As the new week begins, Bitcoin‘s price successfully remains above $30,000, pleasing altcoin investors. However, will the exciting rise for the king of cryptocurrencies continue? Poppe and Kaleo, two experts closely followed by crypto investors who have often made successful predictions, offer their insights into the current market conditions.

Kaleo’s Current Bitcoin Prediction

The famous analyst’s prediction is that the rise for the king of cryptocurrencies will continue. While many experts expect a new correction to the $27,000 level, Kaleo believes more is approaching. The famous analyst targets early 2025 for Bitcoin to reach $100,000. However, he also mentioned that this critical threshold could be reached by the end of 2024.

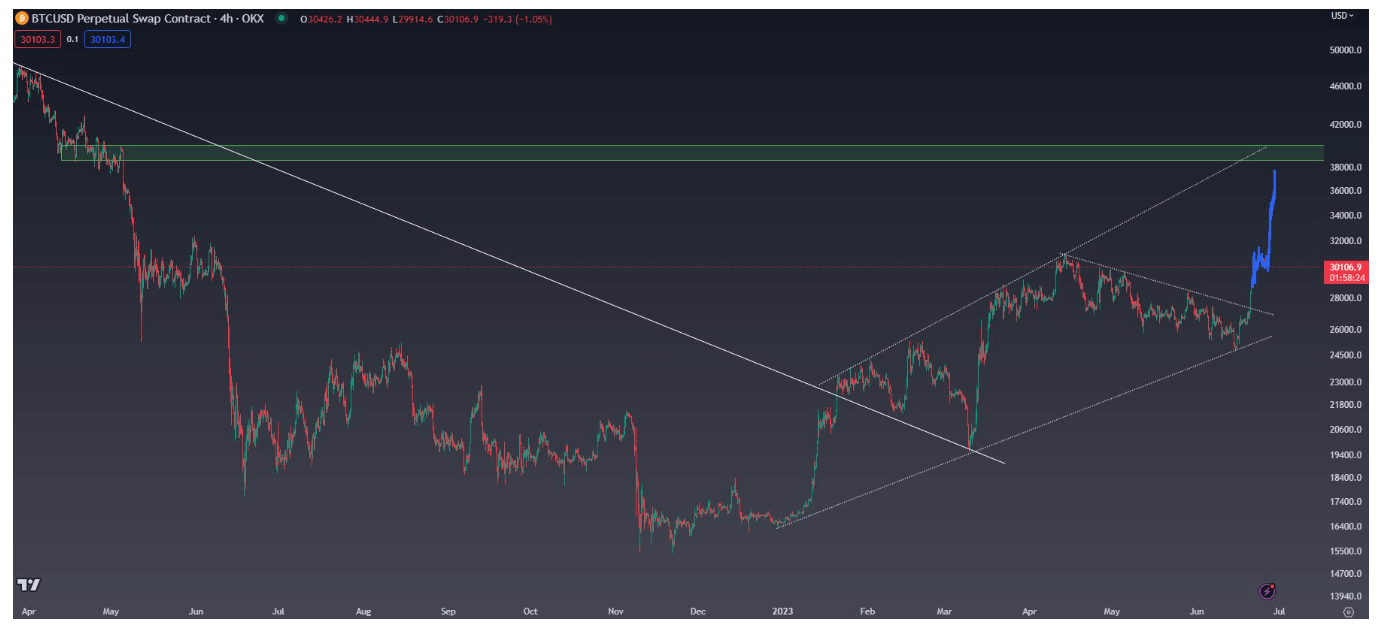

He shared his short-term expectation with the following chart. The expert says that $38,000 is a realistic target for Bitcoin’s price.

If Bitcoin (BTC) can stay above $28,000, it may race towards a $38,000 target.

