At the time of writing, Bitcoin‘s price was poised to break below $26,200 – a development that does not bode well for altcoins. What does this mean for XRP, ADA, and DOGE in the short term? Volatility, once the eager anticipation of daily traders, has now unsettled the market in an unexpected way, disrupting a rather mundane May and marking a tumultuous start to June.

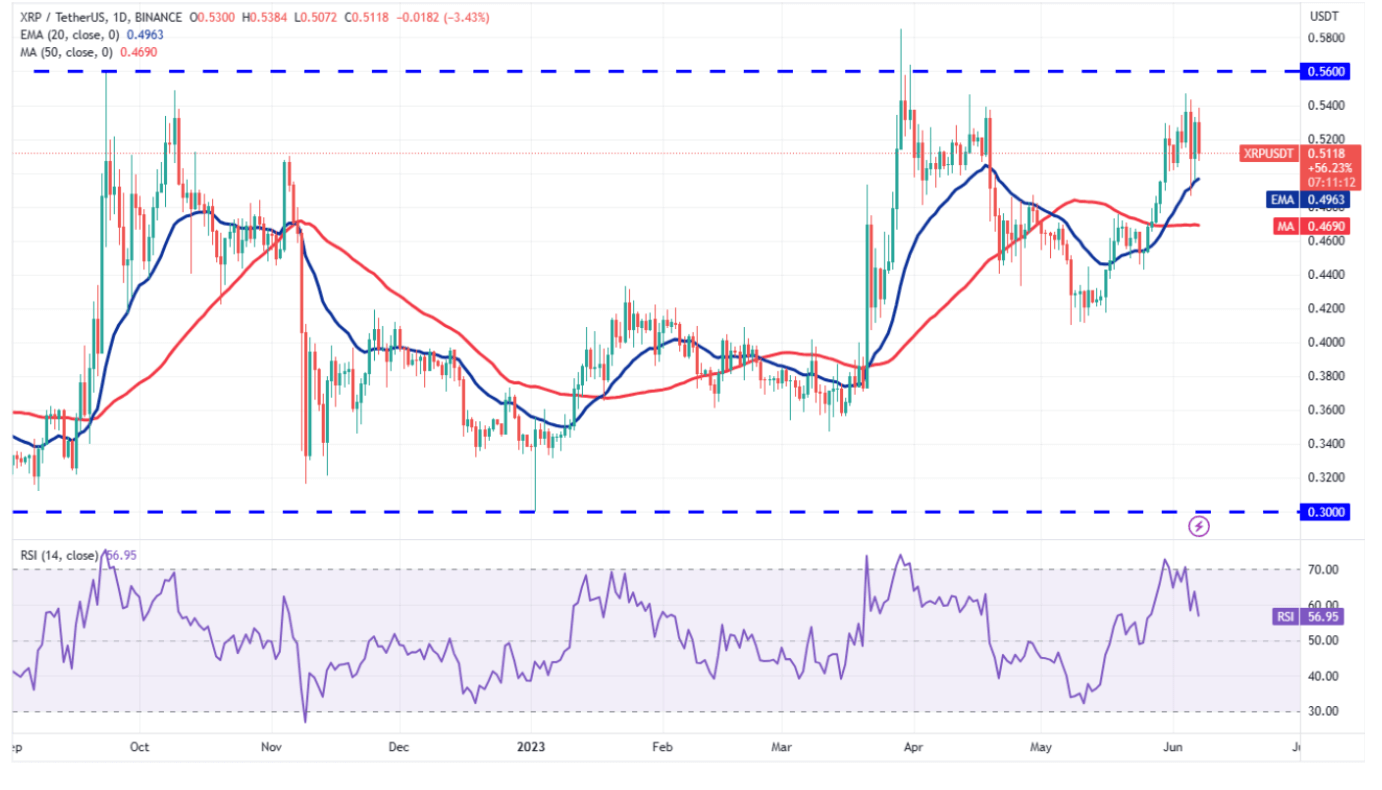

XRP Coin Price Prediction

In a bullish phase, traders typically buy the dip down to the 20-day EMA, as witnessed with XRP on the 5th and 6th of June. For XRP Coin, this level is $0.49. However, the bears are not ready to give in easily. They continue to sell rallies to the resistance zone between $0.56 and $0.59. If the price drops sharply and goes below the 20-day EMA, it would suggest that the bears aim to solidify the range between $0.30 and $0.56. Meanwhile, the buyers might have other plans. Positive developments in the ongoing case could lead to tests of $0.6 and $0.8. The “Hinman Documents” expected on June 13 could trigger a significant move. However, the short-term bearish outlook of Bitcoin could induce a drop to $0.42.

