Data pressures are intense and rapid, turning all eyes to macroeconomic developments in the US this week. The discussion on inflation and the hopes for interest rate cuts in risk assets are highlighted by the Consumer Price Index (CPI). However, before this, on May 14, the Producer Price Index (PPI) for April and a public speech by Fed Chairman Powell will also take place.

Focus Shifts to Powell

Powell will discuss the economy during a moderated discussion with Klaas Knot, the president of the Dutch central bank, at the annual general meeting of the Foreign Bankers’ Association in Amsterdam. Markets have shown extreme sensitivity to Powell’s tone when it comes to clues about future policy moves.

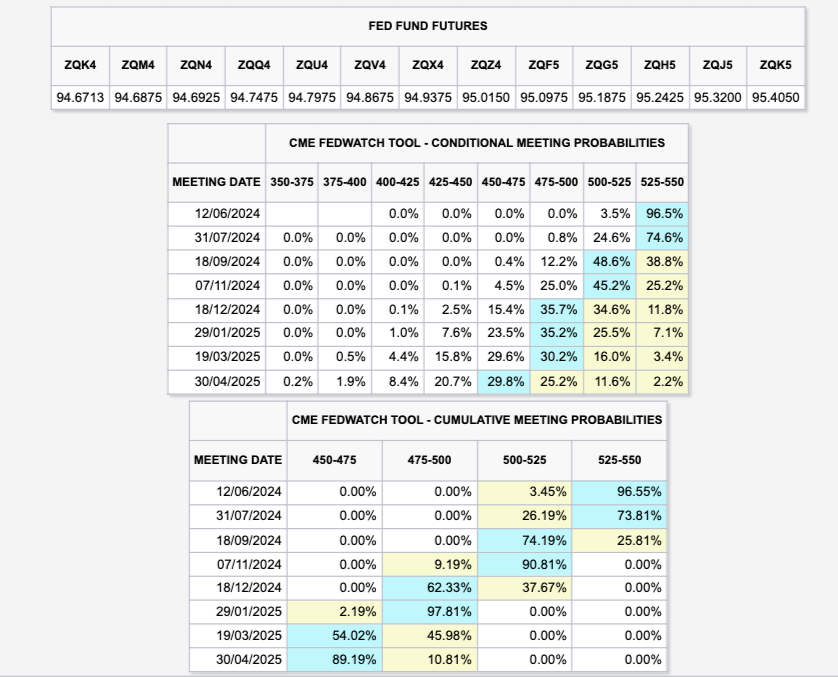

The latest data from the CME Group’s FedWatch Tool underscores the sentiment; investors see almost no chance of a rate cut at the Fed’s next meeting in June, and this probability significantly increases only in September. The current landscape in the futures markets shows the extent of neutrality now characterizing crypto.