Expert Analyst’s Current Crypto Prediction

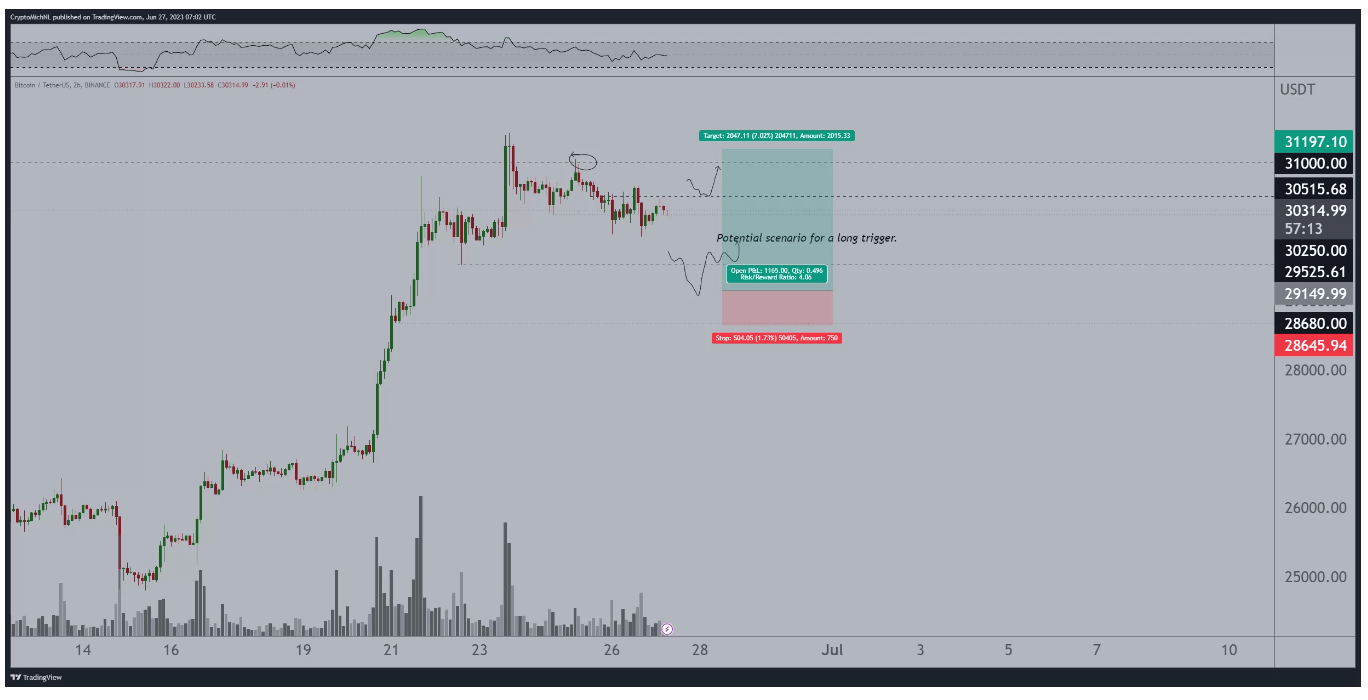

While he may not have foreseen rapid rises, Poppe, who successfully identifies overall trends, pointed to two scenarios. He had previously predicted that if closing prices were above $31,000, Bitcoin could enter a fast-rising phase. Poppe argued that the consumer confidence index, set to be announced today, could cause fluctuations in price.

If the CB Consumer Confidence Index is above expectations, the BTC price could see a sudden mini-correction down to $29,149. However, in the opposite scenario, we’ll see a test of $31,000.

On the other hand, the PCE data to be announced on Friday is of critical importance to investors. The PCE, one of the leading indicators for inflation, could give an important signal about the Federal Reserve’s rate move in July. Fed Chairman Powell had stated they would make decisions based on the data to be received by the end of the month. If there are no significant increases in inflation and leading indicators, we may see the Fed skip the next meeting. The ongoing, albeit weak, contraction in the economy is forcing the Fed to remain calm.