VanEck has executed a cryptocurrency withdrawal exceeding $15 million from its spot Bitcoin  $105,822 and Ethereum

$105,822 and Ethereum  $2,604 ETFs. According to data from Arkham, during this process, VanEck’s ETFs acquired approximately 226 BTC and 366 ETH from the Gemini exchange.

$2,604 ETFs. According to data from Arkham, during this process, VanEck’s ETFs acquired approximately 226 BTC and 366 ETH from the Gemini exchange.

VanEck’s Spot Ethereum ETF Withdraws 366 ETH

About nine hours ago, VanEck’s spot Ethereum ETF, ETHV, withdrew 366.132 ETH from the Gemini exchange. This amount is valued at approximately $965,000, reflecting heightened interest in Ethereum among investors in VanEck’s product. Notably, despite fluctuations in Ethereum’s price, VanEck’s increased investments in this area stand out.

Spot Ethereum ETFs are generally seen as a secure and regulated investment vehicle for institutional investors and large funds. The activity within VanEck’s ETF also demonstrates confidence in Ethereum’s market growth and ongoing investor interest.

Spot Bitcoin ETF Withdraws 226 BTC

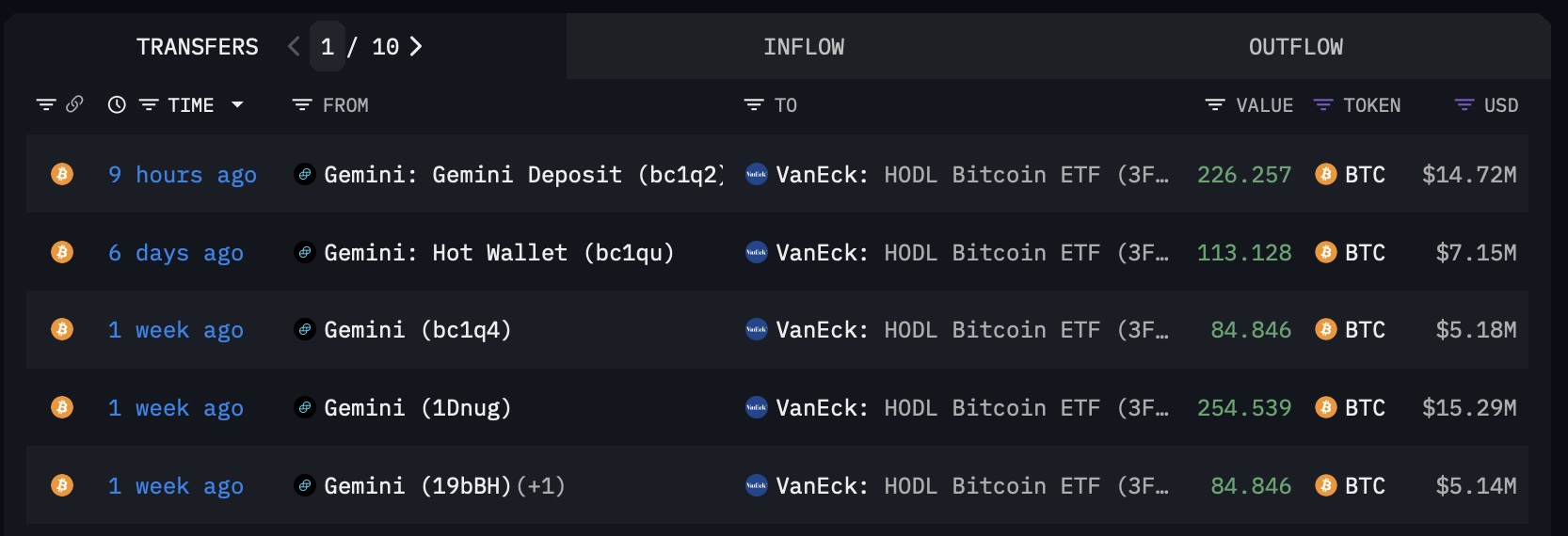

In addition, about eight hours ago, VanEck’s spot Bitcoin ETF, HODL, withdrew 226.257 BTC from the Gemini exchange. This transaction is valued at approximately $14.72 million. As Bitcoin’s price volatility continues, this sizable withdrawal from VanEck is interpreted as a sign of confidence among market participants.

VanEck has long established its presence in the cryptocurrency market by offering ETFs. Transactions involving leading cryptocurrencies like Bitcoin and Ethereum are considered significant due to their potential to increase institutional interest in the cryptocurrency market. Furthermore, such large-scale transactions prompt other market players to reassess their strategies.

Recent data shows that BTC is trading at $65,617 with a 2.84% increase over the past 24 hours, while ETH has risen 1.42%, trading at $2,665 during the same period.

Türkçe

Türkçe Español

Español