At a recent conference, Ethereum (ETH) co-founder Vitalik Buterin dropped a remark that set tongues wagging across the ecosystem. In addressing the audience, Buterin referred to Solana as the most scalable blockchain, suggesting he recognized Solana’s scalability advantage over ETH.

Solana or Ethereum?

This bold statement from the Ethereum boss could potentially prompt a slight recovery in the price and market value of the SOL token, used by the blockchain.

Solana is described as an advanced blockchain infrastructure that hosts Decentralized Applications (dApps) and their related tokens, underpinning scalability. Notably, it uses a combination of the popular Proof-of-Stake (PoS) consensus mechanism and an algorithm known as Proof-of-History (PoH) to make transactions faster and more secure. With PoH, the network can keep up with a verifiable timestamp structure.

On the other hand, Ethereum had been a significant pioneer in the blockchain ecosystem, facilitating dApps, DeFi, and smart contracts. However, it had a pressing bottleneck: scalability. Slower transaction speed and high volumes have led to congestion on the network and exorbitant gas fees.

Solana Maintains Support Level

When things get tough, network outages occur. In these crucial moments, Solana seems to present a better solution than Ethereum.

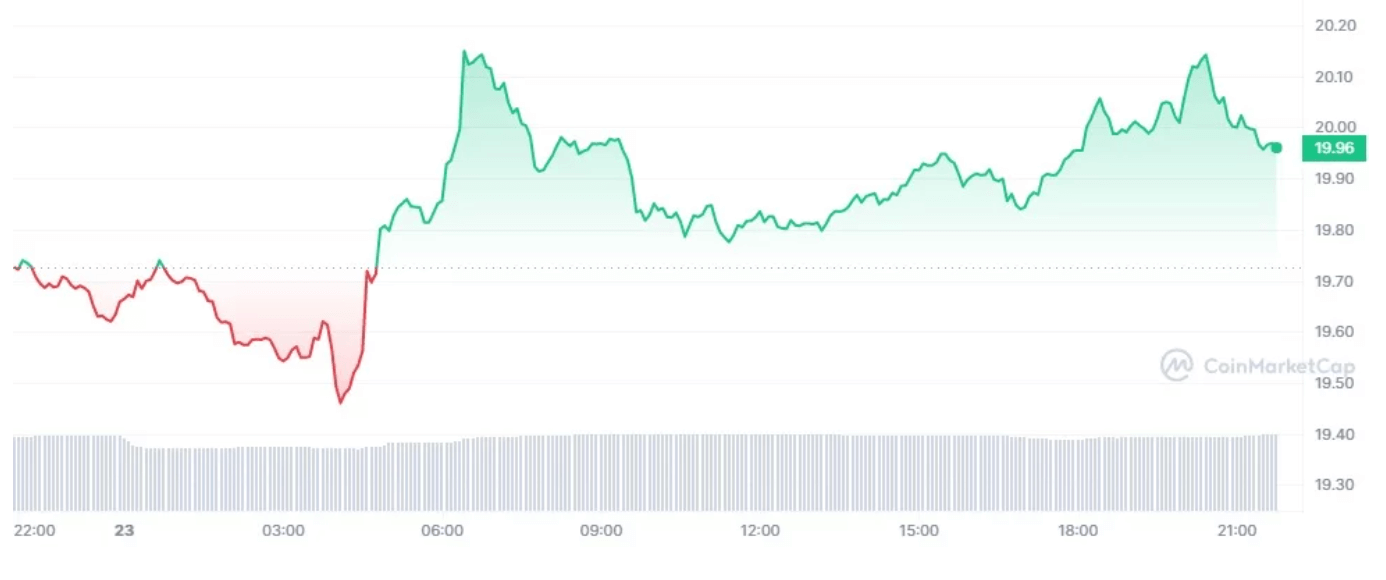

Despite the uptrend in network use, SOL has been on a downward trend, unaffected by the growth in the number of new users. The increase in new users has had no significant impact on SOL’s price. According to CoinMarketCap data, the market price is fluctuating between $19 and $20, and at the time of writing this article, the altcoin is trading at $19.96 after nearly a 1.25% gain in the last 24 hours.

The increased selling pressure is believed to have possibly influenced SOL’s loss of more than 24% in recent weeks. In the first week of May, Solana‘s price surpassed the $22.8 resistance level, but it was short-lived. In the following days, SOL dropped to around $21.33. The downtrend continued until it reached $20, which became the current level.

Buterin’s comments and the raw emotions ready for an upgrade could potentially be a catalyst for a temporary price increase trend for Solana.