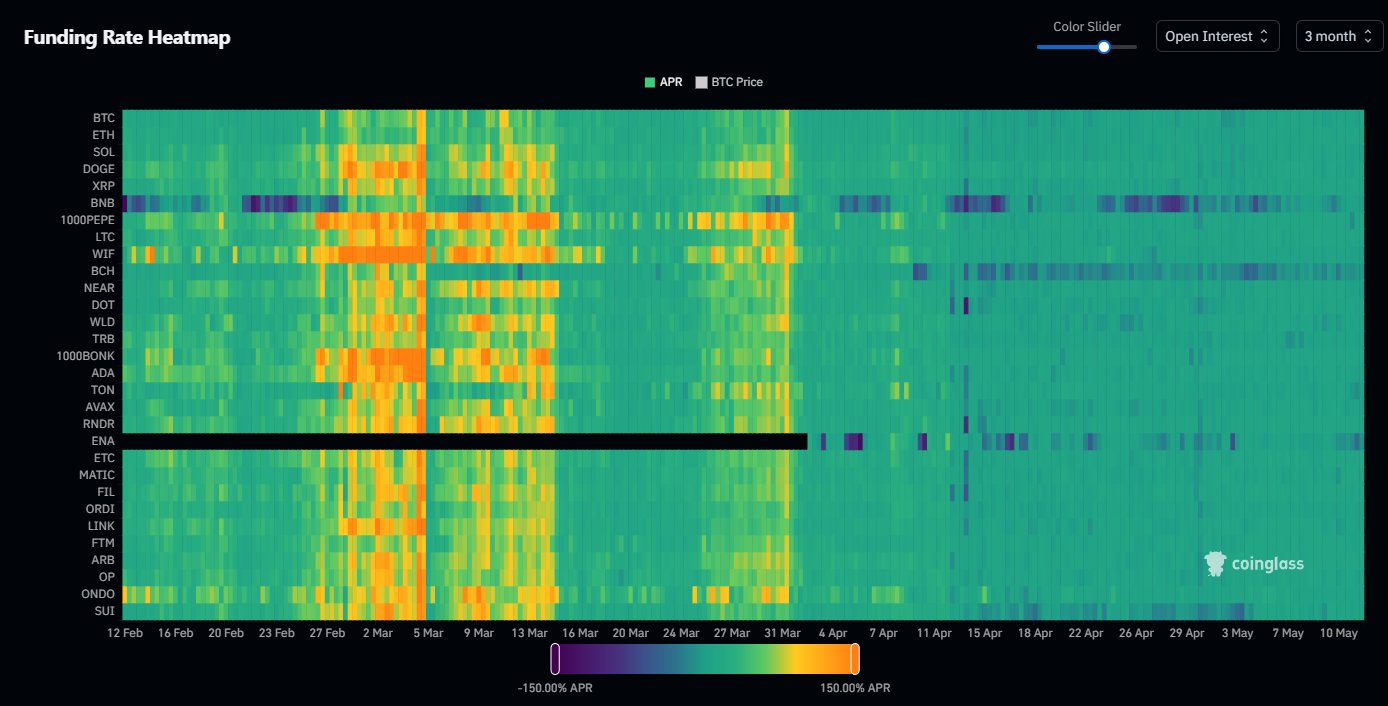

Especially, funding rates remain neutral regardless of near-term price movements; this points to Bitcoin reaching all-time highs in March as a blip on the radar. Daan Crypto Trades commented on this issue:

“Crypto Funding Rates have stayed at neutral levels longer than the overheating in February/March. Basically, this is how it works: Slow market, breakout, overheating, reset. “

What’s Happening on the Bitcoin Front?

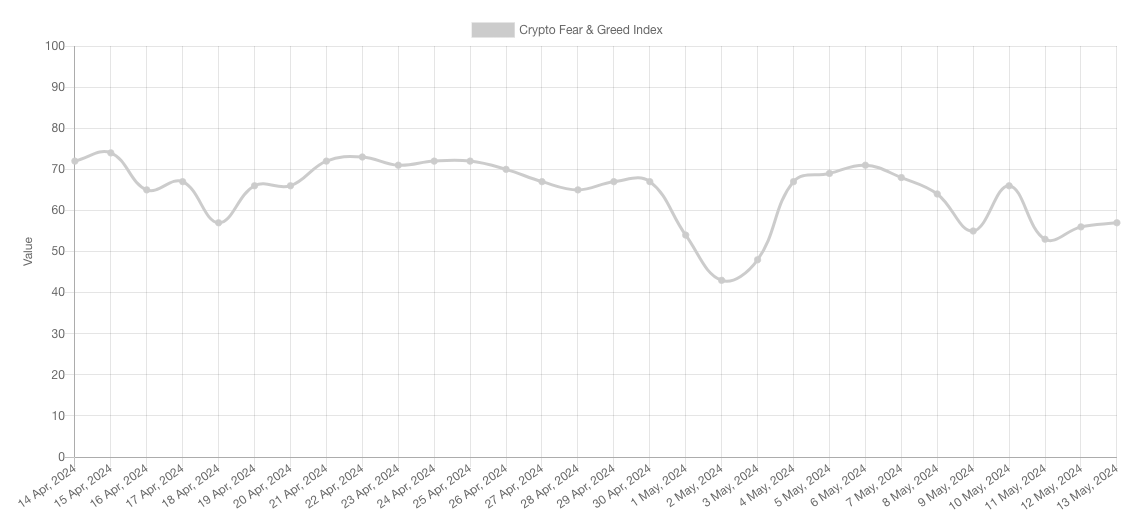

While prices move within a set corridor, volatility is already evident elsewhere in crypto. The Crypto Fear and Greed Index, a classic market sentiment indicator, varies across different states this month. Fear and Greed, as of May 13, stands at 57/100—a quite neutral reading contrasting strongly with the extreme greed zone of 71/100 seen on May 6.

