Bitcoin whales are individuals or groups that own a significant share of the market, in contrast to smaller participants often referred to as small fish. The owner of a wallet or a set of wallets controlled by an asset could be an individual or a group pooling funds to make large investments.

Noteworthy Data from the Bitcoin Sector

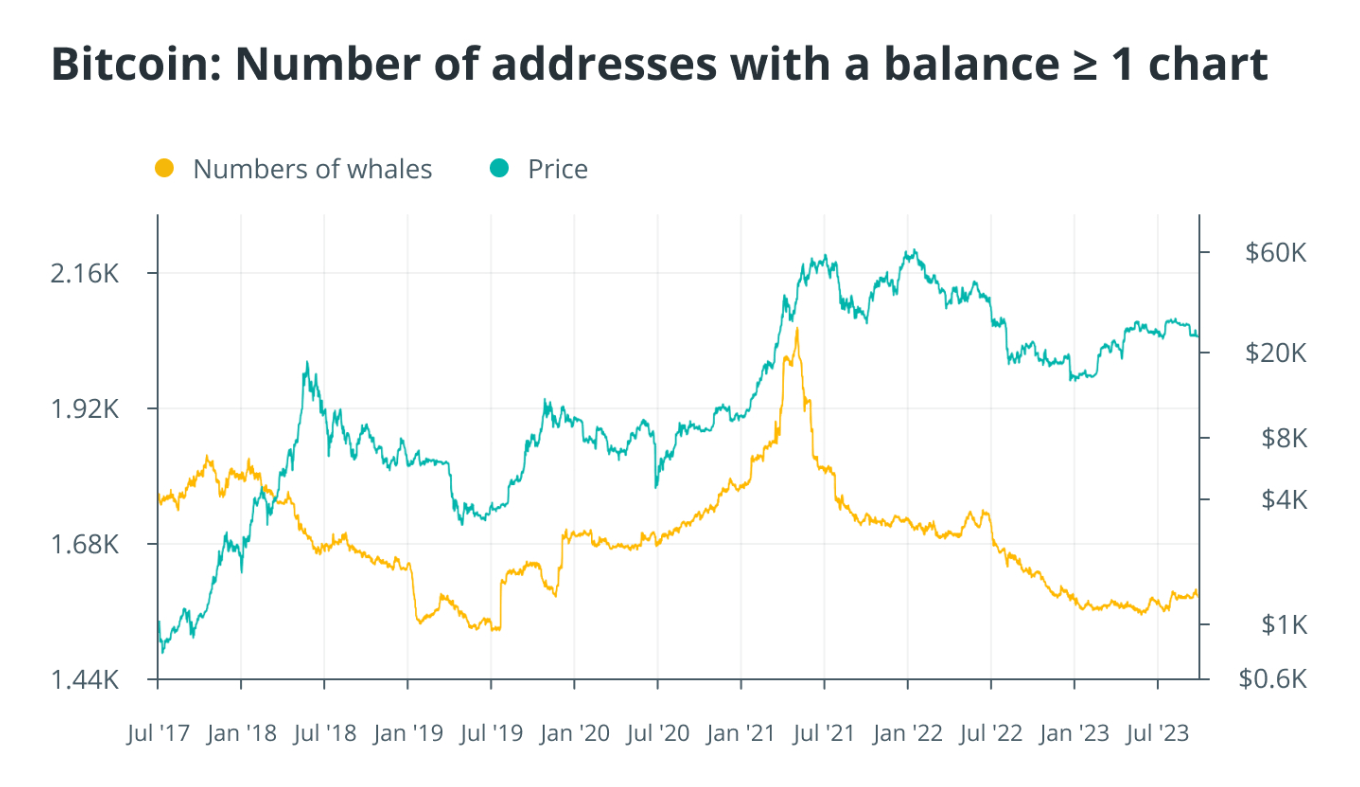

Whales may have accumulated their large holdings through mining, early investments, and other methods. They have access to significant Bitcoin assets, which gives them the power to manipulate the market by making large asset purchases or sales that cause price volatility. The prevalence of whales and extreme volatility are often linked in the cryptocurrency world.

