Bitcoin price dropped today, forcing the rest of the market to follow. Despite this, some altcoins rose, and TRX surpassed ADA with a 10% increase, returning to the top 10 cryptocurrencies. Meanwhile, market leaders continue to make significant statements about Bitcoin. In this context, an official from VanEck highlighted a noteworthy point, once again drawing attention to BTC.

President’s Bitcoin Commentary

According to Matthew Sigel, head of digital asset research at VanEck, the financial giant continues to purchase Bitcoin (BTC).

In a new interview with CNBC, Sigel clarified that four different sellers are driving down the price of the best crypto asset in the BTC market.

The German government sold all its Bitcoin, worth $2 billion. The US government is selling Silk Road-related funds. There are two major bankruptcies where creditors are yet to be paid – these are Mt. Gox and Genesis.

All these sales are behind us… This is a typical seasonal pattern where Bitcoin tends to struggle within one to three months after the April halving. And just before the elections, when the market realizes that we will follow reckless fiscal policies for another four years regardless of which candidate wins – historically, Bitcoin has really peaked at this point. So we are buyers. We think it will recover.

VanEck is one of the few traditional financial companies that launched spot exchange-traded funds (ETFs) tied to Bitcoin and Ethereum (ETH) this year. The investment management company also filed for a Solana (SOL) ETF with the US Securities and Exchange Commission (SEC).

What is Bitcoin’s Price?

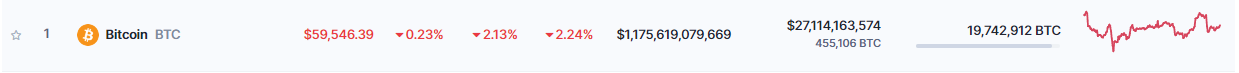

Amidst all this, attention turned to BTC’s price. BTC lost the $61,000 level it reached yesterday and is trading at $59,500 at the time of writing. Developments related to Mt. Gox overnight are thought to have influenced this process.

BTC’s price movement represents a 2% drop, with a similar 2% change over the last 7 days. On the other hand, the price drop also triggered a decline in market volume, which fell to $1.18 trillion. The continued BTC purchases by major companies could be interpreted as an expectation of a rise in the future, potentially encouraging individual investors to buy.

Türkçe

Türkçe Español

Español