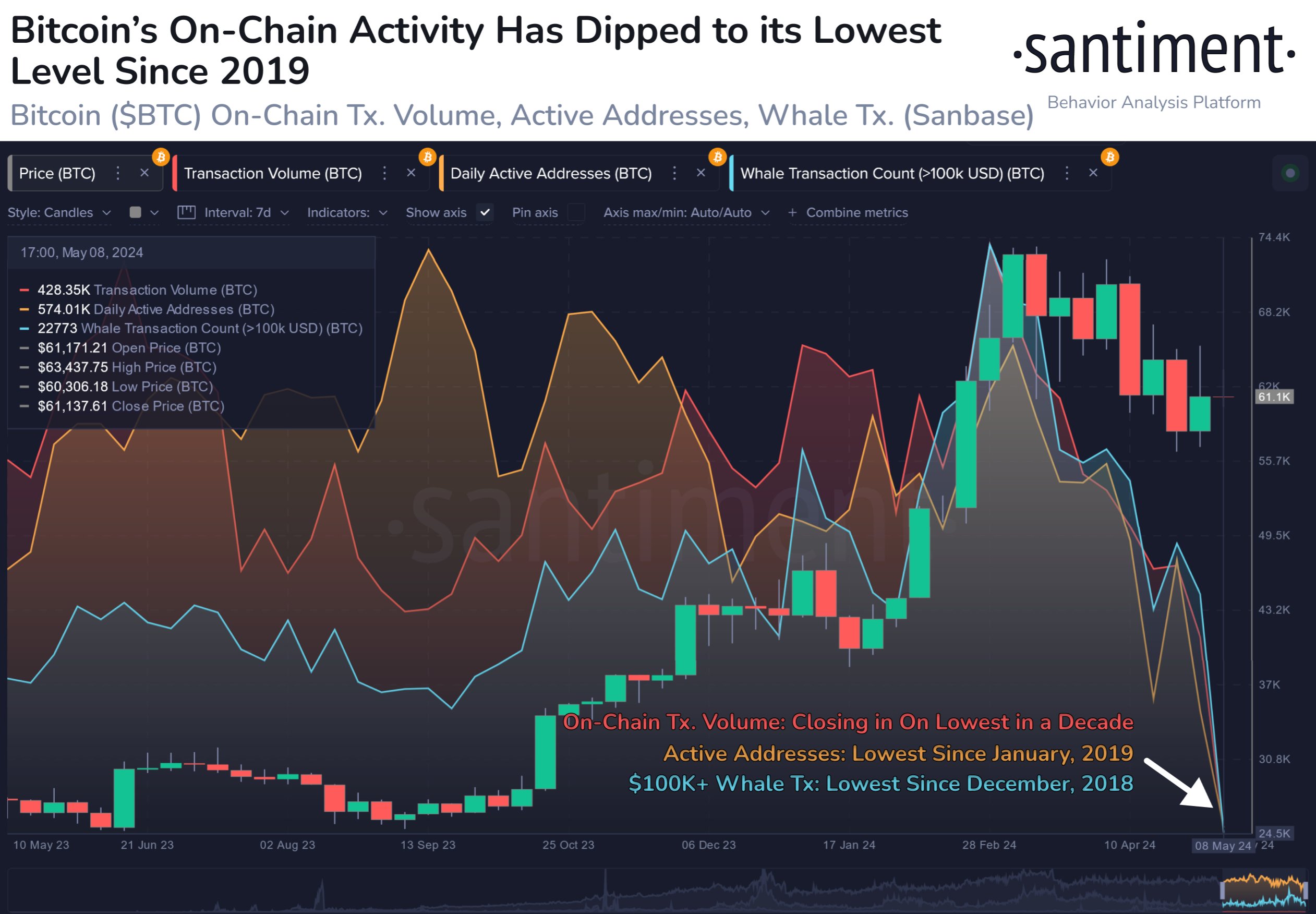

In last week’s new analysis, research firm Santiment also linked the decline in Bitcoin’s on-chain activity to investors’ fear and indecision. An accompanying chart revealed that the total package of on-chain actions had dropped to levels last seen in 2019, and the team shared the following remarks:

“Bitcoin’s on-chain activity is approaching historically low levels, as investors have significantly slowed their transactions in the 2 months since reaching all-time highs.”

Türkçe

Türkçe Español

Español