At the beginning of the week, Bitcoin (BTC) faced some selling pressure and dropped below the $30,000 support level to around $29,000. Despite Bitcoin’s relatively weak outlook, some on-chain indicators are pointing to potential future growth for the largest cryptocurrency.

Bitcoin’s Rising On-Chain Indicators

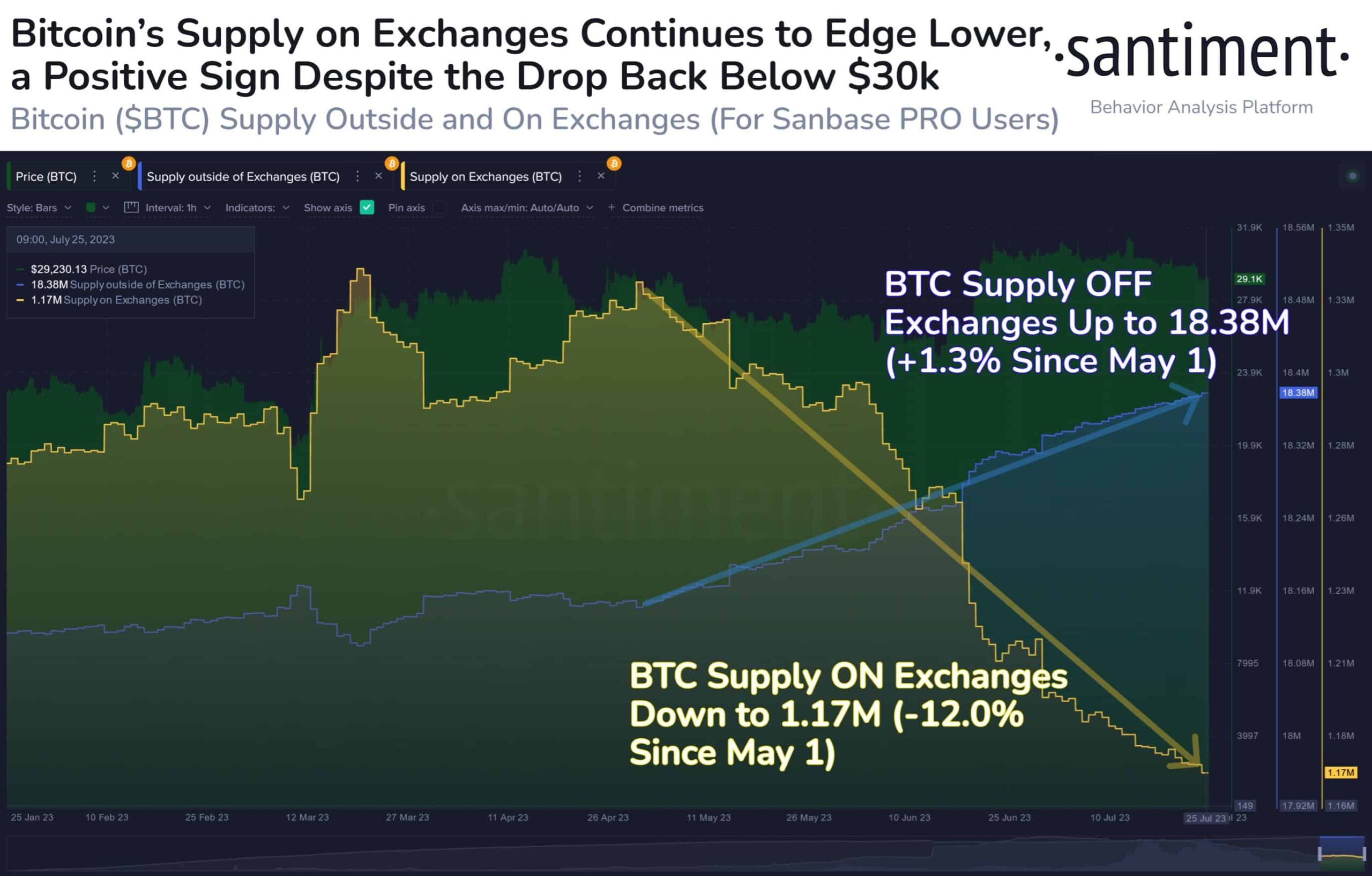

One positive sign is the increasing number of Bitcoins being withdrawn from cryptocurrency exchanges and being held privately. The supply of BTC on cryptocurrency exchanges has reached its lowest level in the past 5 years, with only 1.17 million BTC currently held, the lowest amount since November 2018. The movement of Bitcoin into private wallets indicates an increasing trend among long-term investors and reflects confidence in the asset.

