Trump has begun fulfilling his promises regarding cryptocurrencies, although some actions did not align with investor expectations. One of the most significant announcements from the newly elected president, who has taken exciting pro-crypto steps, was the establishment of a unit focused on cryptocurrency within the White House. David Sacks has been appointed to lead this unit. However, he made a crucial move prior to this appointment.

Details of the Crypto Sale

According to a recently published White House note, David, who serves as Trump’s crypto and AI advisor, sold his $200 million investment in this field before starting his new role. He took this action through his personal investments and his company, Craft Ventures, to avoid any financial gains due to his position.

Many public officials, including the highest-ranking Democrat on the Senate Banking Committee, Elizabeth Warren from Massachusetts, criticized him, suggesting he stood to gain from his crypto involvement. However, an 11-page document indicated that David had already sold his crypto-related assets. This undermined the Democrats’ claims that he held assets like BTC, SOL, ETH, and others in strategic reserves. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

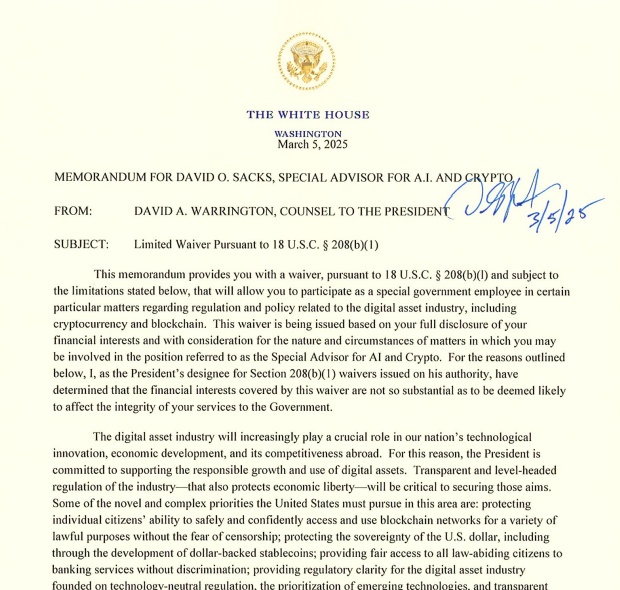

“This document, written by the legal advisor to the U.S. President, David A. Warrington, states that David O. Sacks was granted a waiver to serve as the ‘Special Advisor on Artificial Intelligence and Cryptocurrency.’ This waiver was issued based on the assessment that Sacks’ financial interests are sufficiently small not to impair the integrity of government service under 18 U.S.C. § 208(b)(1). Consequently, Sacks will be able to participate in regulatory policy-making processes in areas like digital assets, cryptocurrency, and blockchain.” – White House

Assets Sold

According to the ethical document, he and his company sold previously acquired assets in BTC, ETH, and SOL Coin. Alongside these, he also closed his direct position in the Bitwise 10 Crypto Index Fund with other liquid crypto assets. Although David appeared to have profited in the short term by selling Coinbase and Robinhood shares, he turned his back on significant long-term gains due to ethical concerns regarding potential crypto surges.

Sacks has also liquidated his limited partnership shares in crypto-focused investment funds like Multicoin Capital and Blockchain Capital. He stated that only 0.1% of his wealth is related to cryptocurrencies and plans to eliminate even this small portion soon.

Türkçe

Türkçe Español

Español