altcoin’s downward trend. At the time of writing, the value of this indicator was recorded at -0.55. For context, only negative values have been recorded since June 6.

This indicator measures the relationship between the strength of buyers and sellers in the market. When its value is negative, bear strength dominates the market. Additionally, the setup of TIA’s Parabolic Stop and Reverse (SAR) indicator supports the above position. The points forming the indicator are located above the price.

This indicator determines the direction of an asset’s price and identifies potential turning points. When the points stand above an asset’s price, the market is said to be in a downtrend. Market participants interpret this as a signal that the price will continue to fall and that they should hold short positions or enter new ones. If TIA’s price continues its downward trend, its value could fall below $6 and trade at $5.77.

Türkçe

Türkçe Español

Español