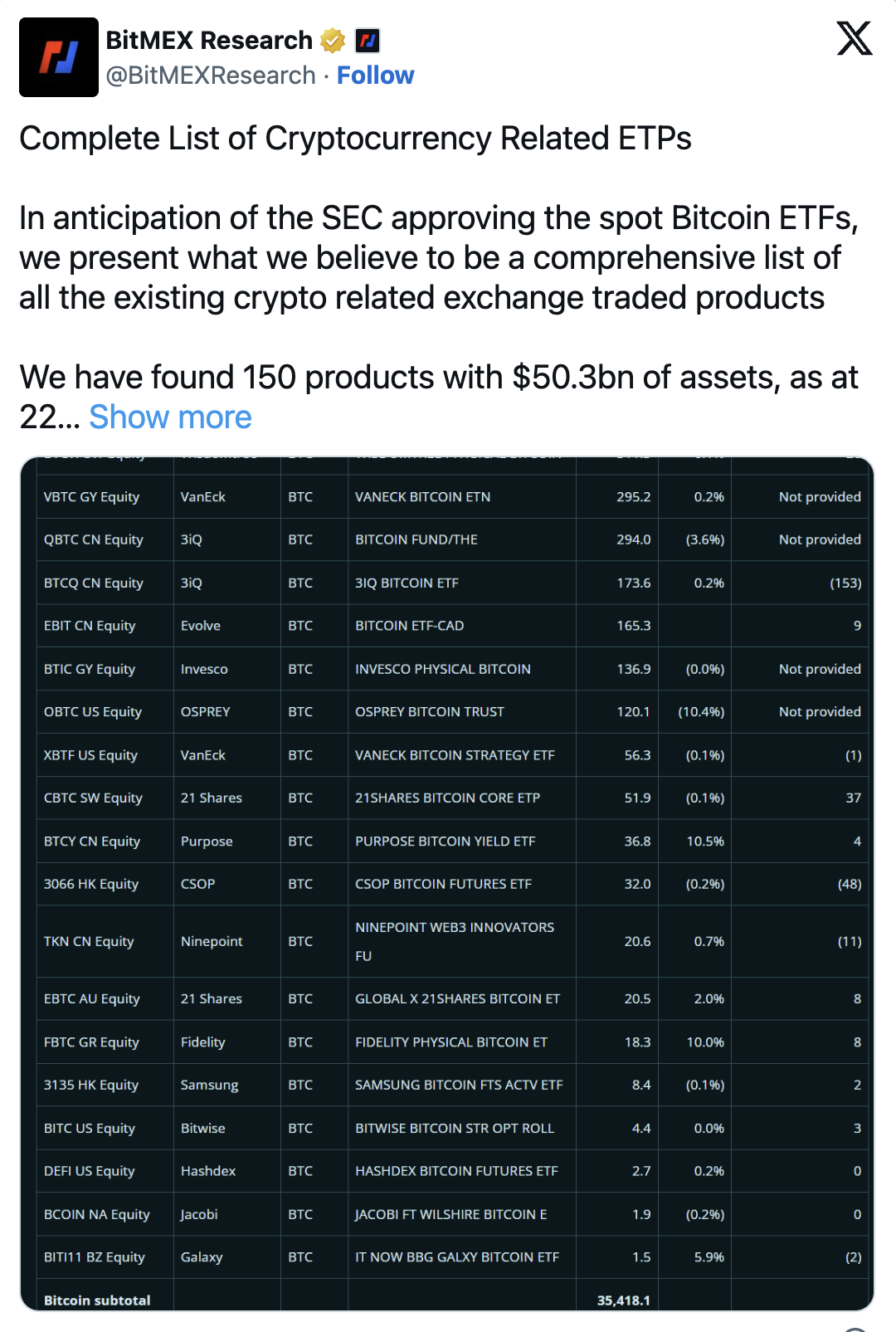

The United States approved spot Bitcoin exchange-traded funds (ETFs) could potentially overshadow the entire crypto sector with a 50 billion dollar ETF market. According to new data obtained by a BitMEX study, the current global market for exchange-traded crypto products includes approximately 150 products valued at a total of 50.3 billion dollars in assets under management.

BitMEX Report on ETF Projections

The list under consideration includes spot and futures funds, which typically track the price performance of Bitcoin and Ethereum. The largest fund on the list is Grayscale’s Bitcoin Trust, which is currently being converted into a spot ETF product. Market commentators believe that the approval of spot Bitcoin ETF applications, expected by the SEC as early as January 10, could double the amount of money invested in crypto ETP funds.

On December 14th, the crypto investment fund Bitwise predicts that spot Bitcoin ETF products will be the most successful ETFs ever launched and expects them to capture about 72 billion dollars in assets under management over the next five years, more than doubling the current market. Global fund manager Van Eck offers a more measured perspective, predicting that approximately 2.4 billion dollars will be invested in spot Bitcoin products in the first quarter of 2024.

Noteworthy Data in the ETF Space

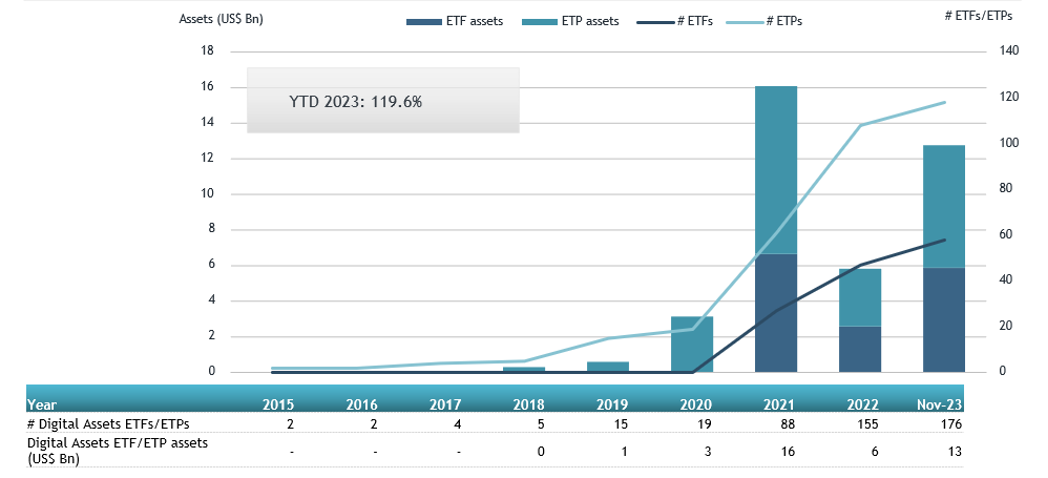

Although a spot Bitcoin ETF product has not yet been approved in the US, such a product is far from being a brand-new development globally. Many countries, including Canada, Australia, and Germany, already allow investors to purchase shares in spot Bitcoin ETF funds.

The optimism for spot Bitcoin ETF products reflects a broader trend of institutional investment in crypto investment products over the past few months. A report by ETF research firm ETFGI dated December 21st revealed that crypto ETF products listed worldwide have attracted 1.6 billion dollars in net inflows since the beginning of the year, with 1.31 billion dollars of that amount added in November alone. This total investment is nearly double the 750 million dollars in net inflows into crypto ETP products in 2022.

Among the 150 crypto funds, the top 20 ETF products attracted the largest investment volume with a total of 1.3 billion dollars throughout 2023. The ProShares Bitcoin Strategy ETF (BITO), launched during the crypto bull market in October 2021, witnessed the largest individual inflow of 278.7 million dollars in 2023.