Ripple  $2 has recently gained attention following a significant development in its long-standing legal battle with the U.S. government. A new proposal suggests that utilizing the altcoin XRP could potentially release $1.5 trillion in liquidity, which may then be used to create a Bitcoin

$2 has recently gained attention following a significant development in its long-standing legal battle with the U.S. government. A new proposal suggests that utilizing the altcoin XRP could potentially release $1.5 trillion in liquidity, which may then be used to create a Bitcoin  $108,492 reserve. However, this plan faces considerable regulatory hurdles that must be addressed for it to succeed.

$108,492 reserve. However, this plan faces considerable regulatory hurdles that must be addressed for it to succeed.

How Can XRP be Utilized for Bitcoin Reserves?

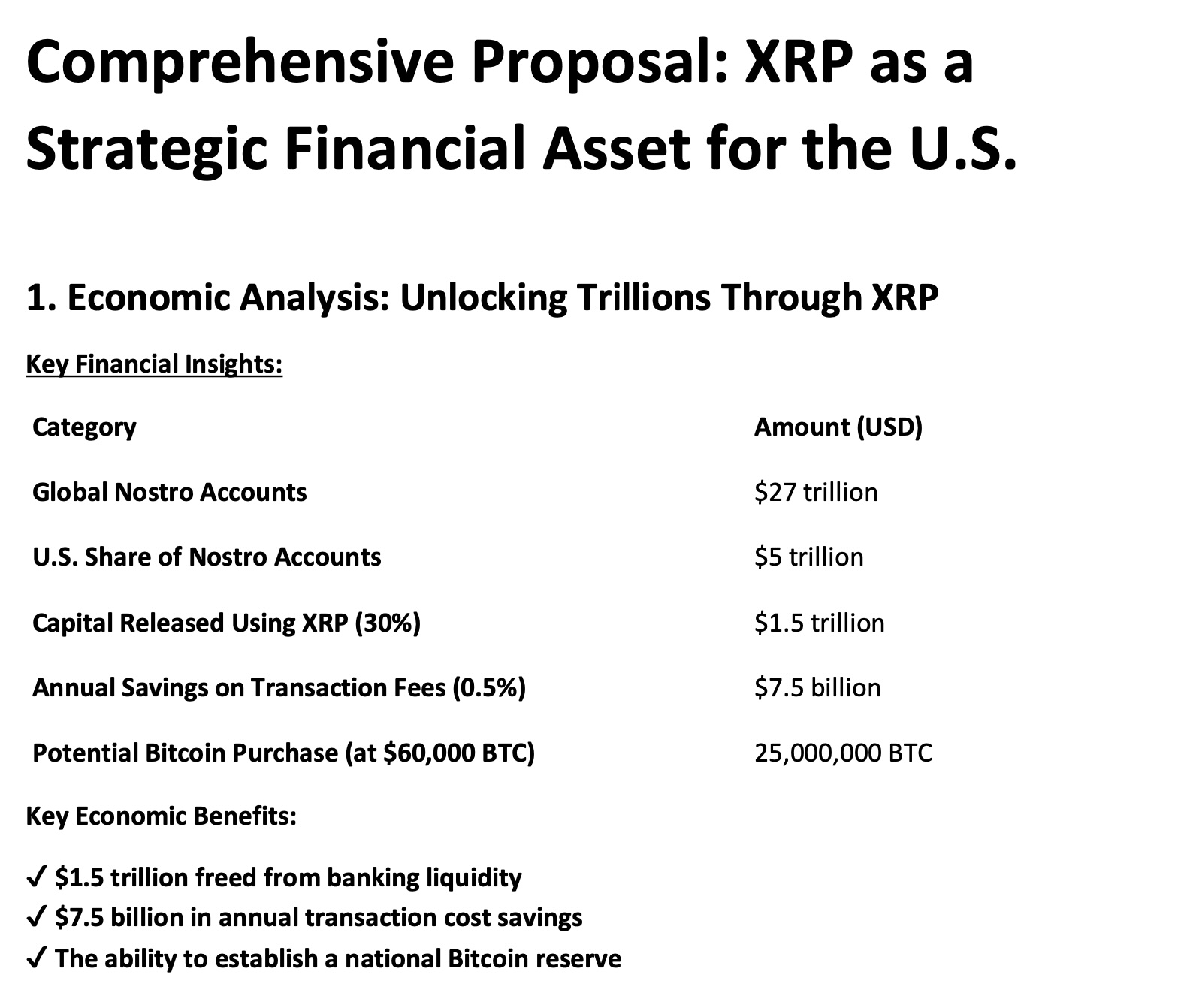

Maximilian Staudinger submitted a five-page proposal to the U.S. Securities and Exchange Commission (SEC), arguing that XRP could play a critical role in the U.S. financial system. According to the proposal, some of the capital trapped in Nostro accounts could be freed up through the use of XRP.

Globally, Nostro accounts hold approximately $27 trillion, with $5 trillion belonging to U.S. banks. Staudinger claims that with the use of XRP, around $1.5 trillion of these funds could be released and utilized for purchasing Bitcoin.

Staudinger believes the U.S. should adopt XRP as a fundamental asset for financial transactions. He also suggests a reserve system centered around Bitcoin while advocating for the use of Solana  $173 and Cardano

$173 and Cardano  $0.752473 in state-backed applications.

$0.752473 in state-backed applications.

Regulatory Challenges Facing the Proposal

While the proposal suggests ambitious targets for Bitcoin acquisitions by the U.S. government, it contains some calculation errors. Although it mentions the U.S. could buy 25 million Bitcoins at $60,000 each, this is unfeasible given Bitcoin’s total supply of 21 million. However, it estimates that using XRP could result in transaction fee savings of up to $7.5 billion annually.

The biggest obstacle to the proposal is the uncertain legal status of XRP in the U.S. Staudinger is advocating for XRP to be classified as a payment instrument rather than a security. He also recommends lifting restrictions on banks’ use of XRP and expediting the SEC’s processes.

The proposal outlines a two-phase implementation process. The standard 24-month phase aims for regulatory approvals, bank adoption, and integration into government payments, while an expedited 6-12 month phase suggests rapid integration of XRP through executive orders and Federal Reserve interventions.

Industry observers stress that independent proposals often struggle to materialize without backing from large financial institutions or government support. As such, it is anticipated that Staudinger’s proposal will remain a conceptual idea for now.

Who is Maximilian Staudinger?

Maximilian Staudinger is an independent analyst specializing in financial technologies and Blockchain. He is known for developing innovative projects within the cryptocurrency market.

Türkçe

Türkçe Español

Español