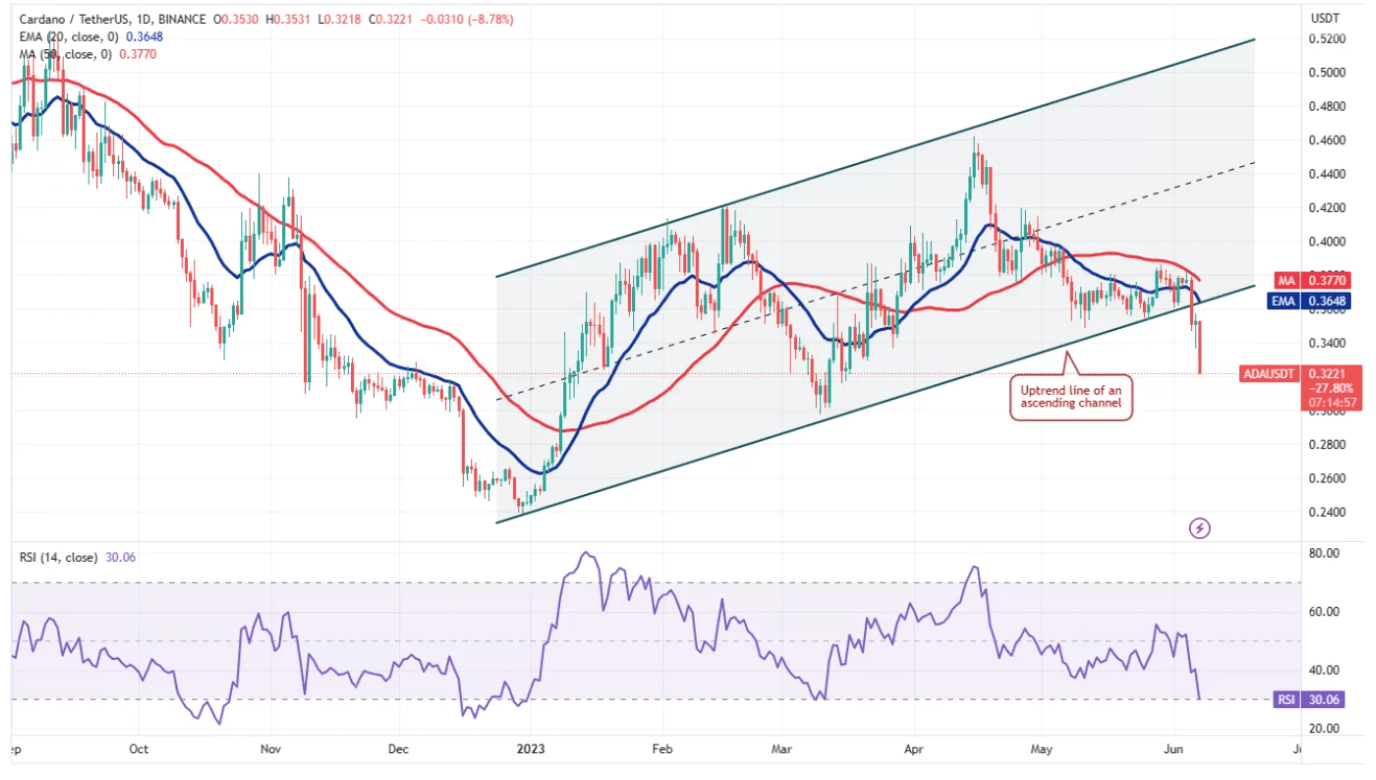

ADA Coin Analysis and Chart

On June 5th, Cardano invalidated its bullish pattern by falling below the uptrend line of its ascending triangle formation. The bulls bought the dip on June 5th, but could not pull the price back into the channel. This suggests that bears are trying to convert the uptrend line into resistance. Selling continued on June 7th, and the bears pulled the price below $0.33. We mentioned yesterday about the ongoing sales by the whales. If the sales can’t hold the price at $0.33, we might see it drop to $0.3.

