According to a recent report, the trading volume of Uniswap (UNI) has decreased. This downward trend has prompted an examination of other important metrics and whether they affect the performance of the UNI token. Since trading volume often serves as a barometer of market activity and interest, the performance of the UNI token may be dependent on the overall health of the Uniswap ecosystem.

Critical Report from Glassnode to Uniswap!

Glassnode’s latest post sheds light on the volume decline in Uniswap, particularly in Ethereum compared to previous years. The data showed only two notable exceptions to this trend: an increase in volume during the rise of Liquid Staking Tokens (LST) and another increase during the launch of meme tokens on the platform.

The volume decline was not due to a lack of trading activity on Uniswap. A closer examination of the distribution of trading volume in different Layer 2 solutions revealed a more comprehensive understanding. A significant portion of trading activity shifted from the Ethereum mainnet to Arbitrum.

As of March, Arbitrum attracted up to 32% of Uniswap’s trading volume, indicating a noticeable divergence from Ethereum. This trend continued and remained high in both June and July, providing a convincing explanation for the volume decline in Ethereum.

Innovations in Uniswap V3!

The latest iteration of Uniswap, known as Uniswap V3, has recently shown a positive volume trend. According to DefiLlama’s data, the weekly trading volume for V3 has exceeded $2.5 billion. Simultaneously, the previous version, Uniswap V2, had a significant volume of approximately $1.2 billion. The cumulative trading volume in Uniswap V3 and V2 was approximately $4 billion.

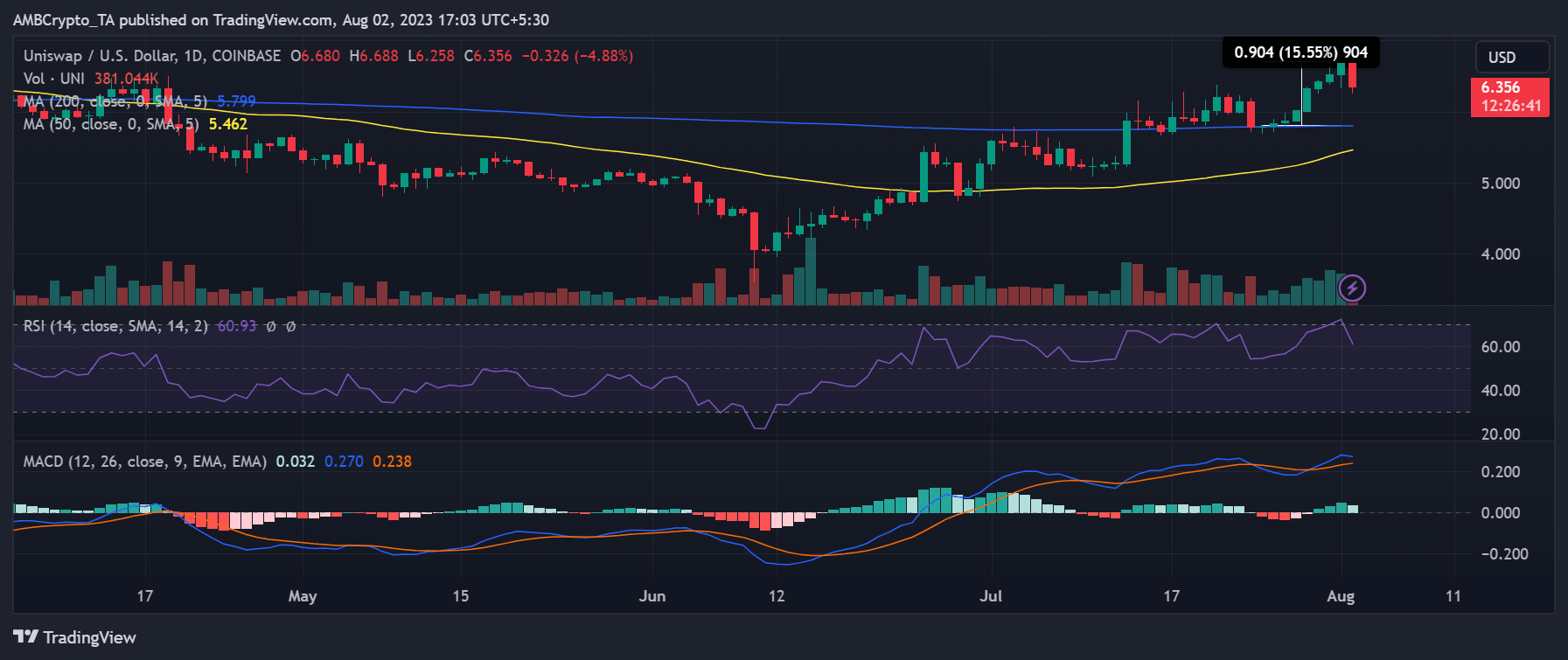

Furthermore, the total value locked (TVL) in Uniswap currently experienced a slight decrease, hovering around $3.7 billion according to the latest available data. However, this performance showed a much better trend compared to a previous decrease in March. The daily timeline graph of Uniswap exhibited a clear and notable upward trend in recent days. In particular, between July 25th and August 1st, UNI witnessed an impressive price increase of over 15% as indicated by the price range indicator.

Türkçe

Türkçe Español

Español