The US Securities and Exchange Commission’s (SEC) lawsuits against the world’s two largest cryptocurrency exchanges, Binance and Coinbase, led to intense selling pressure in Bitcoin (BTC) and the rest of the cryptocurrency market. Harsh regulatory measures in the US and the West resulted in a large portion of Bitcoin supply shifting to the East.

The Bitcoin Supply is Shifting From the West to the East

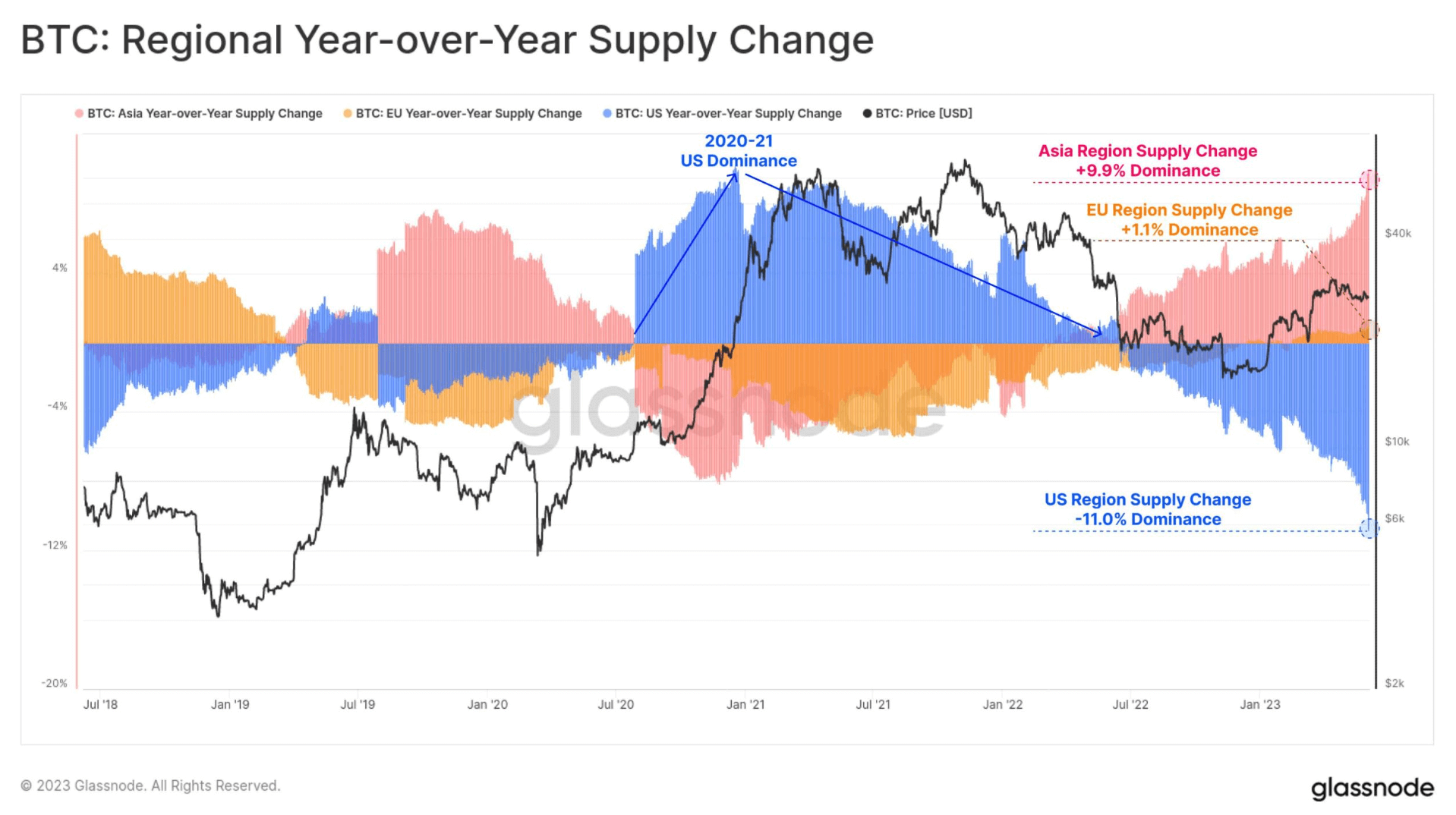

Data obtained by Glassnode on-chain shows a significantly higher rate of Bitcoin outflows from the West compared to the East over the past year. By “West,” it generally refers to the US, as the supply of BTC in Europe has remained almost constant. In its recent report, Glassnode stated:

A clear divergence can be seen in the annual change in BTC supply by geographic regions. The overwhelming dominance of US institutions in 2020-2021 clearly reversed, and the dominance of Bitcoin supply in the US fell by 11 percent since mid-2022. While dominance of BTC supply in Europe remained extremely neutral over the last year, there has been a significant increase in supply dominance in Asia.