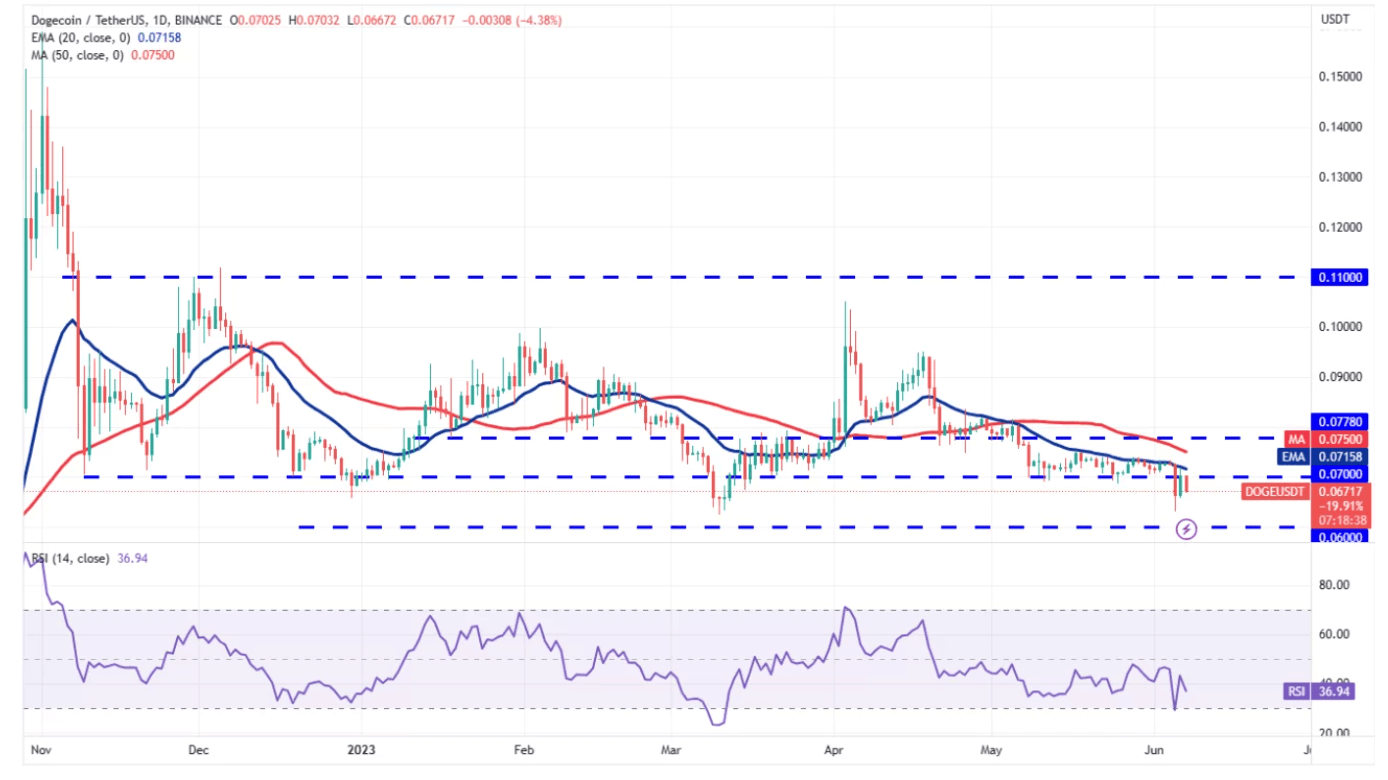

Dogecoin (DOGE) Analysis

Dogecoin dipped below the crucial support of $0.07 on June 5th and bounced back sharply from near $0.06 support. The bulls tried to push the price above the 20-day EMA ($0.07) on June 6th, but the bears sold the rally. This shows that bears are not giving up and continue to sell near stiff resistance. If the negativity on the Bitcoin front persists, we could see sales targeting below $0.06 support. In the opposite scenario, $0.08 could be targeted.