Following Powell’s recent statements, macro developments have become more important for cryptocurrency investors. The Fed chairman acknowledged that the policy is now tight, stating that they will make decisions for future meetings based on upcoming data. Just a moment ago, US JOLTS data was released.

US JOLTS Data

This data explains the current situation regarding job openings to investors. It is included in the JOLTS (Job Openings and Labor Turnover Survey) report. The data, which shows the size of job openings, reflects the demand for labor. If job openings increase, it indicates that the economy continues to grow. However, under current conditions, the arrival of this data may lead to further interest rate hikes, while the Fed wants unemployment to increase.

If the Fed sees an increase in new job opportunities, which they aim to keep the unemployment rate above 4%, it will understand that it is moving away from this target. Therefore, the data that is expected to be announced today should be below the previous month’s level and expectations.

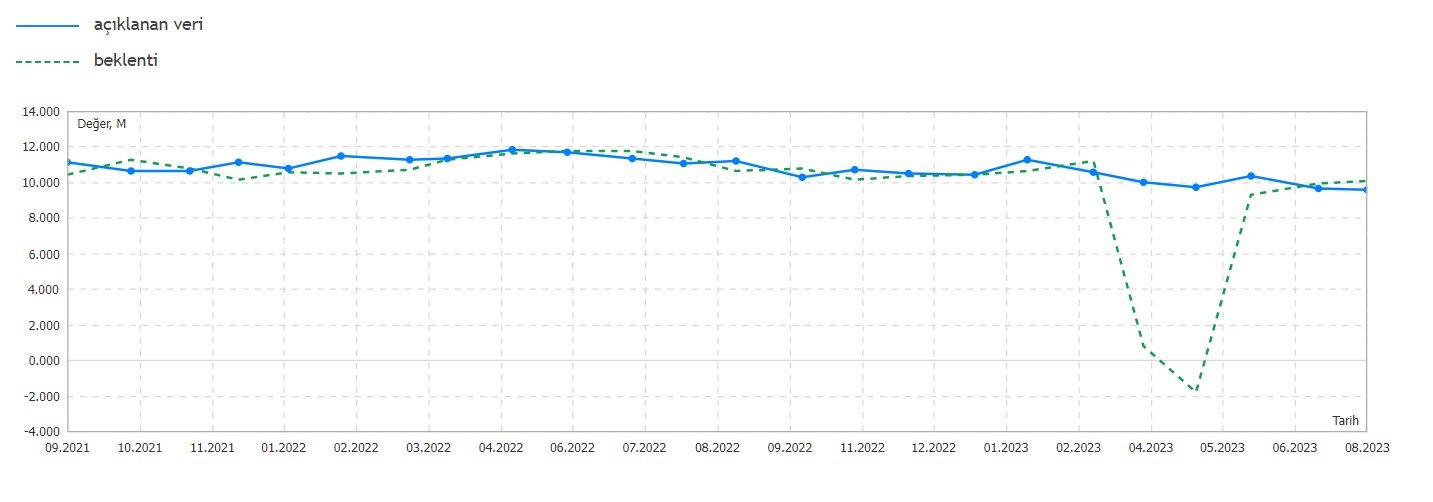

The announced figure was 9.582 million, below the expectation of 10.063 million.

Will Cryptocurrencies Rise?

The rise in the markets will not solely depend on this data, but the recent figure is quite good. It has been declining for three consecutive months. Moreover, if we do not consider the temporary increase, we see that JOLTS is below the level of November 2021. Although the figure is not at the pace desired by the Fed, it indicates the weakness of job opportunities. This week, the upcoming ADP and TDI data could also be favorable for cryptocurrencies.

In the above chart, you can see the situation of the past 2 years based on expectations and announced data.

Bitcoin price is currently trading at $28,882. Although the announced data is below expectations, Bitcoin has not reacted much. Most likely, we would have seen the opposite result at a figure above 10 million. This confirms the market’s bearish trend. It may be beneficial for investors to be cautious in their positions in altcoins in the face of a possible test of $28,300.

Türkçe

Türkçe Español

Español