Similarly, Glassnode made an interesting observation regarding significant changes in Tether (USDT), stating, “Tether has become more popular in countries where the national currency is not strong and it’s hard to get US dollars. Moreover, as the US implements stricter rules for cryptocurrencies, people are moving their USDT, particularly to the East.”

Bitcoin Price and Trading Volume

Following the SEC’s lawsuits against Binance and Coinbase, the Bitcoin price, which fell below $26,000, has recovered and managed to hold above the critical support level of $26,300. Current data indicates that BTC is trading at $26,503 and has a market cap of $514 billion.

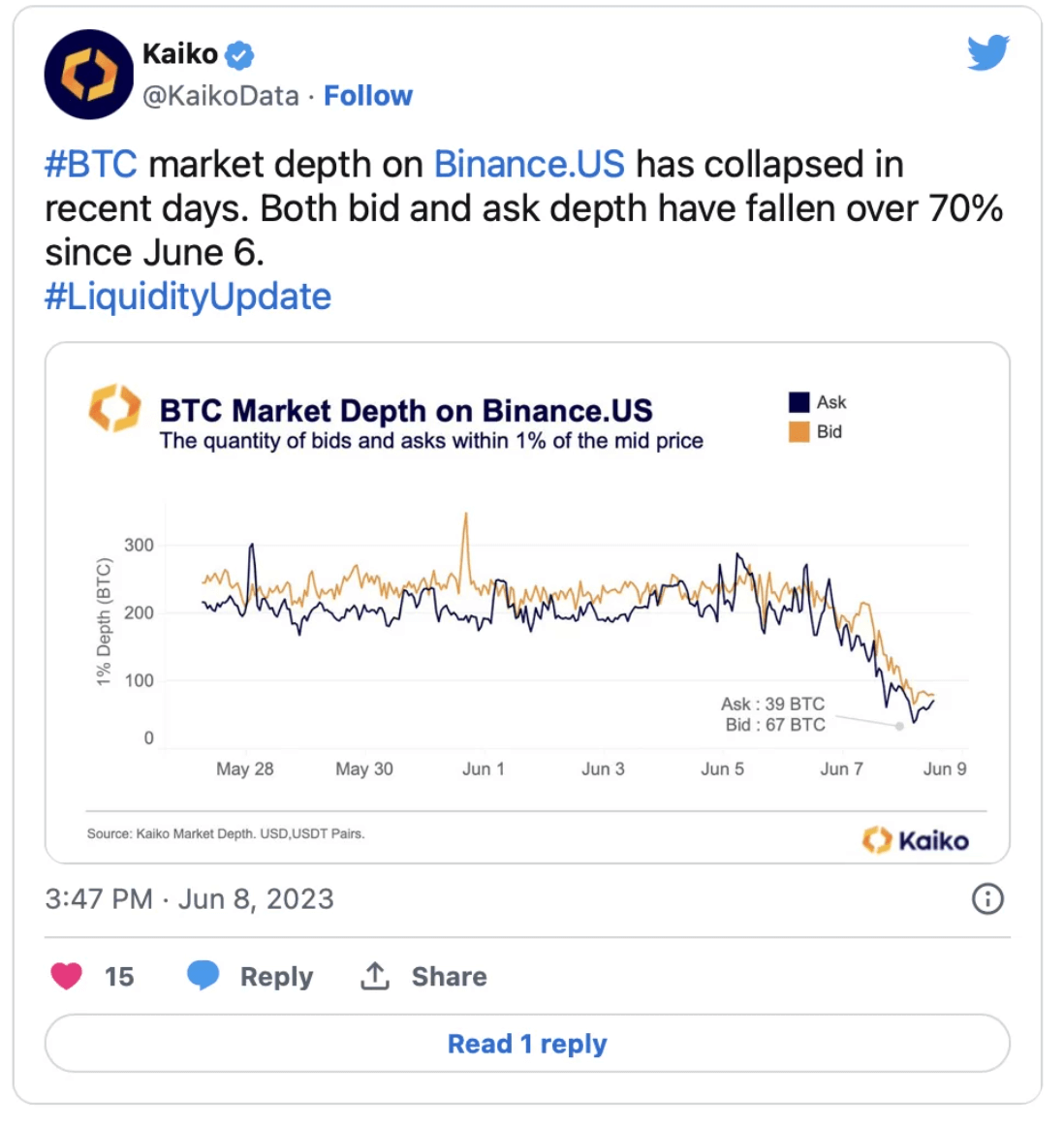

The US regulator’s targeting of Binance has led to a 70% drop in BTC market depth on Binance.US in the last three days. With the suspension of all US dollar deposit transactions announced on Binance.US, this decline is expected to continue.

On the other hand, Santiment reported that the number of unique Bitcoin wallet addresses interacting has exceeded one million in the last two days due to increasing volatility.