Despite its recent price drop, Bitcoin is still trading within a well-known range of $28,000 to $31,800. This narrow range is quite significant considering the significant price movements that the largest cryptocurrency made between 2020 and 2022. The fact that investors did not react strongly to Bitcoin falling below $30,000 and the continuation of this relatively narrow range can be seen as a positive sign for potential market stability.

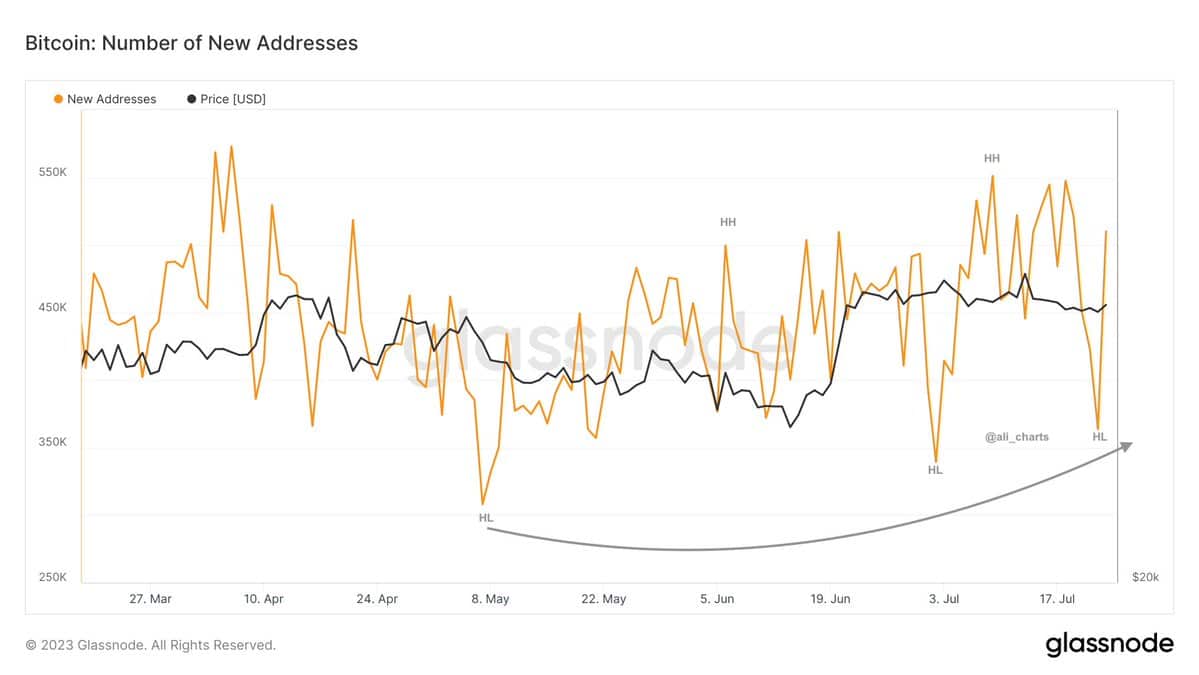

Furthermore, data from on-chain data platform Glassnode shows that the daily number of new wallet addresses created on the Bitcoin network has once again increased. This increase in network usage is considered a bullish signal, indicating a healthier network and increased adoption. When the monthly average of new wallet addresses exceeds the annual average, it indicates increased on-chain activity that is positive for the overall health of the Bitcoin network.

Bitcoin Investors Remain Cautious

While these two on-chain indicators suggest potential positive signals for Bitcoin, investors continue to proceed with caution. Despite the recent drop in Bitcoin’s price and the inability to stay above the psychological support level of $30,000, there seems to be more optimism in the market with more calls for upward movement rather than downward. The low level of concern among investors may indicate a potential reversal in sentiment.

According to CoinMarketCap, Bitcoin is currently trading at $29,238, with a market capitalization of $568.13 billion and a 0.48% increase in the past 24 hours. Data shows that the largest cryptocurrency has decreased by 2.93% in the past 7 days and 3.19% in the past 30 days.