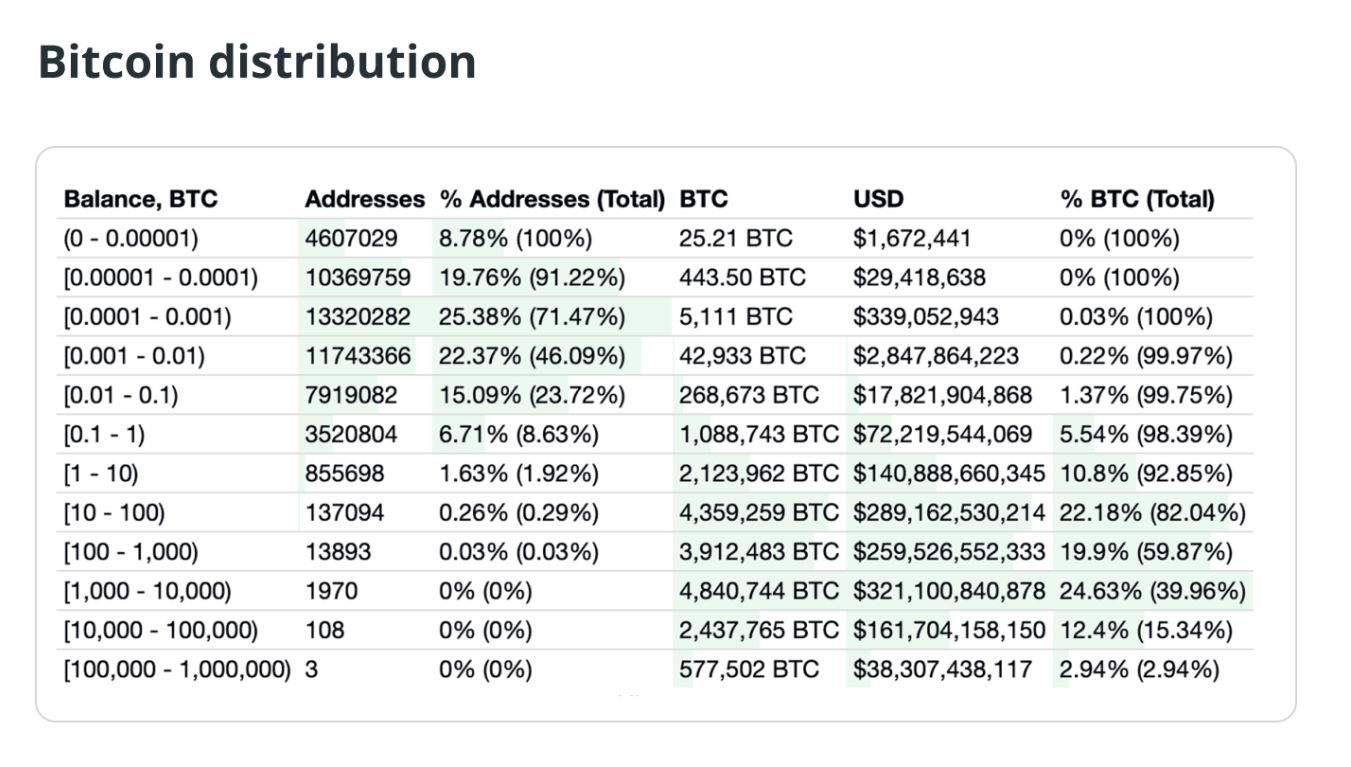

An individual or organization is considered a Bitcoin whale if they own a significant amount of Bitcoin; however, there is no set threshold for this classification. The commonly accepted criterion to be recognized as a Bitcoin whale is owning 1,000 Bitcoins. This criterion is frequently cited by cryptocurrency analytics firms like Glassnode when identifying network assets with at least 1,000 Bitcoins. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

As of March 2024, the distribution of Bitcoin ownership is highly concentrated. Only three Bitcoin addresses hold a total of 577,502 Bitcoins, each containing between 100,000 and 1 million Bitcoins. The next 108 largest owners possess a total of 2,437,765 Bitcoins, with individual holdings ranging from 10,000 to 100,000 Bitcoins. Together, these top 111 addresses account for approximately 15.34% of the total Bitcoin supply.

Whales and Market Dynamics

Whales have a significant impact on market dynamics. Their massive holdings give them the power to influence Bitcoin’s supply and demand, and their transactions can trigger price volatility. When whales increase their Bitcoin stocks, prices tend to rise, while selling off parts of their assets can lead to price declines.

Crypto whales can create scarcity by holding large amounts of cryptocurrency, potentially increasing demand and value. Large transactions by whales can trigger significant price changes, influencing the actions of other investors. These whales often operate in the public eye, and their wallets are monitored by a broader trading community. Consequently, their trading decisions or anticipated moves can lead to significant price changes as investors follow suit.

Some Bitcoin whales prefer over-the-counter (OTC) crypto trading to minimize their impact on prices, while others use exchanges to manipulate markets with large buy or sell signals.

Türkçe

Türkçe Español

Español