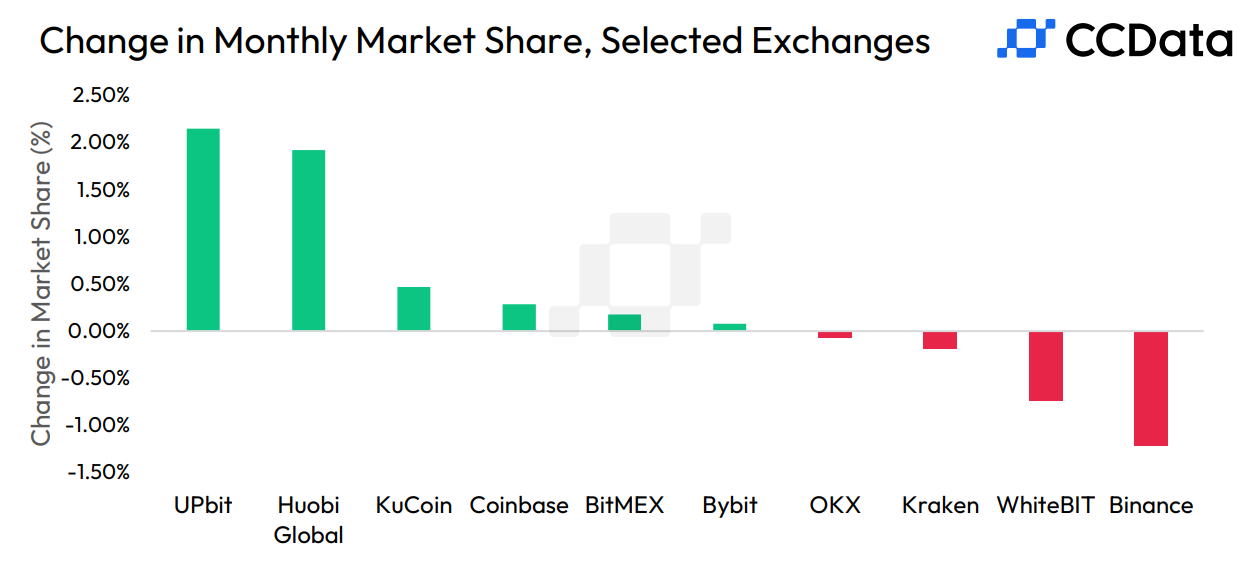

According to an analysis conducted by data agency CCData, South Korean digital asset platform Upbit has surpassed leading global exchanges Coinbase and OKX in spot trading volume. This shift coincided with the regulatory challenges faced by Binance, the world’s largest cryptocurrency exchange.

Upbit Draws Attention with its Growth Rate

According to the analysis, the month of July brought an unexpected increase in Upbit’s trading activities. The spot trading volume on the platform increased by 42.3% to reach a total of $29.8 billion. In contrast, competitors Coinbase and OKX experienced a decline in their trading volumes, with decreases of 11.6% and 5.75% respectively. As a result, Coinbase and OKX’s trading volumes fell to $28.6 billion and $29.0 billion respectively, indicating that they lagged behind compared to previous periods.

Furthermore, the increase in Upbit’s volume reflects a shift in the broader power dynamics of the cryptocurrency ecosystem. This success demonstrated a significant increase in Upbit’s market share to 5.78% among centralized exchanges.

While Upbit dominates in terms of gains, other platforms like Huobi Global and Kucoin also witnessed a slight growth in market share based on trading volume, reaching 3.84% and 2.21% respectively.

Binance’s Market Dominance Declines

Despite remaining the leading platform in spot trading volume with a volume of $208 billion, Binance’s market share continues to decline. Over the past five months, Binance’s market share has steadily declined by 40.4% to reach its lowest point in the past year. This decline occurred after a peak of 57.5% representing a significant shift from its once-held dominance.

Furthermore, Binance may face potential legal barriers due to allegations of fraud made by officials from the US Department of Justice. However, the consequences of such charges, including a potential bank operation similar to the collapse of FTX in November 2022, prompt prosecutors to proceed cautiously. The priority is to prevent a recurrence of the situation with FTX, where significant consumer losses occurred and panic spread in the crypto markets.

Türkçe

Türkçe Español

Español