2022 was a painful period, but those who persevered in the crypto world captured massive gains in the right altcoins. We’ve had an intense year and are saying goodbye to 2023 after many sleepless nights. So, what happened on the regulatory front in the U.S. this year? What should investors know as they enter the new year?

U.S. and Crypto Rules

U.S. has not delivered what was expected in this regard and has bureaucrats eager to sign regulations that are far from the nature of crypto. We know that Senators opposed to crypto, like Warren, have also been vocal. We have seen days when different government agencies made opposite decisions on the same issues and implemented different practices.

Even in court decisions, there were judges who later asked, “Which one is correct?” when opposite decisions were made. Yes, a judge stepped forward and said these overly interpretive SEC lawsuits are causing us conflict; go work on legal regulations. However, this had no binding effect.

Here’s how U.S. institutions view cryptocurrencies:

- IRS (Internal Revenue Service): Cryptocurrencies are property and you must pay capital gains tax when bought and sold.

- FinCEN (Financial Crimes Enforcement Network): Cryptocurrencies are “money“.

- CFTC (Commodity Futures Trading Commission): Most cryptocurrencies are commodities like oil, gold.

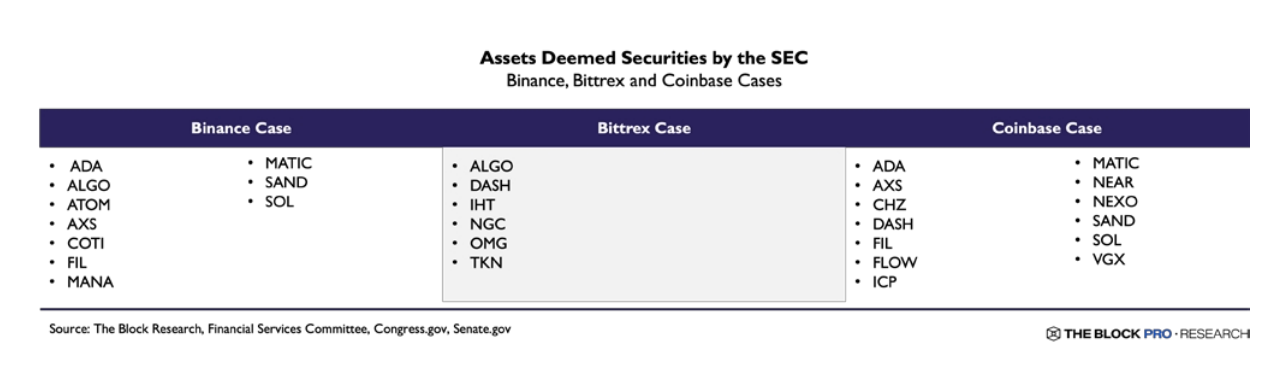

- SEC (Securities and Exchange Commission): Most cryptocurrencies are securities, especially altcoins that have gone through an ICO process.

Below you see altcoins that have been labeled as securities by the SEC in different cases.

Crypto Regulations

State-level regulations are a whirlpool that cryptocurrencies should not enter. The already complex structure becomes even more complicated when different treatments are seen in different states. Therefore, the need for federal regulation at the Congressional level has been voiced by crypto advocates for years.

After the FTX incident, many states updated their existing regulatory rules. New York, known for its BitLicense regime, proposed updates to crypto regulations in September as part of the broader ‘VOLT’ initiative. These updates cover risk assessments, the delisting of cryptocurrencies, and reducing the number of approved cryptocurrencies to Bitcoin, Ether, and six stablecoins.

The varying pace of individual state regulations significantly complicates the operations of crypto companies in the U.S. For example, the Kraken exchange was sued despite being registered with FinCEN as a Money Services Business and being regulated by the Wyoming Banking Division for certain digital asset services.

The Office of the Comptroller of the Currency (OCC) caused the termination of banking charters for Protego and Paxos and the rejection of Custodia Bank’s application to be part of the Federal Reserve System.

Türkçe

Türkçe Español

Español