Hong Kong-based investment firm Victory Securities announced the proposed fees for Bitcoin and Ethereum exchange-traded funds (ETFs) to investors following the recent approval of crypto ETF products in the region. The announcement was made public even though the Hong Kong Securities and Futures Commission (SFC) has not yet published a list of approved ETF issuers.

Hong Kong and the ETF Process

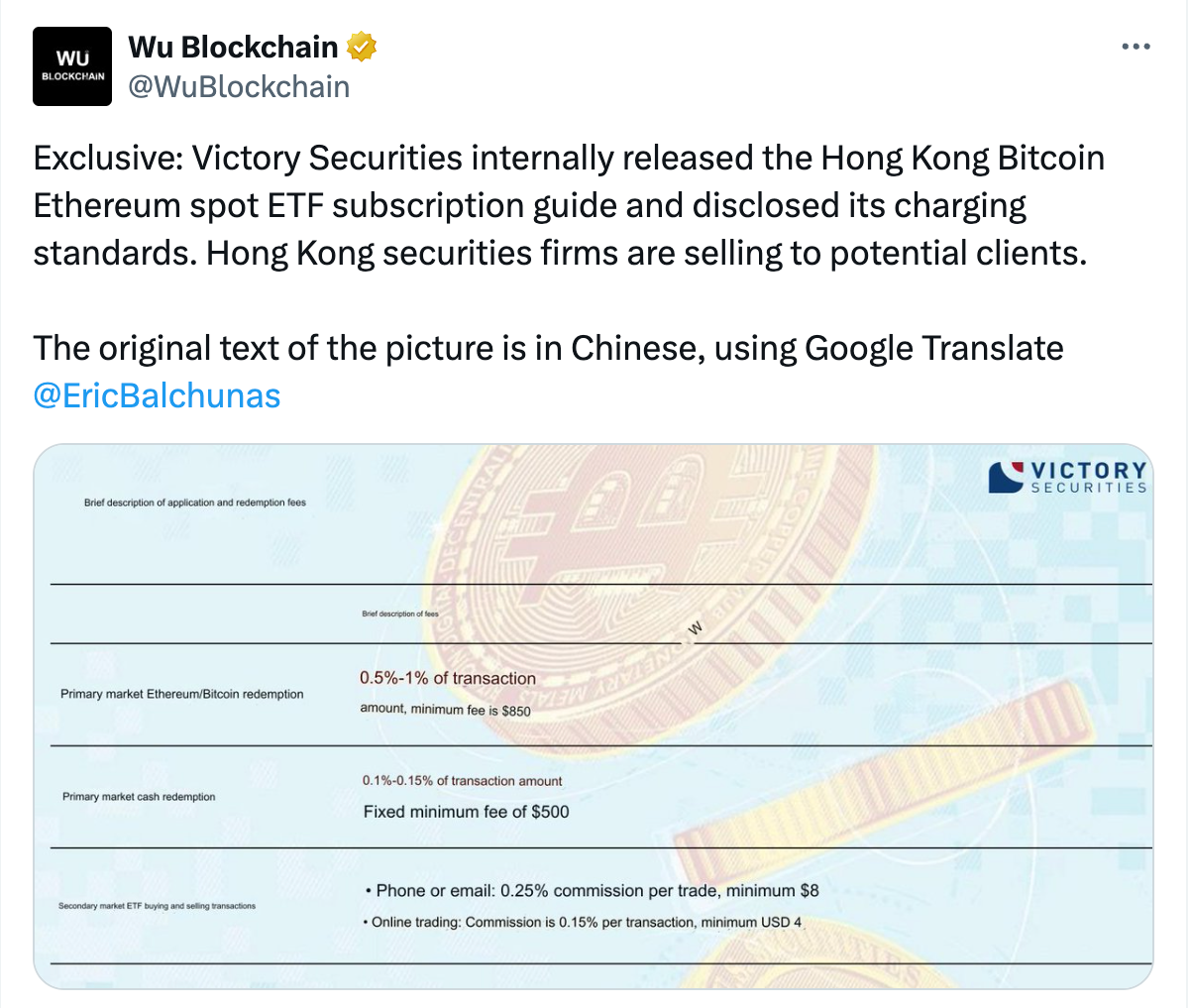

According to a press release, Victory Securities will serve its clients with fees ranging from 0.5% to 1% of the total transaction for primary market shares of Ethereum and Bitcoin ETFs, with a minimum fee of 850 USD, pending approval by the SFC. This development was reported in a translated report shared by Wu Blockchain on April 20.

For investors interested in buying and selling existing ETF shares in the secondary market, the fees will be 0.15% for online transactions and 0.25% for phone transactions. These fees are comparable to those set by U.S. asset managers who have introduced spot Bitcoin ETF funds. While different fees in the U.S. have been waived at various times this year, asset manager Franklin Templeton has set its fee at 0.19%, with other ETF funds varying between 0.20% and 0.90%.

The Grayscale Bitcoin Trust (GBTC) fund, however, applies a rather high fee of 1.5%, which is causing selling pressure on the fund. As reported on April 15, Hong Kong became the latest country to approve spot Bitcoin and Ethereum ETF funds.

Notable Comments from Industry Figures

At least three offshore Chinese asset managers, including the Hong Kong units of Harvest Fund Management, Bosera Asset Management, and China Asset Management (ChinaAMC), plan to launch spot Bitcoin and Ethereum ETF funds soon.

While the approval has received praise from many in the crypto community, including local Hong Kong exchanges, others are more skeptical about the success of ETFs in the region. Bloomberg ETF analyst Eric Balchunas, in a post published on X on April 17, stated:

“Chinese investors, who are prohibited from purchasing crypto assets, will likely not be able to buy the spot Bitcoin and Ethereum ETF funds listed in Hong Kong.”

Türkçe

Türkçe Español

Español