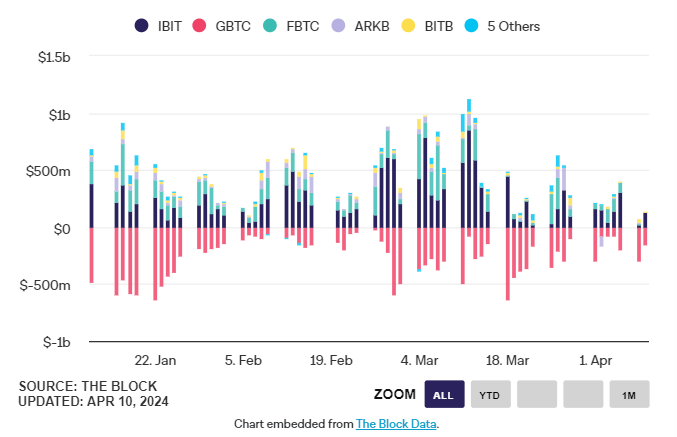

Cryptocurrency markets have experienced significant losses due to net outflows in the Spot Bitcoin ETF channel. However, recent data suggests that this trend is beginning to slow down. The price of BTC has returned to $70,000 after the data release, strengthening the optimism for a bullish trend. So, what are the latest announcements?

GBTC Sales

According to SosoValue data, net outflows from the Spot Bitcoin ETF GBTC, issued by Grayscale Investments, were limited to $17 million yesterday. This record low outflow was motivating after data earlier in the week showed more than $450 million in outflows on Monday and Tuesday. The total net outflow from GBTC over the past three months has reached $15 billion with yesterday’s data.

Since the net inflow to all spot Bitcoin ETFs is over $12 billion, the outflows from GBTC are not as alarming. A portion of the $15 billion outflow from GBTC went to ETFs with lower commission fees. As of today, Blackrock’s spot Bitcoin ETF alone holds over $17 billion in BTC.

Will Cryptocurrencies Rise?

Nick Ruck, COO of ContentFi Labs, says that the weakening outflows from GBTC are a strong bullish signal for cryptocurrencies. The fund, which has already seen a $15 billion outflow, had anticipated such a scenario and thus kept commission fees high. Investors who bought in at a negative premium six months ago did not miss this expected selling opportunity, securing significant gains.

Grayscale Investments CEO Michael Sonneshein also stated in his recent announcement that the downturn in cryptocurrencies is about to end. Sonneshein, who mentioned that outflows are starting to “balance out,” describes this as rapid sales triggered by a combination of settlements and swap transactions resulting from bankruptcies like FTX.

“GBTC outflows appear to have bottomed out, according to rumors that many forced sellers are done. It’s important to remember that we’ve experienced a slowdown for weeks, so I would be cautious about this data point. I think the market is taking it more seriously this time because we will naturally find a balance at some point, and Sonneshein’s comment indicates we are close.”

Sonnenhein’s statements about reaching a balance are significant because he makes these comments with detailed knowledge of the positions of bankrupt companies and major GBTC holders. The market will take this seriously, and with the confirmation of data, further rises are likely during the halving days.