Trillion-dollar asset managers continue to express interest in cryptocurrencies. ETFs have witnessed billions of dollars in inflows. In a bid to expand product alternatives, issuers have already submitted 40 new applications. Fidelity, known for fewer applications and a higher likelihood of approval for certain cryptocurrencies, is pursuing new opportunities.

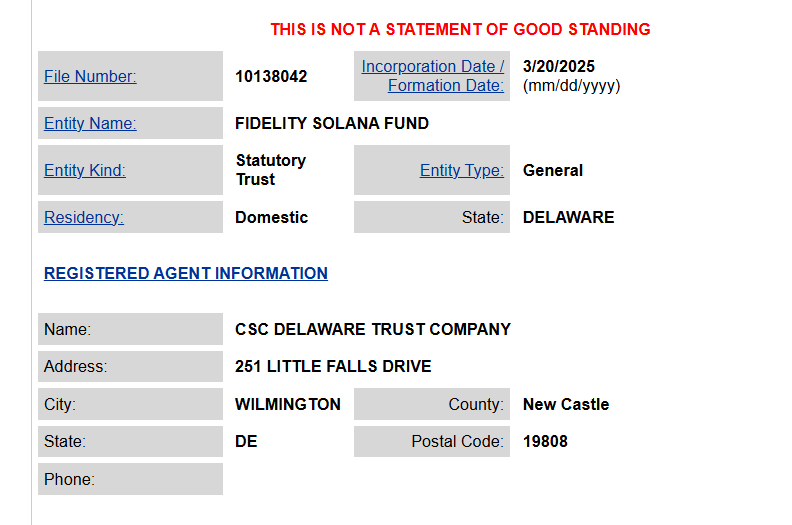

SOL ETF Application

SOL Coin has seen only a 3% increase, showing limited response. Fidelity has recently registered for a SOL ETF in Delaware. Although there is a low probability, this application could be a false move, similar to BlackRock’s XRP filing. However, considering the market’s current state and the price’s lack of reaction, it doesn’t appear to be a speculative fraud operation by manipulators.

If Fidelity is genuinely preparing to apply for an ETF for Solana  $149, the likelihood of approval may increase. Additionally, BlackRock might also take action at some point. Solana is one of the fastest and cheapest networks and remains a focal point due to its heavy usage in the crypto community.

$149, the likelihood of approval may increase. Additionally, BlackRock might also take action at some point. Solana is one of the fastest and cheapest networks and remains a focal point due to its heavy usage in the crypto community.

Potential Shift in Market Sentiment

Last year, BlackRock officials emphasized they would not make altcoin applications besides ETH, citing a lack of demand from investors. However, this viewpoint may change if interest in U.S.-based altcoins rises, possibly influenced by political factors.

Türkçe

Türkçe Español

Español